Most of the world struggled with the start of a more violent secondary Covid-19 infection wave, but Singapore maintains relative control over the pandemic. It often reports single-digit new cases and presently has 76 active ones, none critical, in a population just shy of 6,000,000. It allows the domestic economy to recover faster than in most other economies, while the export sector faces more uncertainty. The USD/SGD completed a breakout above its support zone but was rejected by its short-term resistance zone, confirming the dominance of bearish pressures.

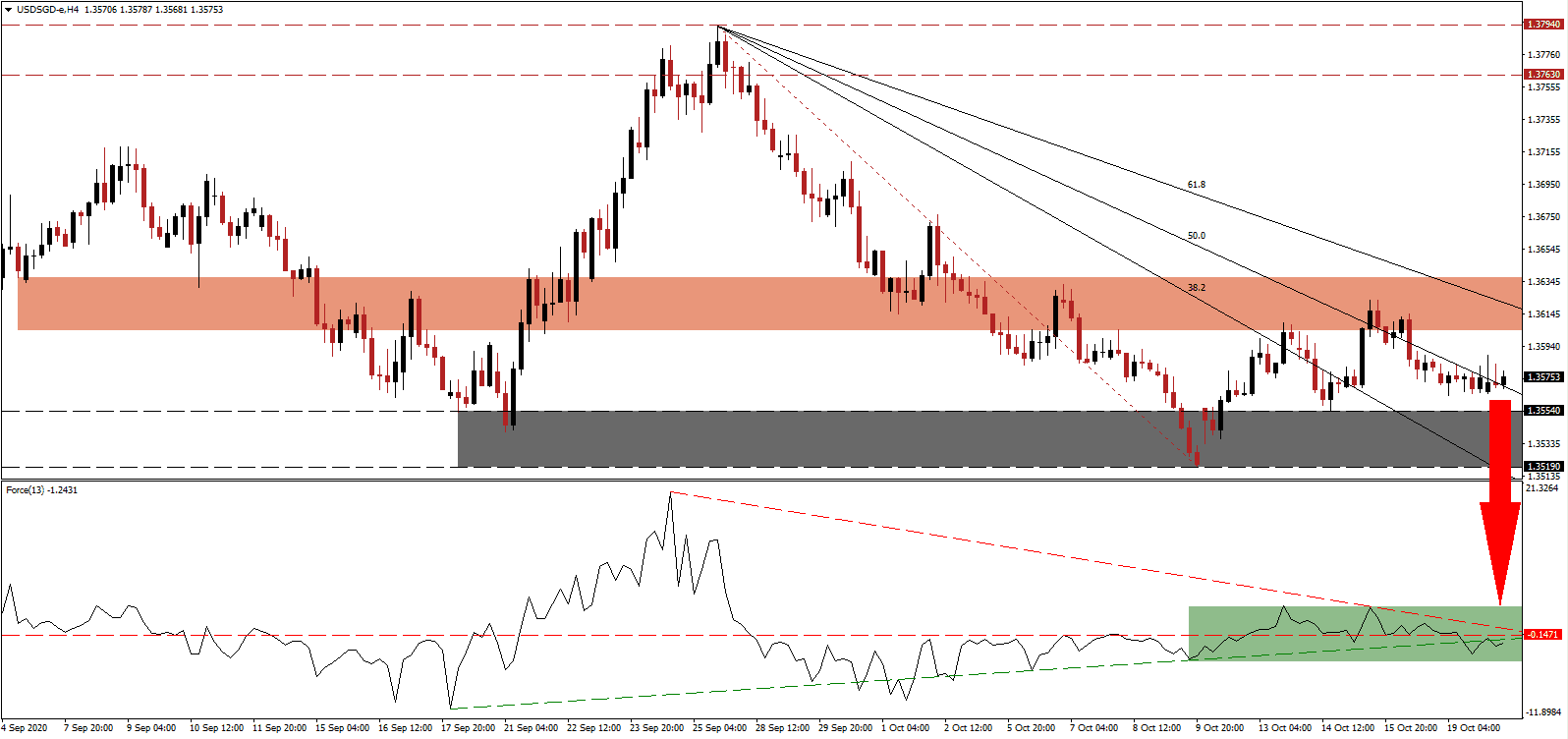

The Force Index, a next-generation technical indicator, remains below the horizontal resistance level, as marked by the green rectangle, and the descending resistance level increases downside momentum. With this technical indicator in negative territory and below its ascending support level, bears remain in complete control over price action in the USD/SGD.

Heng Swee Keat, the Deputy Prime Minister, confirmed plans for Phase 3 of the gradual reopening of the domestic economy. It includes securing early access to approved vaccines, enhances testing, contact tracing, and targeted isolation capabilities. Many presume that Phase 3 will be equivalent to the new normal. The downward adjusted short-term resistance zone located between 1.3604 and 1.3637, as marked by the red rectangle, maintains the well-established long-term bearish chart pattern, from where the corrective phase is positioned to accelerate with a new breakdown.

With Covid-19 continuing to depress global trade, the Ministry of Finance (MOF) announced that S$5.5 billion would be paid out to 140,000 employers on October 29th to support salaries for 1.9 million employees as part of the Jobs Support Scheme (JSS). The program was extended until March 2021 for high-impact sectors. The descending Fibonacci Retracement Fan sequence is favored to pressure the USD/SGD below its support zone located between 1.3519 and 1.3554, as identified by the grey rectangle. Price action will face its next support zone between 1.3442 and 1.3462.

USD/SGD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.3575

Take Profit @ 1.3445

Stop Loss @ 1.3615

Downside Potential: 130 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 3.25

Should the Force Index move above its descending resistance level, the USD/SGD may seek more upside. Any advance will present Forex traders a secondary selling opportunity on the back of a deteriorating US Dollar outlook. The US labor market is weakening, more debt is pending, and political uncertainty on the rise. It limits the potential for an advance to its intra-day high of 1.3676.

USD/SGD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.3640

Take Profit @ 1.3675

Stop Loss @ 1.3615

Upside Potential: 35 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 1.40