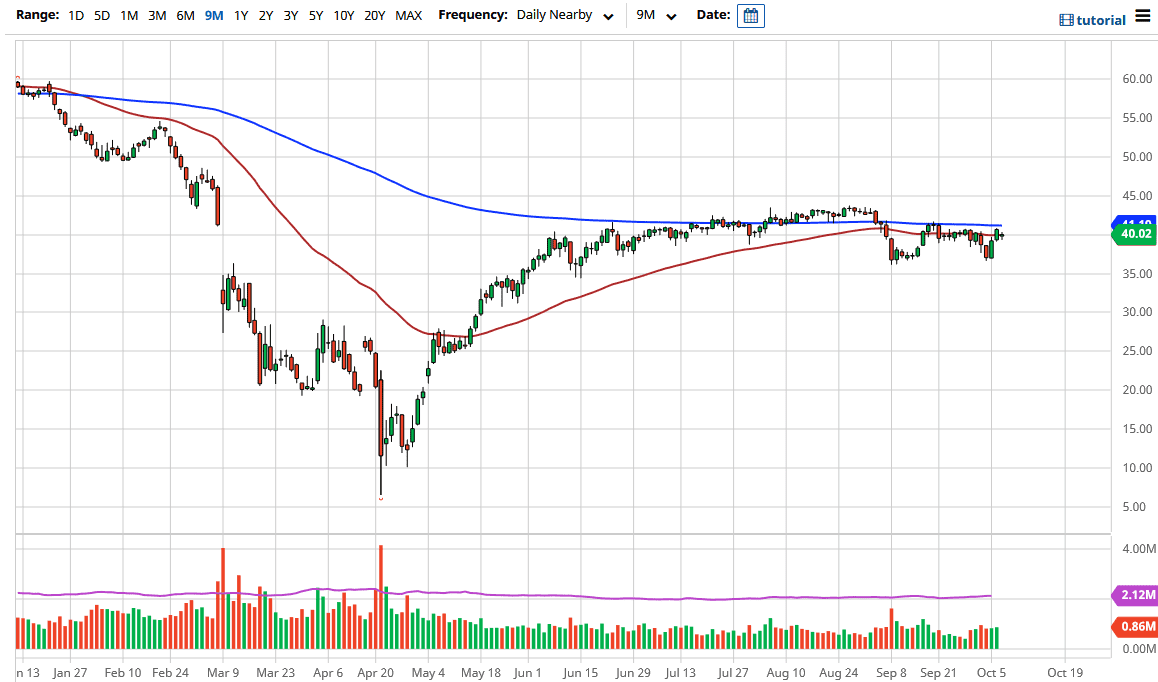

The market ended up forming a very neutral candlestick, and therefore it looks as if we are running out of momentum. The $40 level being an area where we are going to attract a lot of attention due to the fact that it is a large, round, psychologically significant figure is worth paying attention to as well. Beyond that, the 200 day EMA which sits just above is going to offer resistance also.

The crude oil inventories were much more bearish during the trading session on Wednesday as well, so that is another reason to think that perhaps crude oil is not going to rally much from here, and then add to that the fact that the US dollar might strengthen going forward, it is possible we could see oil will continue to take it on the chin. If that is going to be the case, then I think that the $27 level will be threatened, and perhaps the market will go down towards the $35 level.

Ultimately, I think that we are essentially stuck in a range, and therefore as we are closer to the top of the range than the bottom, I think that it makes quite a bit of sense that we continue to see bearish pressure of the next couple of days. In fact, I do not really have a scenario in which I am willing to buy crude oil, unless there is some type of massive stimulus package or dollar event that has the greenback falling apart. If that is going to be the case, then it is likely that crude oil will then go looking towards $45, possibly even $50. However, I do not see that happening anytime soon and even if it did, it is very likely that the sellers would come back in as there simply is not enough demand, and I am not necessarily convinced that stimulus will change that equation, as it has not yet, so it is difficult to imagine that will suddenly change it again. With this, I like the idea of simply playing the tight range that we have been in over the last couple of weeks.