Early criticism over the handling of the first wave of the Covid-19 crisis in Sweden remains, but some European countries started to implement a light Swedish-like approach to the second wave of the pandemic. Anders Tengell, the state epidemiologist and architect of the Swedish model, continues to defend his strategy, noting consistency will beat the virus. He added that Swedes could continue living with the small modifications for years if necessary. The rest of the developed world lacks the self-discipline of Swedes, and following the same policies will likely result in more infections and deaths. The USD/SEK presently challenges its support zone with breakdown pressures on the rise.

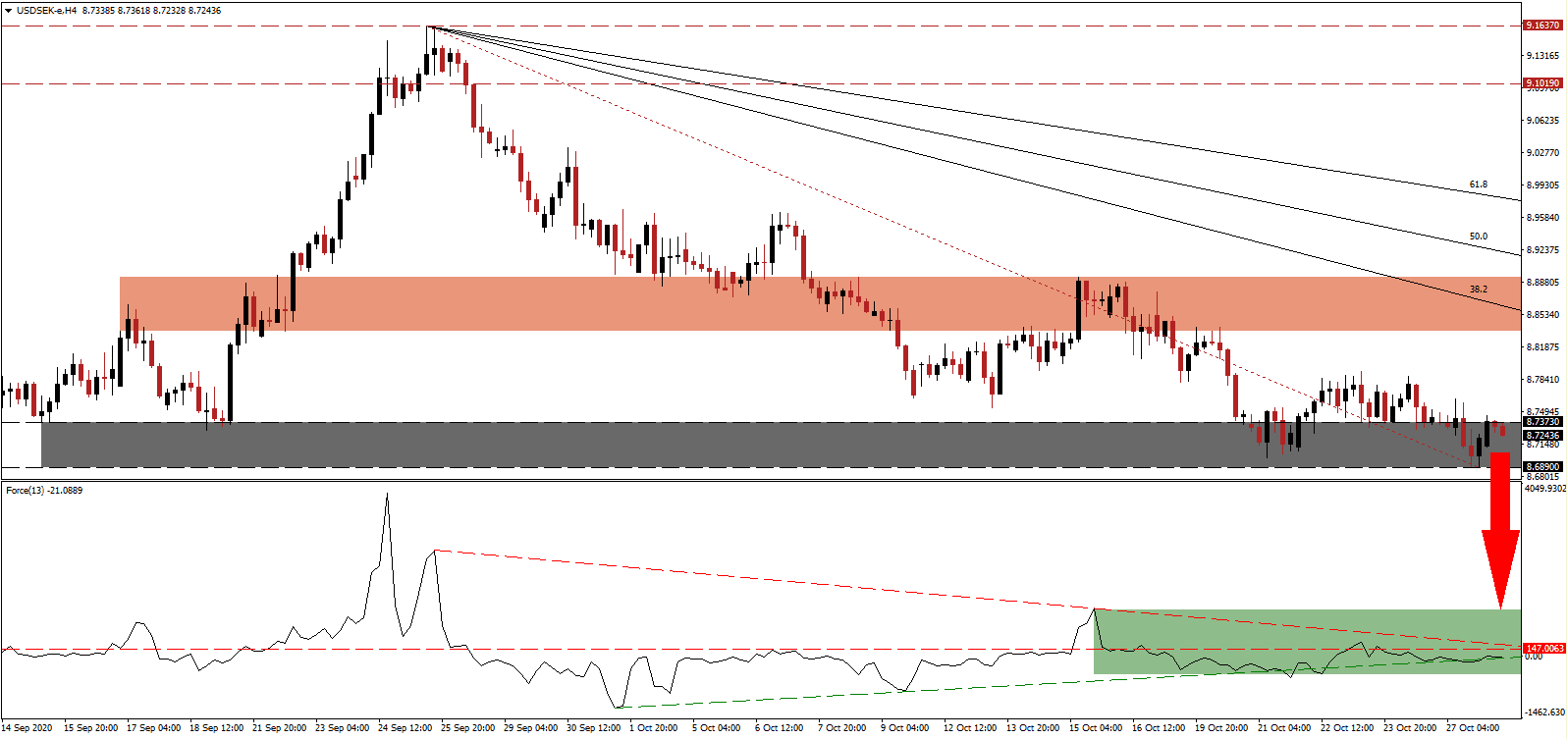

The Force Index, a next-generation technical indicator, maintains its position below the horizontal resistance level. Adding to bearish momentum is the descending resistance level, as marked by the green rectangle, favored to pressure this technical indicator through its ascending support level and farther into negative territory. Bears remain in control over price action in the USD/SEK.

Stefan Ingves, Governor of the Sveriges Riksbank, issued an economic warning amid a worsening outlook for the Covid-19 situation, domestically and internationally. He added it would take years for a full recovery and that the preference for monetary policy would be asset purchased over negative interest rates, already at 0.00%. The revised unemployment rate forecast shows it at 9.6% at the start of 2021, before gradually improving. After the breakdown below its resistance zone located between 8.8353 and 8.8933, as identified by the red rectangle, the USD/SEK faces more downside pressure.

The corporate bond-buying program, launched by the central bank earlier this year, faces harsh criticism amid market manipulation, the same as with other countries, where government interferes, ending free markets. Sweden attempts to unlock a new market in Iran, sponsoring a push for more massive economic corporation amid faltering global trade. The descending Fibonacci Retracement Fan sequence enforces the bearish chart pattern, and the USD/SEK is positioned to correct below its support zone between 8.6890 and 8.7373, as marked by the grey rectangle. Price action will challenge its next support zone between 8.2858 and 8.4180.

USD/SEK Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 8.7250

- Take Profit @ 8.2850

- Stop Loss @ 8.8250

- Downside Potential: 4,400 pips

- Upside Risk: 1,000 pips

- Risk/Reward Ratio: 4.40

In case the ascending support level pressures the Force Index higher, the USD/SEK may attempt a breakout. The US crossed 9,000,000 Covid-19 infections, the population opposes restrictions, and the economic outlook continues to deteriorate with an unsustainable and growing debt burden. Forex traders should sell any rallies with the upside potential reduced to its 61.8 Fibonacci Retracement Fan Resistance Level.

USD/SEK Technical Trading Set-Up - Reduced Breakout Scenario

- Long Entry @ 8.8850

- Take Profit @ 8.9700

- Stop Loss @ 8.8250

- Upside Potential: 850 pips

- Downside Risk: 600 pips

- Risk/Reward Ratio: 1.42