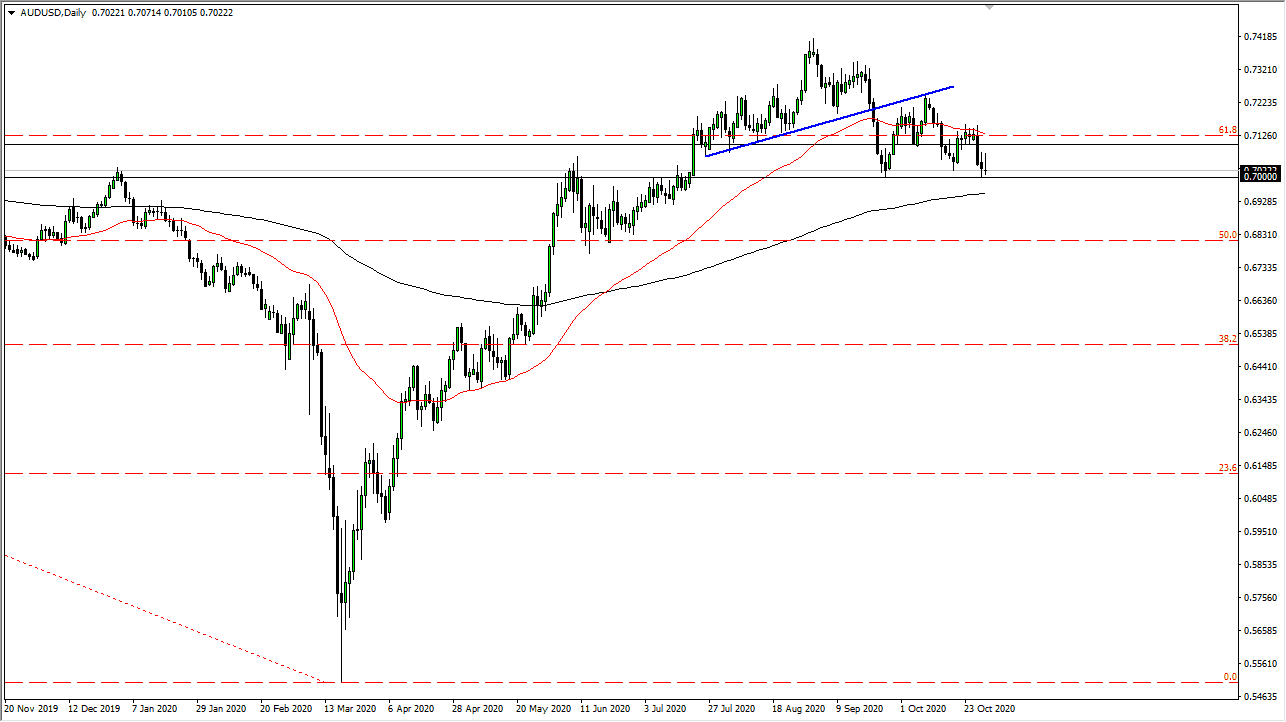

The Australian dollar has rallied during the trading session on Monday, but gave back the gains in order to form a negative candlestick. The candlestick that we have formed suggests that we could finally turn around a break down below the 0.70 level. If we do, it is likely that the market will go much lower.

This is all due to the negativity out there. After all, the US stimulus seems to be on hold at best, and it is likely that we will see the US dollar pick up momentum. Underneath the 0.70 level, we have the 200 day EMA which could come into the picture and offer some support. Unless something changes rather drastically, I do not believe that we will stop falling through there. If we do break down below the 0.70 level, then the 0.68 handle will be the next target. Keep in mind that the Aussie needs “risk on trading” in order to get it going higher. I think any rally is likely to fail near the 0.71 handle. I do believe that it is only a matter of time before we drop.

The Australian dollar has been insulated against the negativity out there, being so highly correlated to the Chinese economy. However, with present uncertainty, people will be looking towards the US dollar for stability. The market has recently broken below a major trendline, and it now looks as if we are ready to form a “lower low” on the higher time frames.

On the upside, even if we break above the 50 day EMA, it looks as if the 0.73 level will be massive resistance. This is a market that I think continues to hear a lot of noise in general, which typically favors the greenback; at the very least, you can put money to work in the treasury market in a relatively “risk-free return.” Gold markets also have pressure against them, which has driven down the value of the Aussie as well.