Sweden opted for a highly controversial and much-criticized no lockdown and limited social restrictions approach during the first wave of the Covid-19 pandemic. The economy suffered equally to the rest of the world, primarily due to the export-oriented nature of the Nordic kingdom. Caution by the population despite the absence of restrictive measures. It paid a high death toll among the high-risk population and currently fares no better during the start of the second wave sweeping across Europe. It adopted a new strategy, mirroring that of Germany, with a focus on large-scale testing and contact-tracing. The USD/SEK reversed its breakdown and moved back onto its resistance zone.

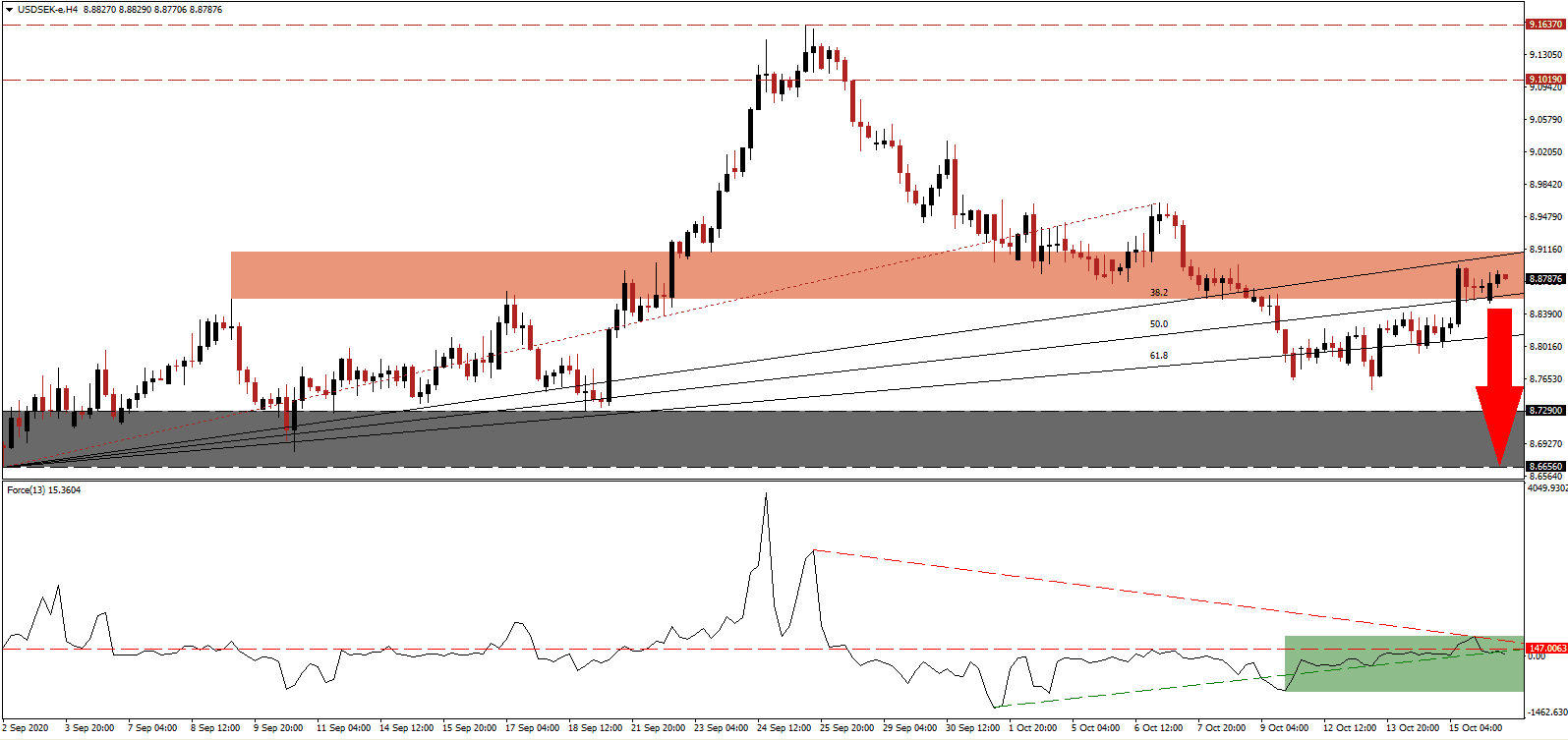

The Force Index, a next-generation technical indicator, was rejected by its descending resistance level, as marked by the green rectangle, and moved below its horizontal resistance level. Bearish pressures magnified following the breakdown below its ascending support level. This technical indicator is on course to slide into negative territory, granting bears complete control over the USD/SEK.

Despite the controversial approach, GDP forecasts for 2020 continue to paint a more positive picture compared to many of its counterparts. Danske Bank is the latest one to join the chorus of upbeat outlooks, relative to the EU, the UK, and the US. The lender predicts a decrease of 3.3%, against calls for a drop of 8.3%, 5.8%, and 4.3%, respectively. Given the second wave of Covid-19, the outlook is likely to deteriorate. The USD/SEK now tests the strength of its short-term resistance zone between 8.8550 and 8.9084, as identified by the red rectangle. A profit-taking sell-off is favored to materialize.

Almost 40% of Swedish companies slashed investment in the first six months of 2020, and the outlook for the second six months calls for even more cuts. Sweden may not recover lost GDP until the second quarter of 2022, and over 3,000,000 Swedes in public sector positions are in wage negotiations, with unions seeking a 3.5% increase from the government. A breakdown in the USD/SEK below its ascending 50.0 Fibonacci Retracement Fan Support Level will position it for a sell-off into its support zone located between 8.6656 and 8.7290, as marked by the grey rectangle.

USD/SEK Technical Trading Set-Up - Profit-Taking Scenario

- Short Entry @ 8.8785

- Take Profit @ 8.6650

- Stop Loss @ 8.9450

- Downside Potential: 2,135 pips

- Upside Risk: 665 pips

- Risk/Reward Ratio: 3.21

Should the Force Index accelerate above its descending resistance level, the USD/SEK may attempt a breakout. Forex traders should take advantage of more upside with new net short positions amid a worsening US labor market and the prospects of more debt. The US has retaken the top spot for new daily Covid-19 infections, adding economic uncertainty, and the upside potential remains confined to its downward revised resistance zone between 9.1019 and 9.1637.

USD/SEK Technical Trading Set-Up - Confined Breakout Scenario

- Long Entry @ 9.0350

- Take Profit @ 9.1450

- Stop Loss @ 8.9450

- Upside Potential: 1,100 pips

- Downside Risk: 900 pips

- Risk/Reward Ratio: 1.22