While Mexico lacks required Covid-19 testing capabilities, with just over 2,000,000 conducted on a population close to 130,000,000, the government of President López Obrador announced plans to purchase up to 34,400,000 does of a vaccine produced by Pfizer, if it meets specific criteria, this year. By the end of next year, the government committed to purchasing a total of 140,000,000 doses, enough to vaccinate the entire population. The USD/MXN bounced higher after reaching the upper range of its support zone, but the absence of bullish momentum favors a new breakdown phase.

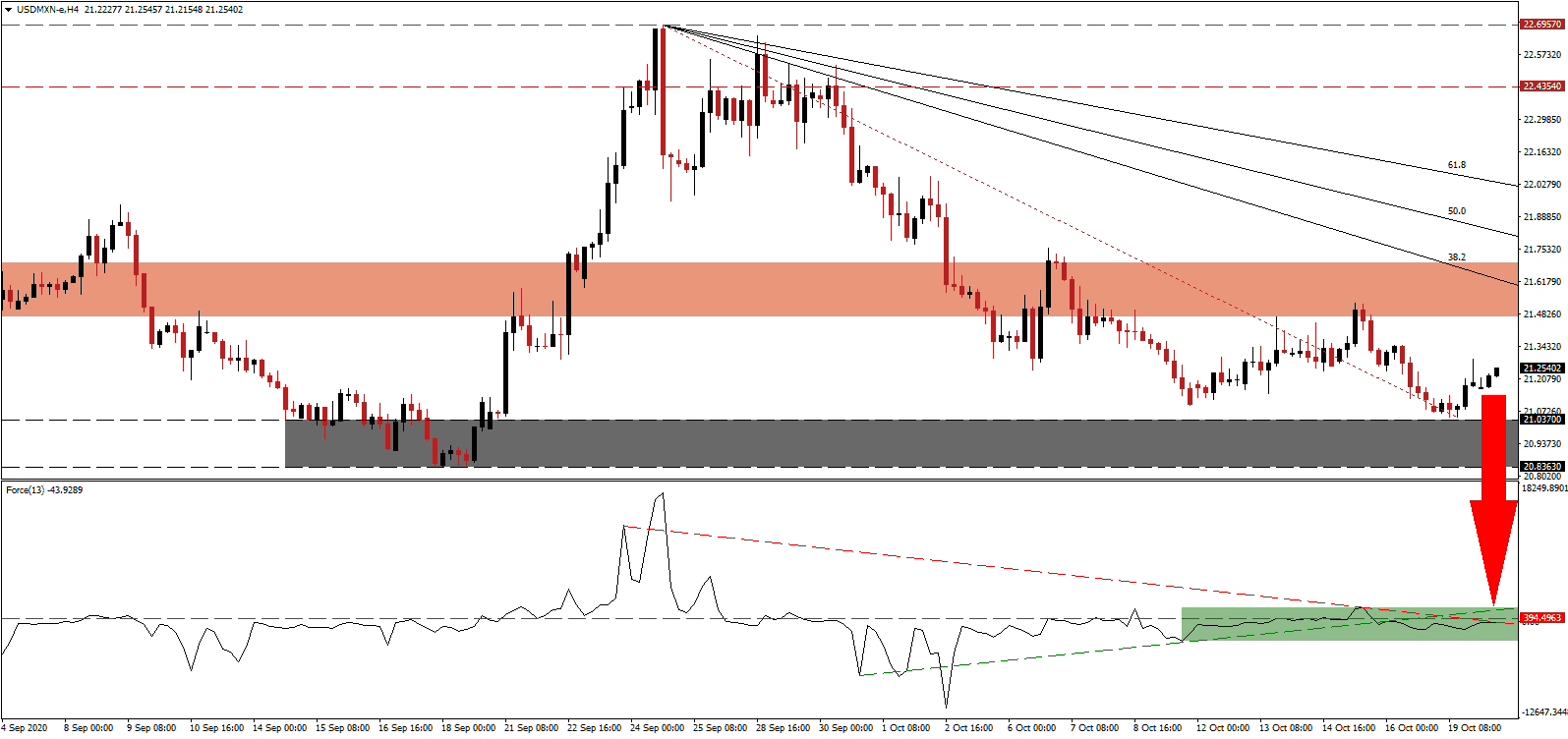

The Force Index, a next-generation technical indicator, remains below its horizontal resistance level, with the descending resistance level adding to bearish momentum. Following the move below its ascending support level, as marked by the green rectangle, bears assumed complete control over the USD/MXN, magnified by the move into negative territory by this technical indicator.

Concerns over the vital relationship Mexico has with the US continue to increase. Following the controversial border issue, the energy policy of President López Obrador emerges as the next problem. The suspension of auctions for renewable energy and transmissions contracts, together with regulatory changes favoring domestic champion Petróleos Mexicanos, remain at the core of issues. While the USD/MXN drifted higher, the pending downward adjustment of its short-term resistance zone, presently located between 21.4698 and 21.6980, as marked by the red rectangle, suggests more downside pressure.

Another flashpoint emerged related to water distribution at the border. Mexican farmers occupied the La Boquilla Dam on the Rio Conchos in Chihuahua in September. The occupation was in protest against sending 512 cubic meters of water to the US, part of a 1944 treaty that lacks enforcement powers or penalties against non-compliance. The threat of more profound water wars will likely strain relations between Mexico and the US moving forward. With the descending 38.2 Fibonacci Retracement Fan Resistance Level set to pressure the USD/MXN into its support zone located between 20.8363 and 21.0370, as identified by the grey rectangle, a collapse into its next support zone between 19.8919 and 20.2760 is anticipated.

USD/MXN Technical Trading Set-Up - Breakdown Resumption Scenario

Short Entry @ 21.2500

Take Profit @ 19.9000

Stop Loss @ 21.5000

Downside Potential: 13,500 pips

Upside Risk: 2,500 pips

Risk/Reward Ratio: 5.40

A breakout in the Force Index above its ascending support level, serving as resistance, could lead to more short-term gains in the USD/MXN. Forex traders should take advantage of any price spike with new sell orders due to a worsening outlook for the US Dollar. A fresh debt spike and a weakening labor market recovery add to breakdown pressures. The upside potential remains confined to its 50.0 Fibonacci Retracement Fan Resistance Level.

USD/MXN Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 21.6200

Take Profit @ 21.8000

Stop Loss @ 21.5000

Upside Potential: 1,800 pips

Downside Risk: 1,200 pips

Risk/Reward Ratio: 1.50