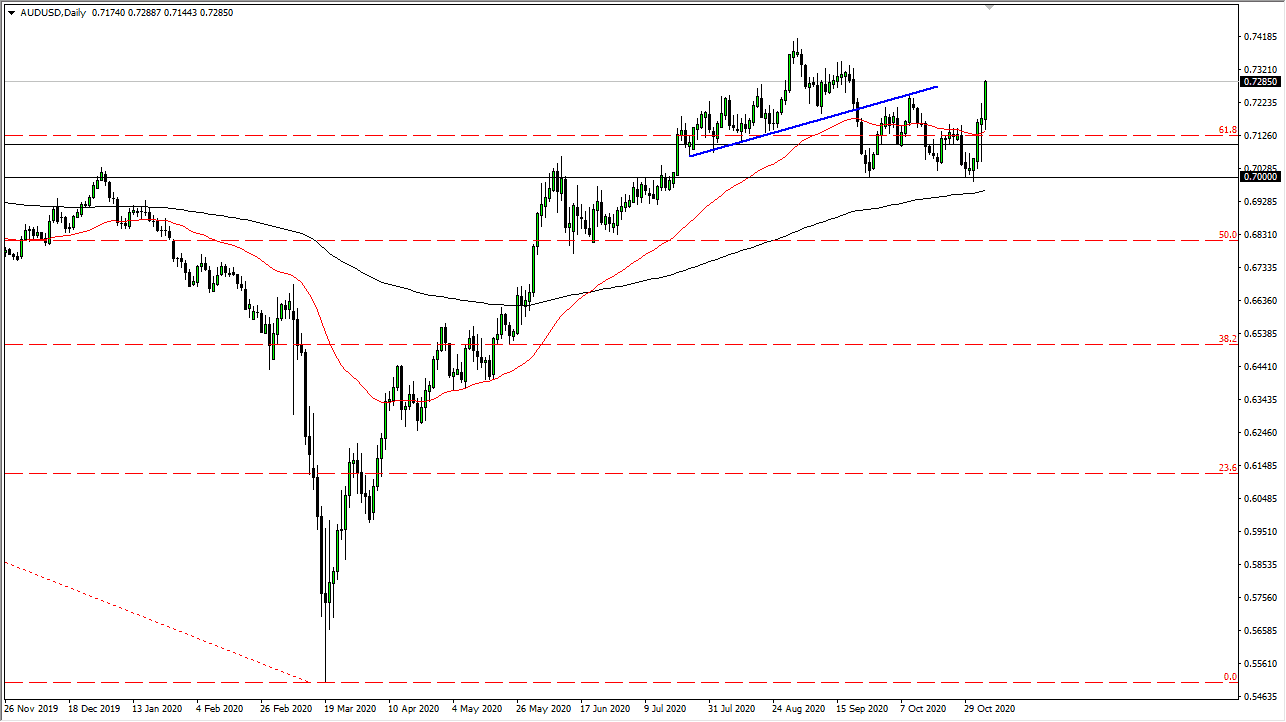

The Australian dollar has rallied quite sharply during the trading session on Thursday, as we are reaching towards the previous uptrend line which we had broken through and tested at least once. At this point, we are getting rather close to the 0.73 level, which coincides quite nicely with the massive selloff that we had seen previously to crash through that uptrend line. The Australian dollar is going to be moving on risk appetite, and perhaps the help of potential stimulus.

That being said, the United States is currently a place that is in turmoil to say the least from an election standpoint, and then we also have the jobs number which will come out on Friday. That something that should be paid attention to, as it is likely to cause a lot of noise. With that being the case, I think what we are looking at here is the market trying to reach towards major supply, to test it for whether or not it can hold. Ultimately, I think this is a market that will eventually find some type of resolution, but keep in mind that the Reserve Bank of Australia has already signal that that it is going to get loose with its monetary policy as well. In other words, this may come down to whether or not there is any growth. Obviously, stimulus does add a little bit of a short-term sugar high, but this will be the fourth package in the United States. In other words, will there really be any growth this time?

All of this being said, we are still between the 0.7350 and 0.70 levels, which is the consolidation area that we had been in previously. This has not changed, although it is starting to look more and more like the Australian dollar may be able to find some type of bid. Quite frankly, after the news conference coming out of the Federal Reserve, it was pointed out more than once that the federal government has to step up to the plate, and to think that is going to happen in the short term is a bit of a stretch. Because of this, I believe that the market will find plenty of sellers as we have gotten stretched, at least for the short term. Eventually we will get some certainty, but that is not something that we have at the moment.