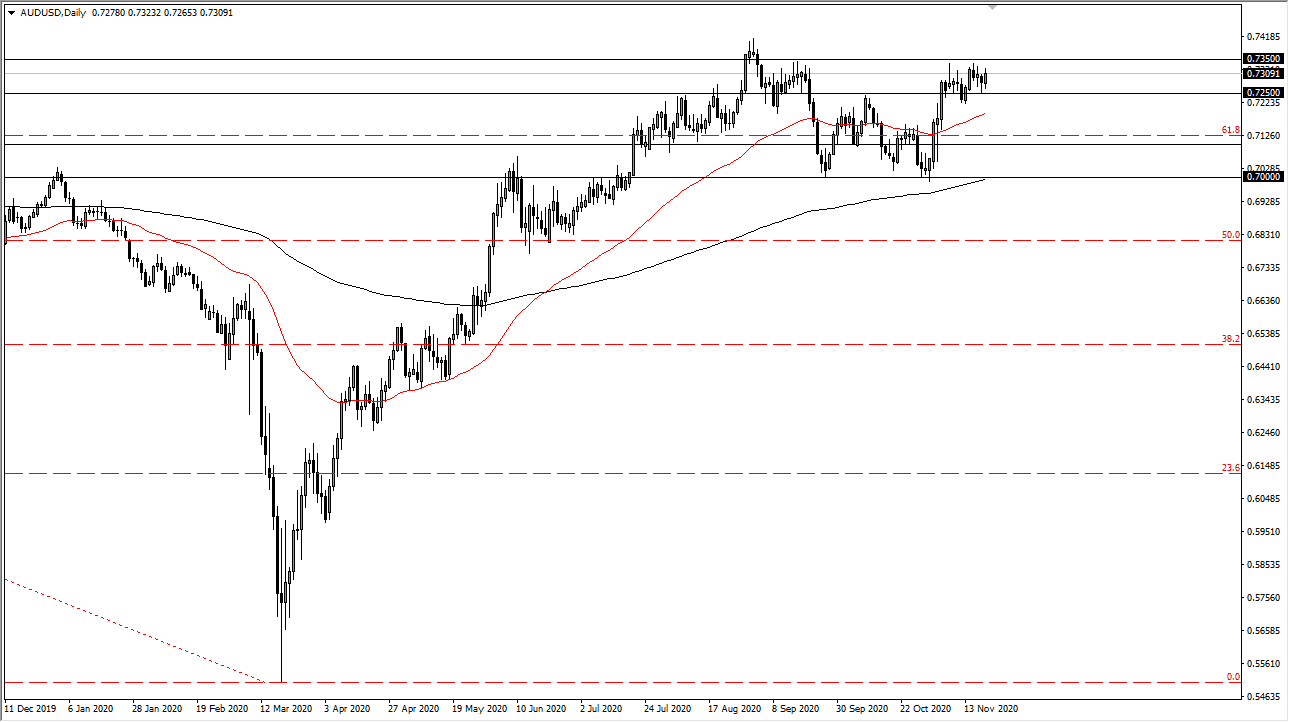

The Aussie dollar fluctuated during the course of the trading session on Friday but had a generally positive tone. The 0.7350 level above is resistance, just as the 0.7250 level is support. The market will eventually see a breakout or breakdown, and I plan on following that.

In the short term, the 100-PIP range is something that you can trade back and forth, but you need to do so on short-term charts. The position size should be relatively small, because we will eventually break past the barriers. Once we do, I have a little bit more to work with as far as a bigger trade. Until then, we will probably just vacillate.

If we can break above the 0.7350 level - and by a break above, I mean to close above there - then we could go looking towards much higher levels. However, if we break down below the 0.7250 level, then at the very least we will go looking towards the 50-day EMA, perhaps even down to the 0.71 level. There are 100 points worth of support down at that area, as well as the 200-day EMA, so many people will be looking at that as a potential buying opportunity longer term. We need to pay attention to any breakout that comes along, but we are facing a lot of different headwinds and crosscurrents now that will make it difficult to get overly aggressive or particularly invested in any particular trade until we get an obvious move.

We also need to keep in mind that the RBA is loose with its monetary policy, but people are waiting to see whether or not the Federal Reserve really steps on the gas. After all, Jerome Powell has made it clear over the last couple of years that he is willing to support the markets however he can - meaning the stock markets. If he does, that typically will have people selling the greenback. This is a market that continues to see more of a push to the upside longer term, but right now we still have a lot of to do. You need to look at this as a “trading range” within another “trading range.”