Addressing the Clean Green Index Award Ceremony in Islamabad, Imran Khan, the Prime Minister of Pakistan, confirmed fears over the second wave of Covid-19 infections in urban centers, including Faisalabad, Lahore, Peshawar, Karachi, and Gujranwala. While new daily confirmed cases remain relatively low compared to other countries, acting before the situation gets out of control, as in Europe and the US, will position the healthcare system and economy on a healthier foundation to maneuver through a complicated winter season. The USD/PKR descended into its support zone from where a breakdown is pending.

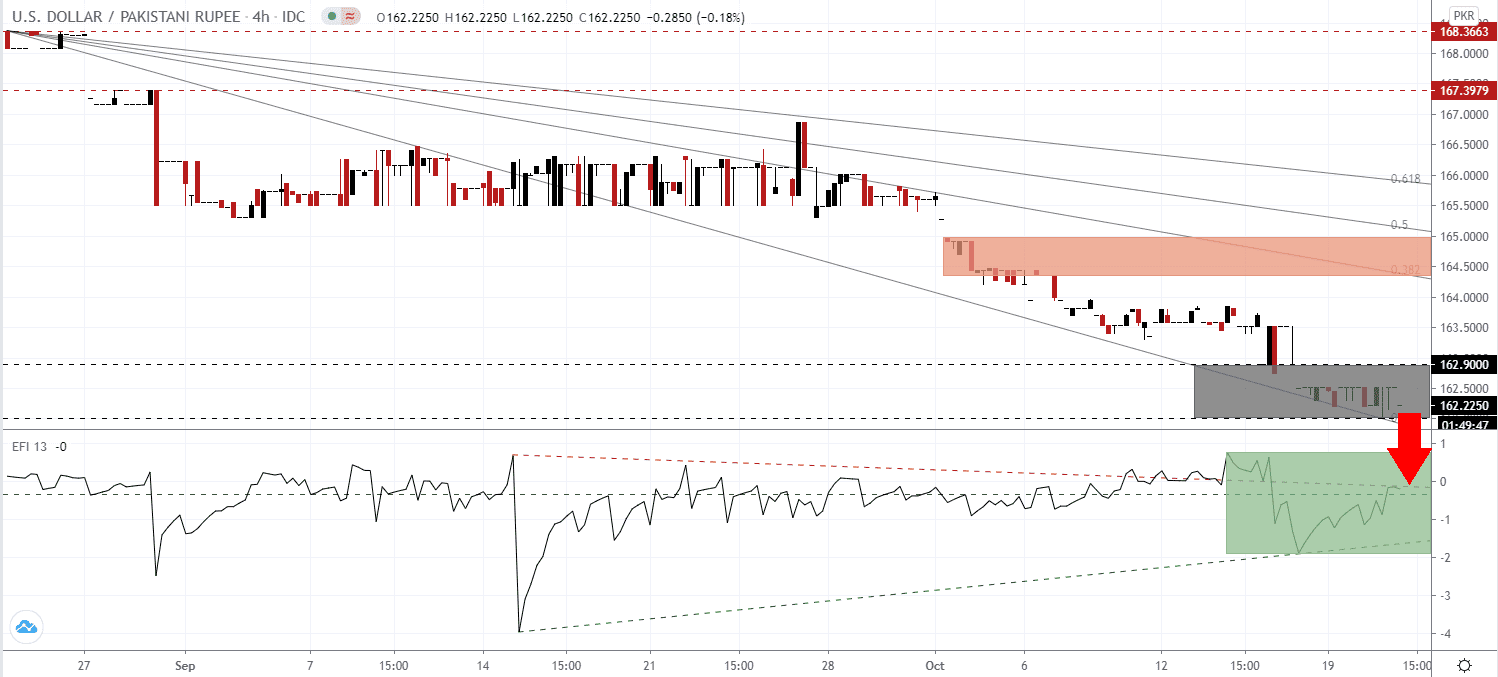

The Force Index, a next-generation technical indicator, recorded a higher low and advanced above its horizontal resistance level, converting it into support. It now faces rejection by its descending resistance level, as marked by the green rectangle, which is favored to force it below its ascending support level. Bears have the upper hand over price action in the USD/PKR with this technical indicator below the 0 center-line.

According to a new assessment by the International Monetary Fund (IMF), the economy in Pakistan will improve over the next three years. Government revenues will increase, the debt-to-GDP ratio decrease, and a primary budget surplus expected for the fiscal year ending in 2023. The IMF report also called for government spending to decrease, slashing the budget deficit by 50% to 4.0%. It adds a long-term bullish catalyst to the Pakistani Rupee. After the USD/PKR completed a breakdown below its short-term resistance zone located between 163.8500 and 164.4400, as identified by the red rectangle, bearish pressures intensified.

While the business elite remains angered at the response of the government to the Covid-19 pandemic, General Qamar Javed Bajwa, the Chief of Army Staff (COAS) of the Pakistan Army, gave an upbeat speech but also noted the challenges ahead. Reports following his speech indicated the majority was pleased with his outlook and the involvement of the military in securing the future of Pakistan. The descending Fibonacci Retracement Fan sequence is well-positioned to lead the USD/PKR into a breakdown below its support zone located between 162.0000 and 162.9000, as marked by the grey rectangle. Price action will face its next support zone between 156.7000 and 158.0000.

USD/PKR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 162.2500

Take Profit @ 156.7500

Stop Loss @ 164.0000

Downside Potential: 55,000 pips

Upside Risk: 17,500 pips

Risk/Reward Ratio: 3.14

Should the Force Index spike above its descending resistance level, the USD/PKR could attempt a short-term reversal. The financial outlook for Pakistan remains moderately bullish, but the US faces growing challenges while refusing to implement necessary adjustments. With more debt imminent in a slowing economy, Forex traders should sell any reversals. The upside potential is reduced to its 61.8 Fibonacci Retracement Fan Resistance Level.

USD/PKR Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 164.7000

Take Profit @ 165.9000

Stop Loss @ 164.0000

Upside Potential: 12,000 pips

Downside Risk: 7,000 pips

Risk/Reward Ratio: 1.71