Stimulus in the United States is not necessarily coming in the short term, and if that does end up being what people pay attention to and try to react, the idea is that crude oil could take a bit of a hit if there is going to be less demand.

The biggest problem that people are going to continue to deal with in this market is the fact that OPEC plus is trying to extend cuts, but quite frankly there is not necessarily signs that it is going to be that easy. If that is the case, this is a market that should see more downward pressure given enough time. True, stimulus can work against the value of the US dollar, which does give a bit of a boost to commodities, but we have seen stimulus at least four times before and you can certainly make an argument for a market that simply does not have a lot of demand. Until the economy picks up, it is quite ridiculous to think that crude oil is something that we should be buying for a longer-term move. In the meantime, this is a market that simply grind back and forth between a couple of very prominent levels.

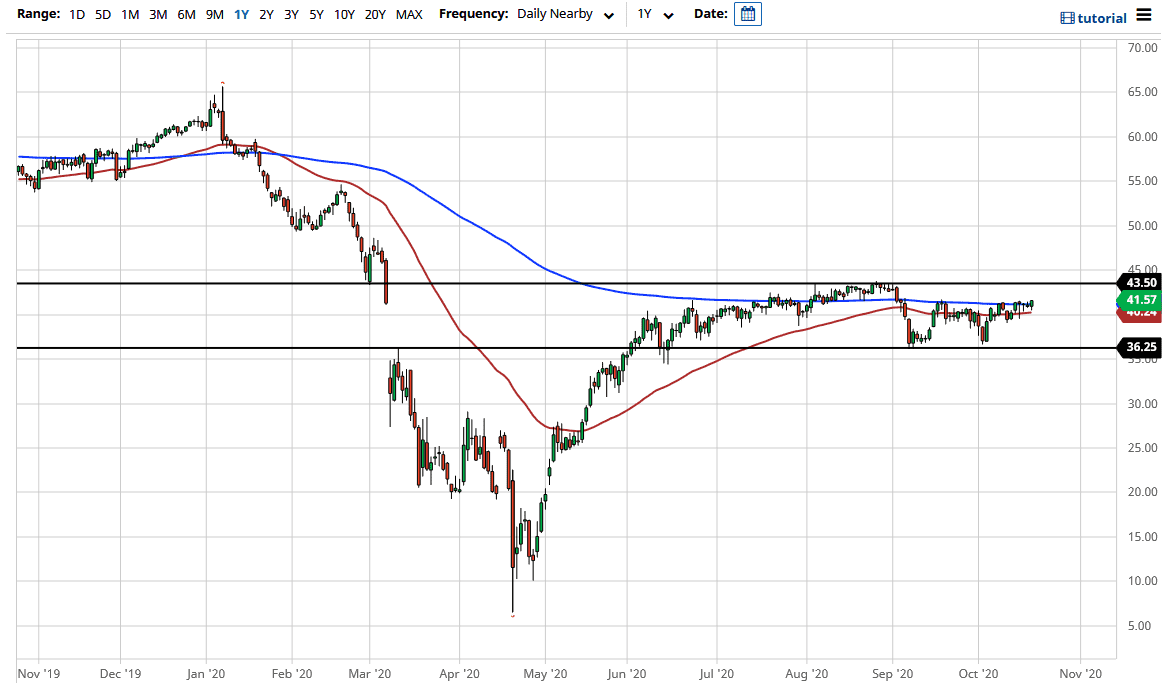

To the downside, the $36.25 level seems to be massive support, just as the $43.50 level should offer resistance. We are getting closer to the top, so I think the trade here is to simply wait for signs of exhaustion that you can start selling. It is not until we get a daily close above the highs of the recent consolidation that I would consider buying this market. At that point, we would more than likely test $45, and then the $47.50 level after that. To the downside, I think that the $36.25 level will continue to be rather supportive and of course the $40 level will cause some noise. I think at this point in time, the markets are simply chopping around and offering short-term buying and selling opportunities more than anything else.