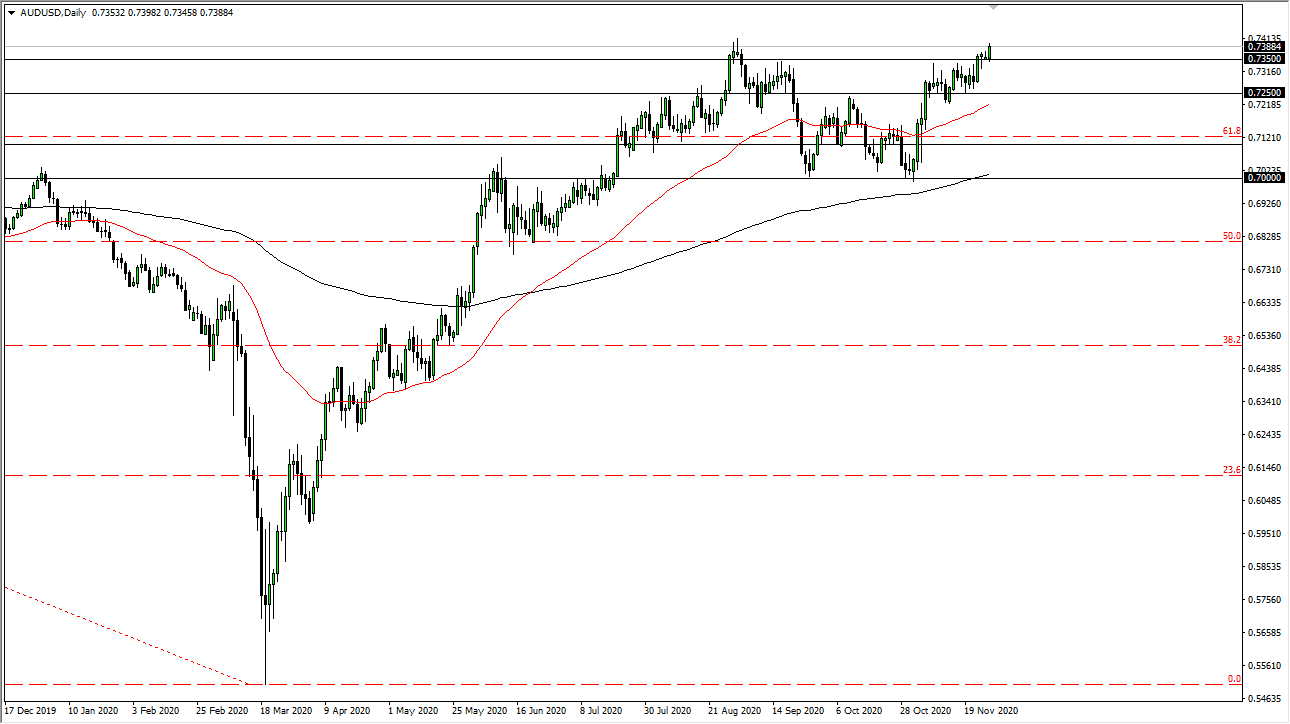

The Australian dollar rallied during the trading session on Friday, breaking above the 0.7350 level and then reaching towards the 0.74 handle. It looks as if the Aussie is ready to go higher, but do not be surprised if we get an occasional short-term pullback. This is a market that seems to be floating, and people are starting to trade on the idea of a global economy after a coronavirus vaccine. That should continue to favor commodities and growth currencies in general, which includes the Aussie.

Furthermore, the Australian dollar is highly levered to the Chinese economy, so as China seems to be strengthening, it follows that the Aussie would do the same. Pullbacks at this point should have plenty of buying opportunities, just as the 50-day EMA underneath starts to rise to reach towards this level. One thing is certain: we have seen a lot of resilient behavior in the Aussie dollar, and even though there are many things that could be considered “black swan events”, it is likely that the market is willing to look past much of it.

Global liquidity measures continue to be the major driver of this pair, as the Federal Reserve is very dovish and will continue to be loose with monetary policy. This should continue to work against the value of the US dollar, so we will continue to see upward pressure. In fact, I do not have a scenario in which I'm willing to short this market yet; at the very least, I would need to see the 0.7250 level beaten to the downside. As you can see, we have formed a huge “W pattern”, which suggests that the buyers have become more and more aggressive. I anticipate that eventually we will see a bigger move. As things stand right now, that bigger move looks to be higher, not lower. I look at short-term dips as potential short-term buying opportunities. From a longer-term standpoint, if we can break above the 0.75 handle, then it becomes more of a “buy-and-hold” type of market.