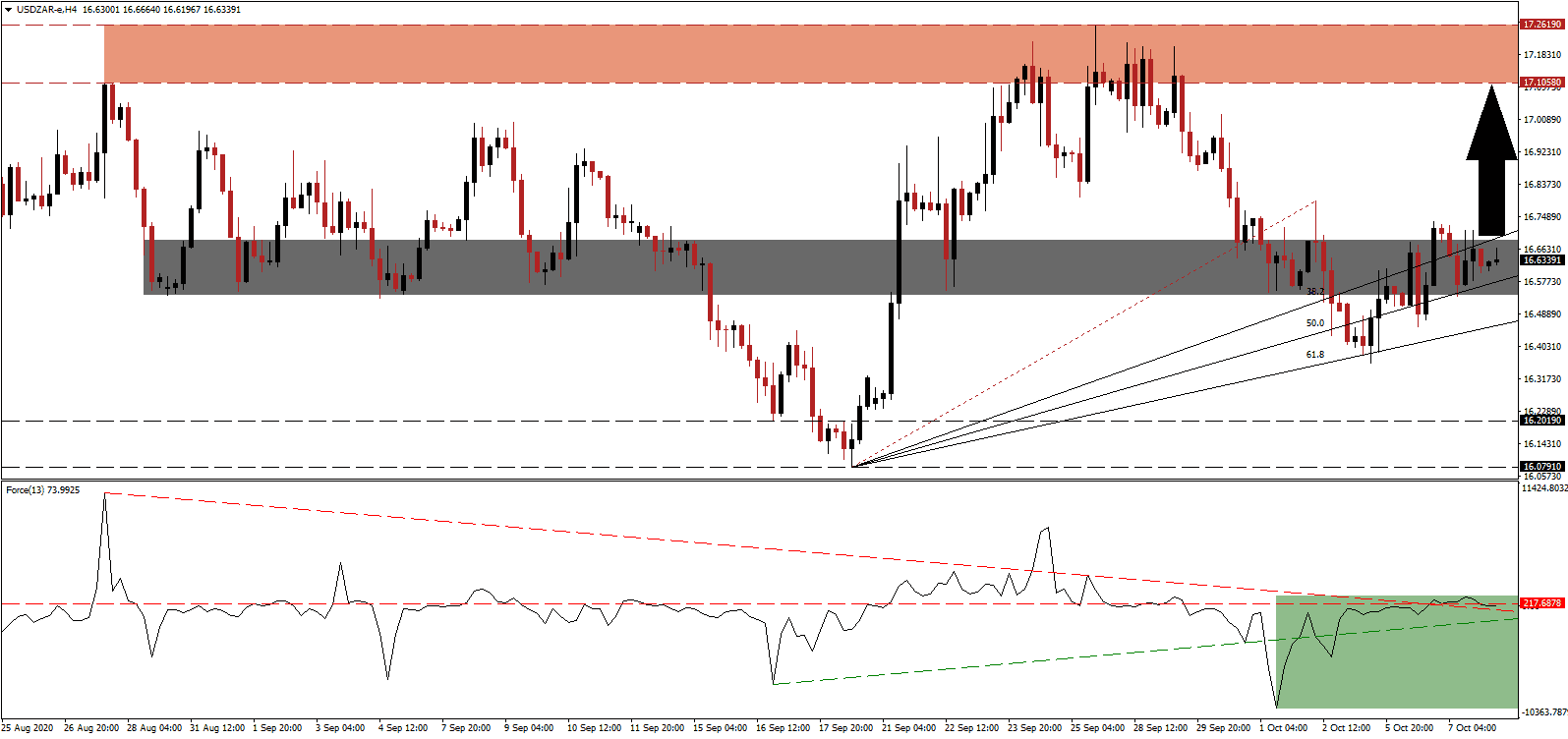

After easing lockdown measures and social distancing rules, the economy entered a post-lockdown recovery as expected, but its alarming unemployment rate and ongoing electricity issues remain significant obstacles. Fundi Tshazibana, the Deputy Governor of the South African Reserve Bank (SARB), suggested it could take until the end of 2022 for the economy to reach pre-pandemic levels. The USD/ZAR extended its counter-trend advance and converted its short-term resistance zone into support.

The Force Index, a next-generation technical indicator, briefly pierced above its horizontal resistance level, but bullish momentum was not strong enough to maintain it. It was able to remain above its descending resistance level, as marked by the green rectangle, and the ascending support level is adding to short-term upside pressure. This technical indicator crossed above the 0 center-line, allowing bulls to assume control over the USD/ZAR.

Big Four accounting firm PricewaterhouseCoopers (PwC) released a new report criticizing the South African government operating model, which led to the world’s most unequal society. Many South Africans depend on social grants and do not participate in the economy. They lack stable jobs and the financial, social, and psychological benefits associated with it. Until President Cyril Ramaphosa acts on promised reforms, the USD/ZAR may remain under upside pressure inside of its converted short-term support zone located between 16.5400 and 16.6873, as marked by the grey rectangle, from where a breakout is possible.

One area outlined as a catalyst for the South African economy is hydrogen. Andries Rossouw, a PwC Africa Energy, Utilities, and Resources expert, pointed out the joint plea by struggling national utility Eskom, and Gwede Mantashe, the Minister of Mineral Resources and Energy, for mining companies to invest in their energy infrastructure. Hydrogen is more efficient due to energy storage problems with other alternative sources, and industry experts consider it as an essential driver for South Africa. After the USD/ZAR moved above its redrawn ascending 50.0 Fibonacci Retracement Fan Support Level, an extension into its downward revised resistance zone located between 17.1058 and 17.2619, as identified by the red rectangle, cannot be excluded.

USD/ZAR Technical Trading Set-Up - Short-Term Breakout Scenario

- Long Entry @ 16.6350

- Take Profit @ 17.1050

- Stop Loss @ 16.4850

- Upside Potential: 4,700 pips

- Downside Risk: 1,500 pips

- Risk/Reward Ratio: 3.13

Should the Force Index collapse below its descending resistance level, serving as support, the USD/ZAR is favored to resume its long-term downtrend. The US Dollar remains under bearish pressures amid a slowing labor market and high debt levels, while localized lockdowns amid new Covid-19 infections add to the grim outlook. Forex traders should view any advance as a selling opportunity into its support zone between 16.0791 and 16.2019.

USD/ZAR Technical Trading Set-Up - Breakdown Resumption Scenario

- Short Entry @ 16.3550

- Take Profit @ 16.0850

- Stop Loss @ 16.4850

- Downside Potential: 2,700 pips

- Upside Risk: 1,300 pips

- Risk/Reward Ratio: 2.08