With new Covid-19 infections trending higher globally, Singapore maintains control over the pandemic, for now. It reports low single-digit daily cases and presently has less than 200 active ones with just one critical. The death toll of 27 from nearly 58,000 infections remains an example of a well-executed strategy. Singapore is well-positioned to move ahead of the curve when it comes to post-Covid-19 economic recalibration and recovery and is expected to handle the second global wave of infections effectively. The USD/SGD shows dominant bearish pressures, and the short-term resistance zone keeps the sell-off intact.

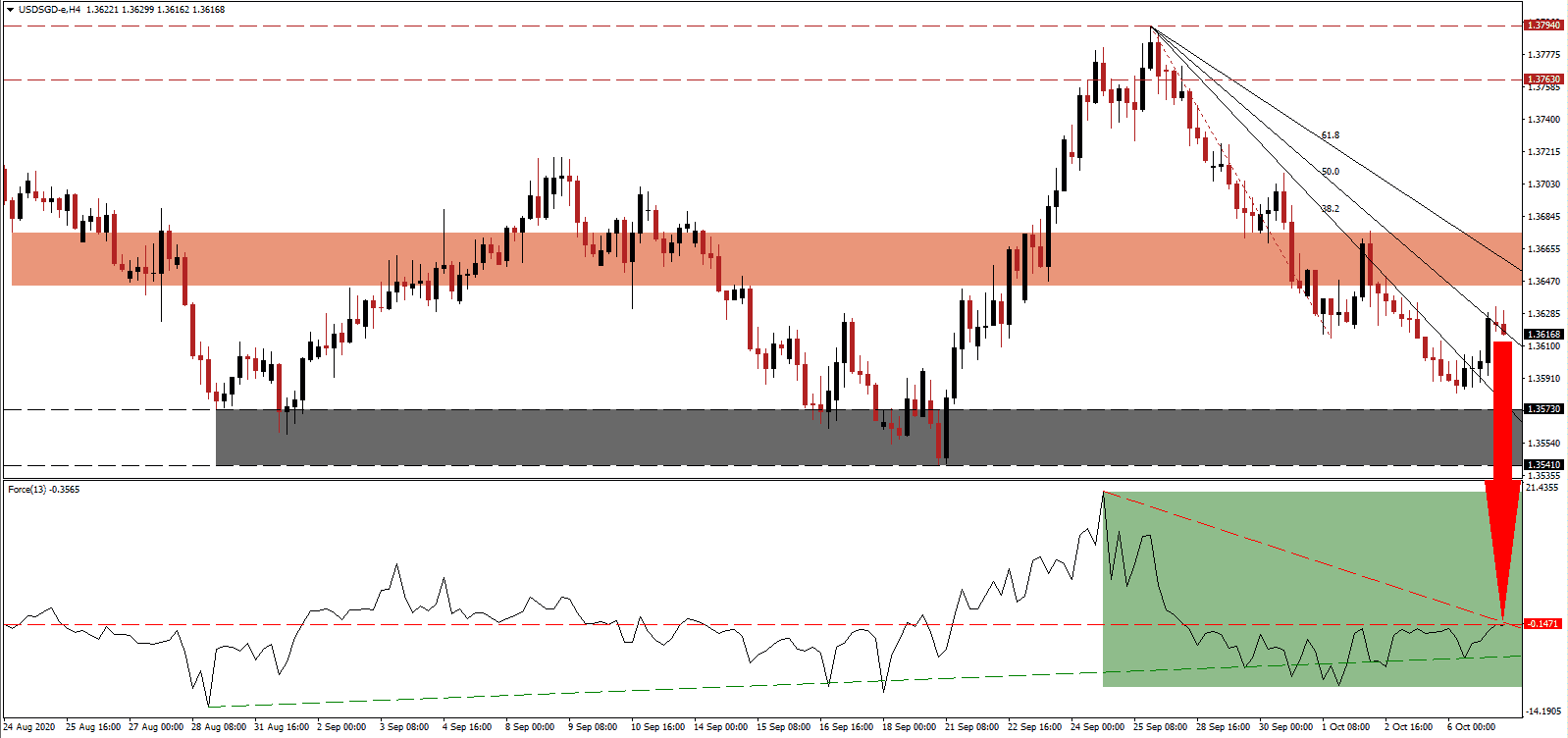

The Force Index, a next-generation technical indicator, drifted higher after sliding below its ascending support level. It recovered above it, but remains below its horizontal resistance level, as marked by the green rectangle. The descending resistance level adds to downside pressure, favored to guide this technical indicator farther into negative territory. Bears remain in control of the USD/SGD.

Heng Swee Keat, the Deputy Prime Minister, and the Minister of Finance confirmed that the government would expand the Progressive Wage Model (PWM) to cover more sectors. The aim is to ensure more businesses can absorb ongoing shocks the global trade, which directly impacts the export-oriented economy of Singapore. The USD/SGD paused its sell-off and advanced marginally, but the short-term resistance located between 1.3644 and 1.3675, as identified by the red rectangle, maintains breakdown pressures on this currency pair.

Calls for consumers across Singapore who are in a position to spend and support economic activity are rising. Chan Chun Sing, the Minister for Trade and Industry, announced that Singapore is building a network of digital economy agreements to assist companies in accessing expanding global markets online. The descending 50.0 Fibonacci Retracement Fan Resistance Level presently forces the USD/SGD into a retreat. It is expected to challenge its support zone located between 1.3541 and 1.3573, as marked by the grey rectangle. A collapse into its next support zone between 1.3442 and 1.3464 is probable.

USD/SGD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.3615

Take Profit @ 1.3445

Stop Loss @ 1.3655

Downside Potential: 170 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 4.25

More upside in the Force Index, driven by its ascending support level, may allow the USD/SGD to drift higher in the near-term. It will present Forex traders with a second short-selling opportunity. After US President Trump advised his negotiators to stop seeking a fifth multi-trillion bailout until after the election, more US Dollar weakness lies ahead. The upside potential remains confined to its intra-day high of 1.3709.

USD/SGD Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 1.3775

Take Profit @ 1.3705

Stop Loss @ 1.3655

Upside Potential: 30 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 1.50