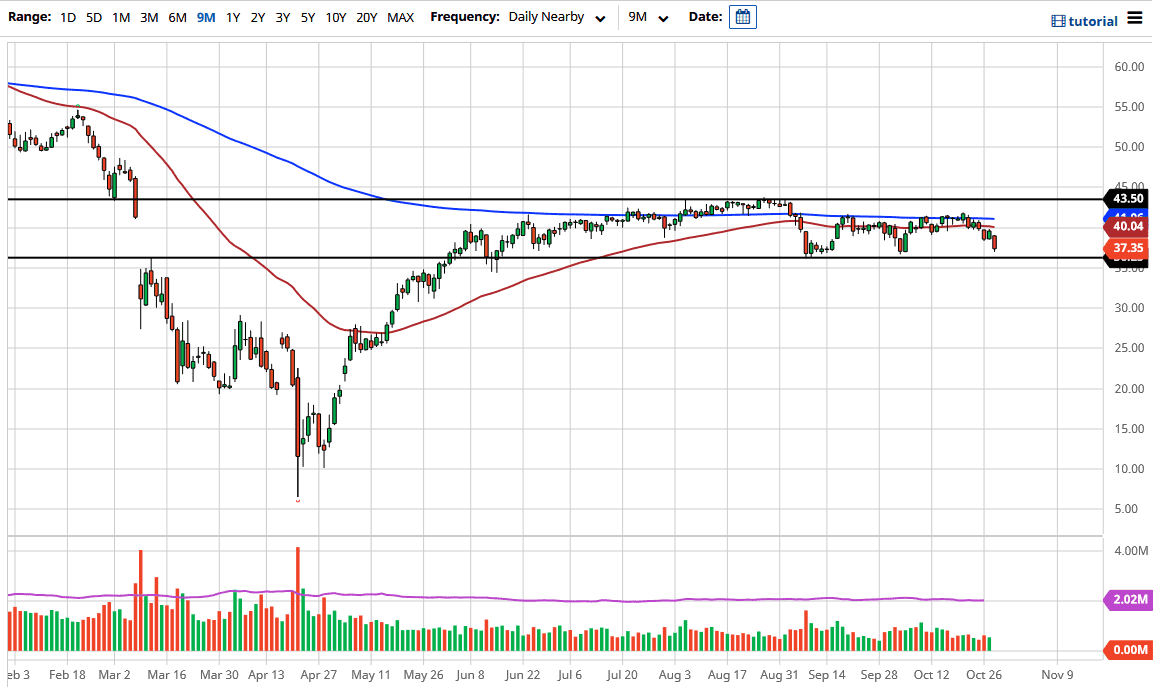

The market is testing major support to be found near the $36.25 level, which is an area that we have seen offer support a couple of times in the past. In fact, at one point some people were talking about a potential “double bottom”, but obviously that is no longer the case. As a general rule, this sets up a nice shorting opportunity if we can break down below that double bottom.

If and when we do break down below that double bottom, the market is very likely to go looking towards the $35 level almost immediately, followed by a move down towards the $30 level after that. This makes quite a bit of sense, because the crude oil markets are going to continue to face negativity due to the fact that the US dollar of course continues to strengthen and during the day on Wednesday we got a bearish inventory figure as well. That suggests that we are going to continue to see a serious lack of demand going forward. Furthermore, we also have to worry about several European economy slowing down now, due to the coronavirus figures. In other words, it is hard to imagine where the demand comes from, especially as we have so much in the way of oversupply.

Rallies at this point in time should be selling opportunities, at the first signs of exhaustion. I believe that the $40 level above will be massive resistance, not only due to the fact that it is a large, round, psychologically significant figure, but it is also an area that features the 50 day EMA and therefore I think a certain amount of people will be paid attention to that technical indicator. Between the 50 day EMA and the 200 day EMA, I think there is even more resistance from a technical standpoint. It is all but impossible to see a scenario where you should be an aggressive buyer of crude oil, unless of course the US dollar suddenly melts down, something that does not seem very likely to happen anytime soon.