South Africa, home to the world’s most unequal society, continues to struggle more from procrastination by the government of President Cyril Ramaphosa than from the Covid-19 pandemic. Africa’s most industrialized nation is also the most-infected country on the continent and the ten most-infected globally. With the extended unemployment rate set increase above 45%, the government must implement structural reforms. Hopes remain that President Ramaphosa will be forced by markets to deliver, keeping the breakdown sequence in the USD/ZAR intact.

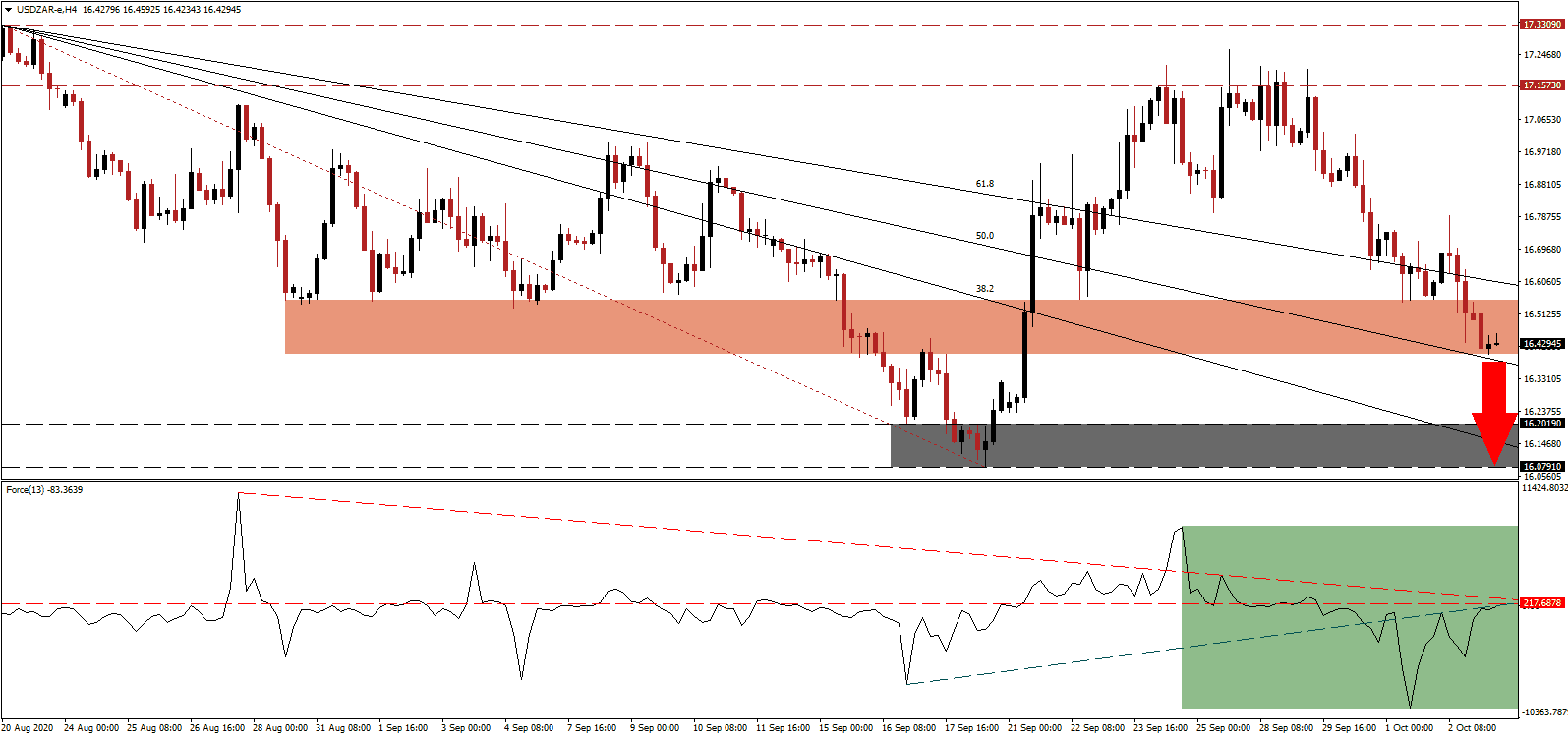

The Force Index, a next-generation technical indicator, recovered from a plunge to a fresh multi-week low. Bearish pressures are dominant, as it maintains its position below its horizontal resistance level and its ascending support level. The descending resistance level is expected to guide this technical indicator farther into negative territory, as marked by the green rectangle. The USD/ZAR faces more downside and is under the control of bears.

While the government continues to negotiate, two trends have emerged across the population. The uncertain outlook has increased demand to own property, a positive long-term development for the economy. On the other side of the spectrum, hatred towards immigrants amid the dire job market intensified, and the first openly anti-immigrant group, Put South Africa First, formed. Cautious optimism keeps bearish pressures alive, with the USD/ZAR pausing inside of its short-term resistance zone located between 16.3991 and 16.5525, as identified by the red rectangle.

Until South Africa does not address and resolve its energy problem, with Eskom at the core of it, any recovery plan is positioned to fail. German engineers assist with upgrades, but a more diversified energy mix is paramount. The government hopes that the energy-intensive mining sector will aide the economic recovery, adding more pressure on resolving the insufficient and unreliable electricity grid. With the descending Fibonacci Retracement Fan sequence enforcing the bearish chart pattern, the USD/ZAR is set to challenge its support zone located between 16.0791 and 16.2019, as marked by the grey rectangle.

USD/ZAR Technical Trading Set-Up - Breakdown Resumption Scenario

Short Entry @ 16.4300

Take Profit @ 16.0800

Stop Loss @ 16.5200

Downside Potential: 3,500 pips

Upside Risk: 900 pips

Risk/Reward Ratio: 3.89

A breakout in the Force Index above its descending resistance level can lead the USD/ZAR into a brief price spike. Forex traders should consider it as a selling opportunity due to the worsening outlook for the US Dollar. The Covid-19 infection of President Trump, and uncertainty over his health, added to the halt in short-term selling pressure, with the long-term bearish trend intact. The upside potential is confined to its intra-day high of 16.7926.

USD/ZAR Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 16.6100

Take Profit @ 16.7400

Stop Loss @ 16.5200

Upside Potential: 1,300 pips

Downside Risk: 900 pips

Risk/Reward Ratio: 1.44