Mexico will exceed 800,000 Covid-19 infections today with the death toll on track to surpass 83,000, ranking it fourth globally in that category. Adding to health issues is Hurricane Delta, which ripped through its Caribbean tourist hotspot Cancún. It followed last week’s tropical storm Gamma. Hurricane Delta is now gathering strength in the Gulf of Mexico and is on its way to hit the US. It dealt a blow to tourism, seen a vital for the post-Covid-19 recovery of Mexico. The USD/MXN maintained its bearish stance and slid below its short-term resistance zone from where an accelerated sell-off is favored.

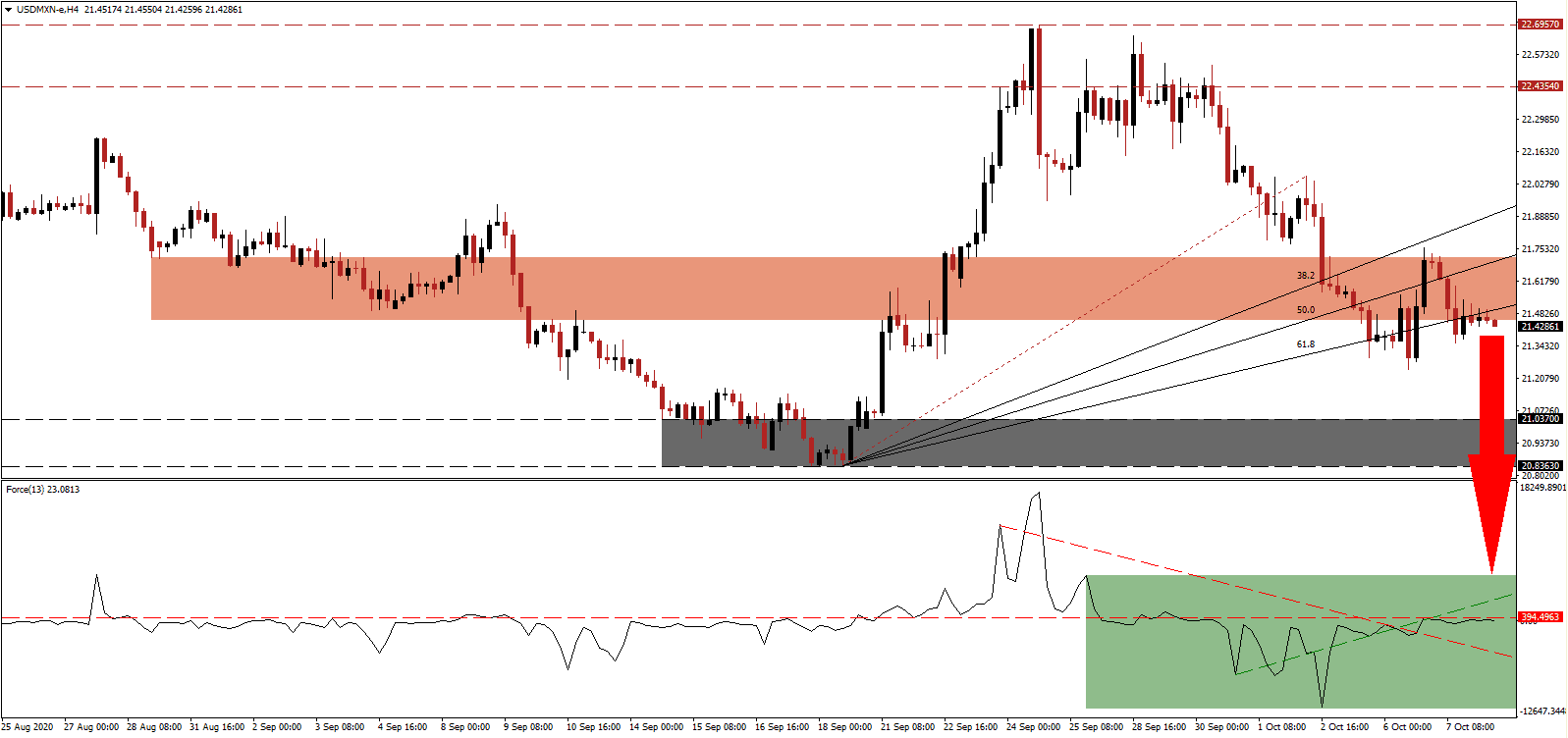

The Force Index, a next-generation technical indicator, flatlined below its horizontal resistance level, as marked by the green rectangle. Following the move below its ascending support level, bearish pressures intensified. This technical indicator is positioned to correct below its 0 center-line, and through its descending resistance level, granting bears complete control over the USD/MXN.

With the economy struggling, President López Obrador continues to bank on infrastructure projects. The government confirmed four additional ones for Quintana Roo, where Cancún is located. They will complement the 1,500 kilometer Maya Train line and include a new airport, an 8.7-kilometer bridge, a cruise dock, and a light rail transport system to Cancún. Bearish pressures increased following the breakdown in the USD/MXN below its short-term resistance zone located between 21.4538 and 21.7182, as identified by the red rectangle.

Recommendations by the US-based International Monetary Fund (IMF) regarding the issuance of more debt, tax reforms, and the suspensions of some infrastructure projects were rejected by the government. President López Obrador asked the IMF to respect the sovereignty of Mexico and not dictate domestic economic policy, as it has done in the past. The contraction on the USD/MXN below its ascending 61.8 Fibonacci Retracement Fan Support Level cleared the path for a correction into its support zone located between 20.8363 and 21.0370, as marked by the grey rectangle. An extension into its next support zone between 19.8919 and 20.2760 remains a distinct possibility.

USD/MXN Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 21.4300

- Take Profit @ 19.9000

- Stop Loss @ 21.7200

- Downside Potential: 15,300 pips

- Upside Risk: 2,900 pips

- Risk/Reward Ratio: 5.28

A breakout in the Force Index above its ascending support level, providing temporary resistance, may lead the USD/MXN into a brief price spike. Forex traders should consider any advance as an excellent selling opportunity, amid intensifying weakness for the US Dollar. The upside potential is reduced to its intra-day high of 22.0585 with US monetary and economic policy providing significant resistance for the US Dollar.

USD/MXN Technical Trading Set-Up - Reduced Reversal Scenario

- Long Entry @ 21.8500

- Take Profit @ 22.0500

- Stop Loss @ 21.7200

- Upside Potential: 2,000 pips

- Downside Risk: 1,300 pips

- Risk/Reward Ratio: 1.54