South Africa is inching closer to 700,000 confirmed Covid-19 infections but will leave the Top Ten most-infected list over the next 48 hours, as France will overtake Africa’s most industrialized nation. It is not a sign of improvement in conditions across South Africa, but deterioration elsewhere. With the domestic economy ailing, a prolonged global depression in trade will add to economic stress. One bright spot remains commodity demand out of China, which benefits the dominant South African mining sector. The USD/ZAR showed signs of a breakout extension before a resurgence of bearish pressures ignited a fresh sell-off.

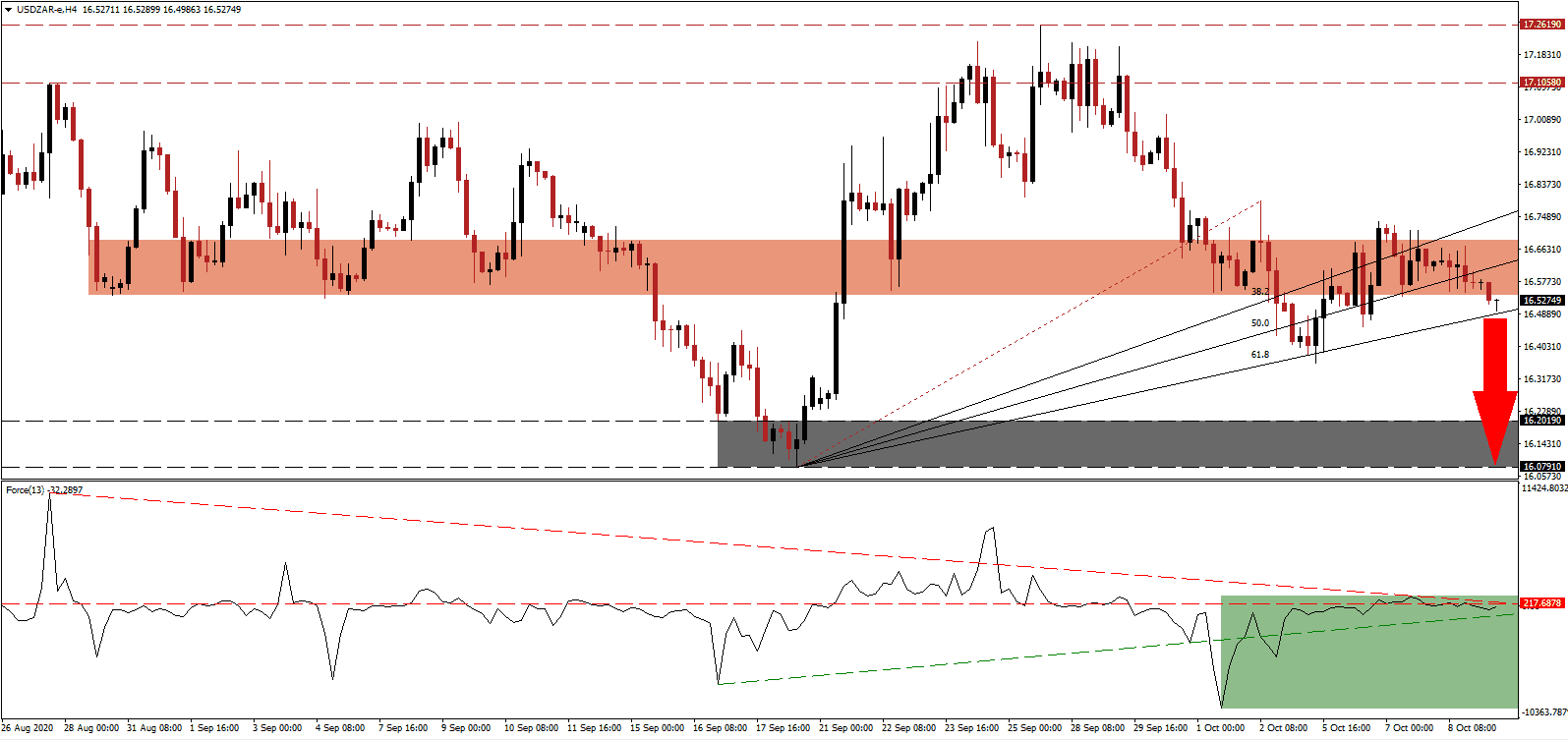

The Force Index, a next-generation technical indicator, failed to maintain its advance above the horizontal resistance level, as marked by the green rectangle, and a shallow downtrend followed. While it remains above its ascending support level, bearish momentum is on the rise, enhanced by its descending resistance level. This technical indicator moved below the 0 center-line, granting bears the upper hand in the USD/ZAR.

A new World Bank report outlined the first recession in Sub-Saharan Africa in 25 years, with a GDP contraction of 3.3%. Nigeria and South Africa, the continent’s two largest economies, are leading the output drop. GDP-per-capita may decrease by 6.0%. The Covid-19 pandemic is forecast to push 40 million into extreme poverty, reversing five years of progress. The USD/ZAR converted its short-term support zone into resistance after the breakdown, which is located between 16.5400 and 16.6873, as marked by the grey rectangle.

Eskom CEO de Ruyter announced load-shedding, partially blamed for long-lasting economic issues, will be significantly reduced until plans to eliminate it by September 2021. It suggests that South Africa is slowly on the path to recovery, but the South African Chamber of Commerce and Industry (SACCI) urges caution amid weakening business confidence. US Dollar weakness helped the USD/ZAR reverse its most recent advance. A breakdown below its ascending 61.8 Fibonacci Retracement Fan Support Level can take it into its support zone, located between 16.0791 and 16.2019, as identified by the grey rectangle.

USD/ZAR Technical Trading Set-Up - Breakdown Resumption Scenario

- Short Entry @ 16.5275

- Take Profit @ 16.0800

- Stop Loss @ 16.6500

- Downside Potential: 4,475 pips

- Upside Risk: 1,225 pips

- Risk/Reward Ratio: 3.65

A reversal in the Force Index above its descending resistance level could delay the pending sell-off in the USD/ZAR. Forex traders should consider any short-term advance as a selling opportunity amid a worsening outlook for the US Dollar. While South Africa gradually implements necessary improvements, the conditions for the US economy over the medium-term falter. The upside remains limited to its intra-day high of 16.7926.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 16.7000

- Take Profit @ 16.7900

- Stop Loss @ 16.6500

- Upside Potential: 900 pips

- Downside Risk: 500 pips

- Risk/Reward Ratio: 1.80