The most industrialized nation on the African continent entered the pandemic on a weak economic footing, but Covid-19 has forced the government to address significant problems. President Cyril Ramaphosa delivered his much-delayed South African Economic Reconstruction and Recovery Plan on October 15th and addressed a debate by the to a Joint Hybrid Sitting of Parliament yesterday. The initial response was positive, and breakdown pressures on the USD/ZAR will accelerate the correction.

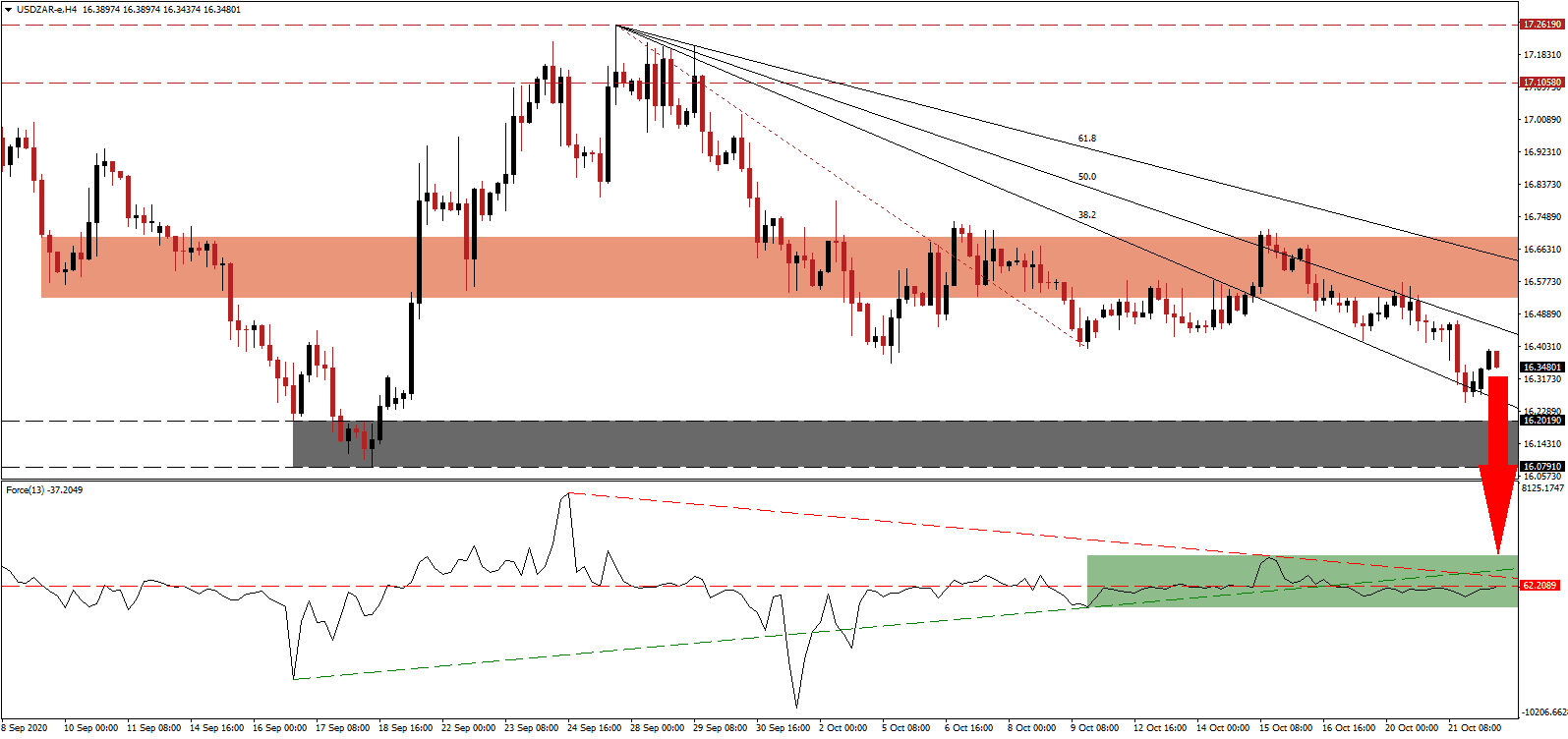

The Force Index, a next-generation technical indicator, continues to trend sideways below its horizontal resistance level, confirming the dominance of bearish momentum following the collapse below its ascending support level. Adding to breakdown pressures is the descending resistance level, as marked by the green rectangle. Bears remain in complete control over the USD/ZAR with this technical indicator in negative territory.

Busi Mavuso, the CEO of Business Leadership South Africa (BLSA), gave support to the plan, suggesting it aligns the interests of government and business. He added that South Africa needs a more functioning government, degraded by years of corruption and mismanagement and that the Economic Reconstruction and Recovery Plan delivers a roadmap to achieve it. The breakdown in the USD/ZAR below its short-term resistance zone between 16.5315 and 16.6944, as marked by the red rectangle, spiked bearish momentum.

While South Africa struggles with depressingly high unemployment, the World Economic Forum (WEF) cautioned that numerous jobs would become redundant. Insurance underwriters, sales representatives, data entry clerks, assembly, and factory workers are on the list of phased out positions from the domestic labor market. The descending 50.0 Fibonacci Retracement Fan Resistance Level is on course to force a breakdown in the USD/ZAR below its support zone between 16.0791 and 16.2019, as identified by the grey rectangle. The next support zone awaits between 15.4844 and 15.7308.

USD/ZAR Technical Trading Set-Up - Breakdown Acceleration Scenario

Short Entry @ 16.3500

Take Profit @ 15.4900

Stop Loss @ 16.5800

Downside Potential: 8,600 pips

Upside Risk: 2,300 pips

Risk/Reward Ratio: 3.74

A breakout in the Force Index above its ascending support level may lead the USD/ZAR into a temporary reversal. Forex traders should take advantage of any price spike with new net short positions. The outlook for the US Dollar remains distinctively bearish due to a combination of monetary policy, political uncertainty, and labor market weakness. The upside potential was reduced to its intra-day high of 16.7926.

USD/ZAR Technical Trading Set-Up - Reduced Reversal Scenario

Long Entry @ 16.6700

Take Profit @ 16.7900

Stop Loss @ 16.5800

Upside Potential: 1,200 pips

Downside Risk: 900 pips

Risk/Reward Ratio: 1.33