Over the next two weeks, Mexico is on track to cross 800,000 infections. With economic, health, and social challenges ahead, private sector economists start to revise their 2020 and 2021 GDP forecasts higher. The consensus now calls for a 2020 contraction of 9.8% and a 2021 growth rate of 3.3%. Despite the improving outlook, it remains distant from official government predictions for a decrease of 8.0% and an increase of 4.6%, respectively. The USD/MXN continues its correction, but a sideways trend after the breakdown below its short-term resistance zone may precede the next leg lower.

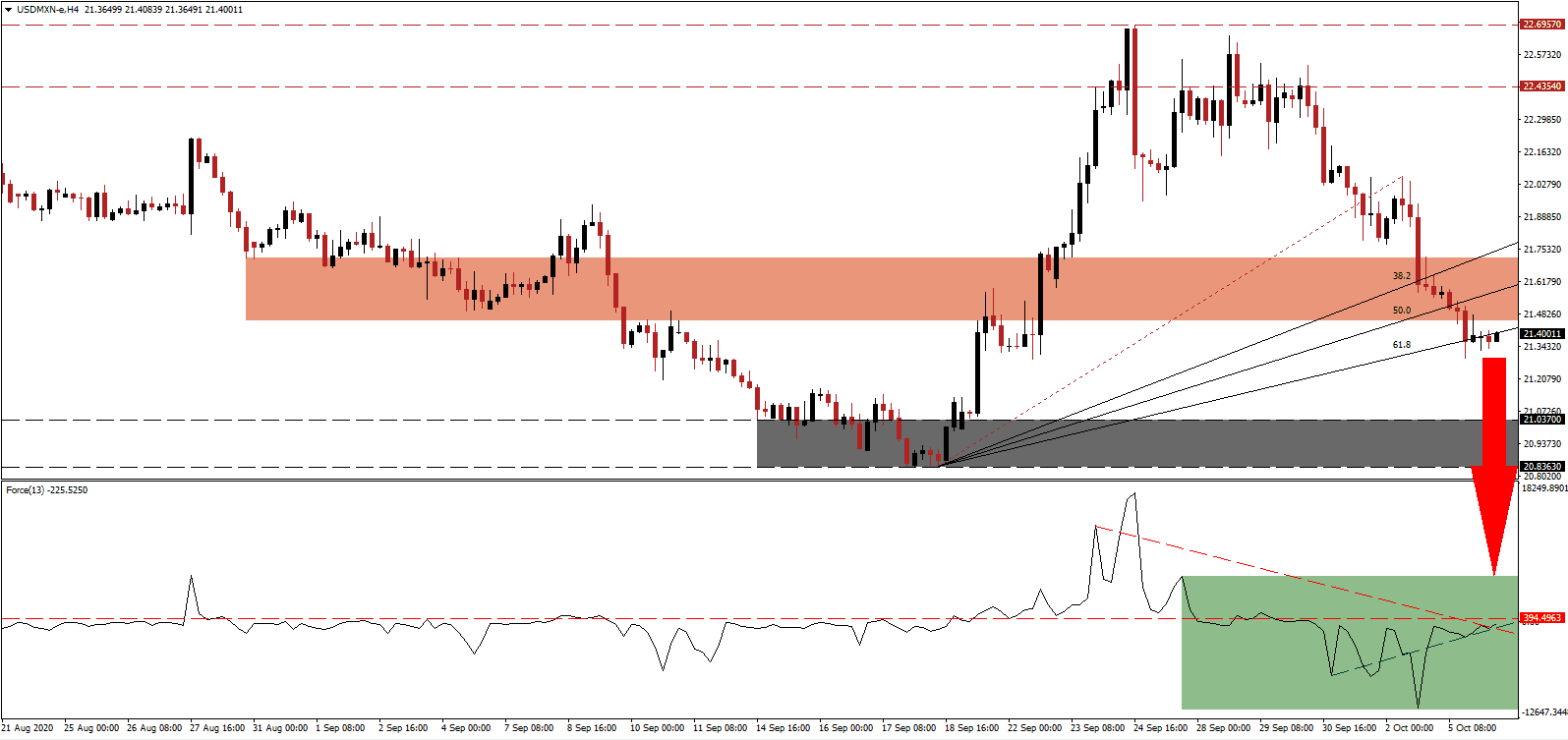

The Force Index, a next-generation technical indicator, recovered from a new multi-month low. It reclaimed its ascending support level, as marked by the green rectangle, and pierced above its descending resistance level. Downside pressures remain dominant with this technical indicator in negative territory below its horizontal resistance level. Bears have the upper hand and control price action in the USD/MXN.

President López Obrador announced a private sector backed MEX$297 billion plan to restart the ailing economy. The first phase consists of 39 projects in the communication, energy, and environment sectors. The government forecasts the creation of 190,000 jobs, with a focus on the energy sector, which is a cornerstone of the economic policy of President López Obrador. Following the breakdown in the USD/MXN below its short-term resistance zone located between 21.4538 and 21.7182, as marked by the red rectangle, price action is well-positioned to extend its long-term correction after moving below its ascending 61.8 Fibonacci Retracement Fan Support Level.

Adding to positive progress for the Mexican economy is support for the Chinese dual global system, allowing Latin America’s second-largest economy to diversify. Graciela Márquez Colín, the Secretary of Economy for Mexico, noted a dual system could boost the domestic economy and promote global sustainability. Her remarks echo those of President López Obrador, who favors a domestic economy as the growth engine instead of exports. The USD/MXN is on track to challenge its support zone located between 20.8363 and 21.0370, as identified by the grey rectangle. A breakdown into its next support zone between 19.8919 and 20.2760 is probable.

USD/MXN Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 21.4000

Take Profit @ 19.9000

Stop Loss @ 22.7200

Downside Potential: 15,000 pips

Upside Risk: 3,200 pips

Risk/Reward Ratio: 4.69

An extension of the uptrend in the Force Index, driven higher by its ascending support level, may temporarily pressure the USD/MXN to the upside. With the US labor market slowing, economic data moving forward is likely to reflect weakness amid localized shutdowns to contain the renewed spike in Covid-19 infections. The upside potential remains limited to its intra-day high of 22.0585, and Forex traders should sell any rallies from present levels.

USD/MXN Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 22.8500

Take Profit @ 22.0500

Stop Loss @ 22.7200

Upside Potential: 2,000 pips

Downside Risk: 1,300 pips

Risk/Reward Ratio: 1.54