South Africa experiences a gradual increase in new Covid-19 infections as the second wave spirals out of control in Europe and the US, prompting France and Germany to announce new nationwide lockdown measures for November. South African President Cyril Ramaphosa downplayed rumors that he considers to follow suit, as he entered self-quarantine after one of the guests at a charity dinner tested positive for the virus. The USD/ZAR briefly spike during a short-covering rally but was rejected, providing the spark for the next breakdown sequence.

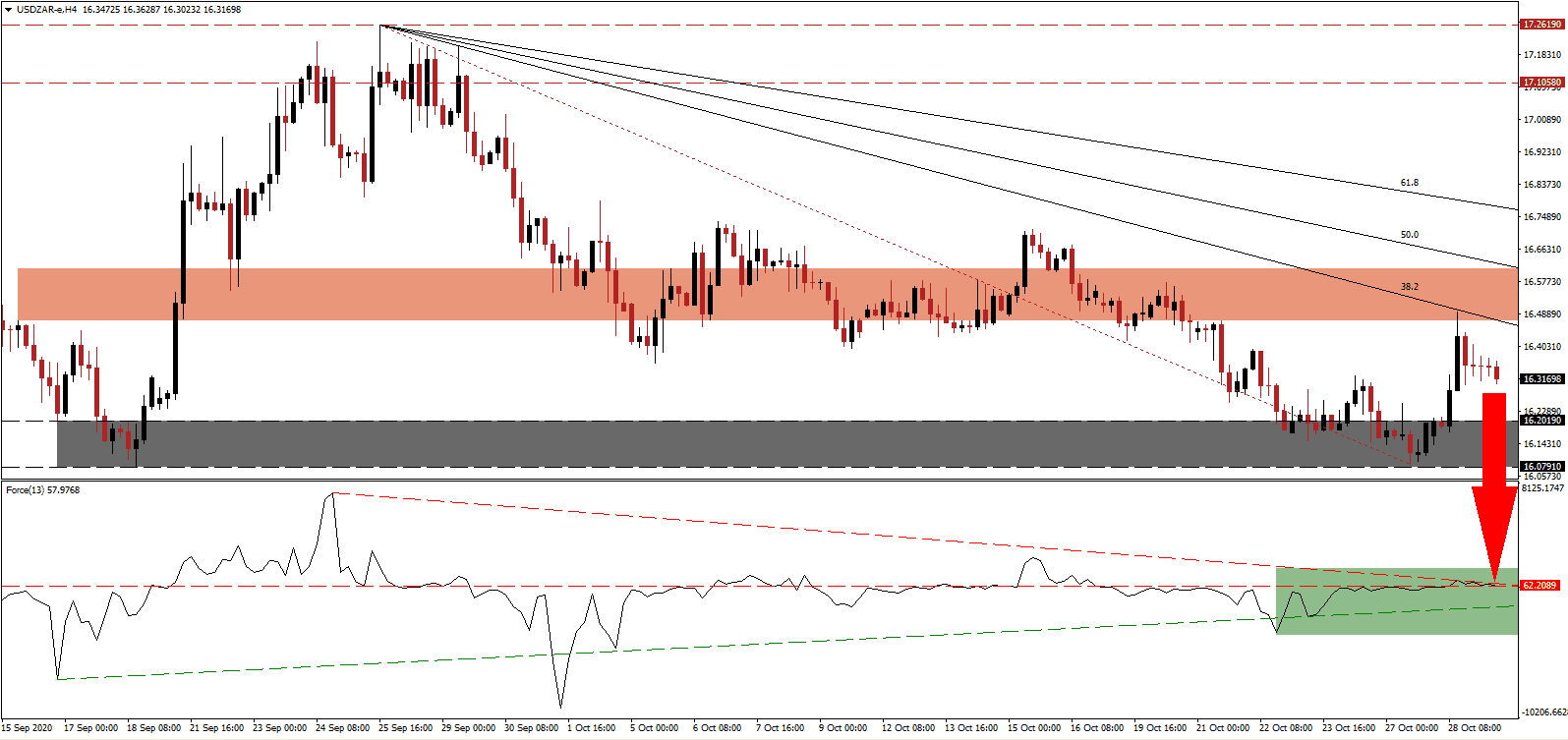

The Force Index, a next-generation technical indicator, moved above its horizontal resistance level, but the descending resistance level now pressures it for a renewed breakdown. Bearish momentum continues to expand, and this technical indicator is well-positioned to collapse below the 0 center-line, and through its ascending support level, granting bears complete control over the USD/ZAR.

Part of the economic recovery plan for South Africa includes support for small businesses, which employ 47% of the workforce and contribute 20% of GDP. The announced relief programs remain selective. For example, the Sukuma Fund distributed R1 billion to official small businesses able to survive the pandemic, saving 32,000 jobs. By contrast, 3,000,000 jobs are forecast to vanish in 2020. The short-term resistance zone located between 16.4708 and 16.6092, as identified by the red rectangle, rejected an extension of the counter-trend advance in the USD/ZAR, from where a breakdown acceleration can materialize.

Tito Mboweni, the South African Minister of Finance, delivered the mid-term budget statement. Matthew Parks, the parliamentary coordinator for the Congress of South African Trade Unions (Cosatu), urged the government to inject more capital into the economy. It outlined wasteful spending and corruption-related costs of R150 billion per year. The descending Fibonacci Retracement Fan sequence is set to force the USD/ZAR into is support zone between 16.0791 and 16.2019, as marked by the grey rectangle. A breakdown will extend the correction into its next support zone between 15.4844 and 15.7308.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 16.3150

- Take Profit @ 15.4900

- Stop Loss @ 16.5150

- Downside Potential: 8,250 pips

- Upside Risk: 2,000 pips

- Risk/Reward Ratio: 4.13

A breakout in the Force Index above the descending resistance level may lead the USD/ZAR into a secondary push higher. Given the deteriorating conditions for the US economy, the US Dollar faces rising bearish momentum. Political uncertainty and weakening fundamentals add to selling pressure. The upside potential remains reduced to its 61.8 Fibonacci Retracement Fan Resistance Level, and Forex traders should sell any rallies.

USD/ZAR Technical Trading Set-Up - Reduced Breakout Scenario

- Long Entry @ 16.6150

- Take Profit @ 16.7550

- Stop Loss @ 16.5150

- Upside Potential: 1,400 pips

- Downside Risk: 1,000 pips

- Risk/Reward Ratio: 1.40