The Australian dollar rallied significantly during the trading session on Tuesday, despite the RBA cutting rates to a historic low. This is because large amounts of stimulus will be coming to the United States. The idea of the US election getting a relatively quick result would also be a major component to this pair moving higher - not necessarily because the Australian dollar should strengthen, but rather that it would be a move against the US dollar.

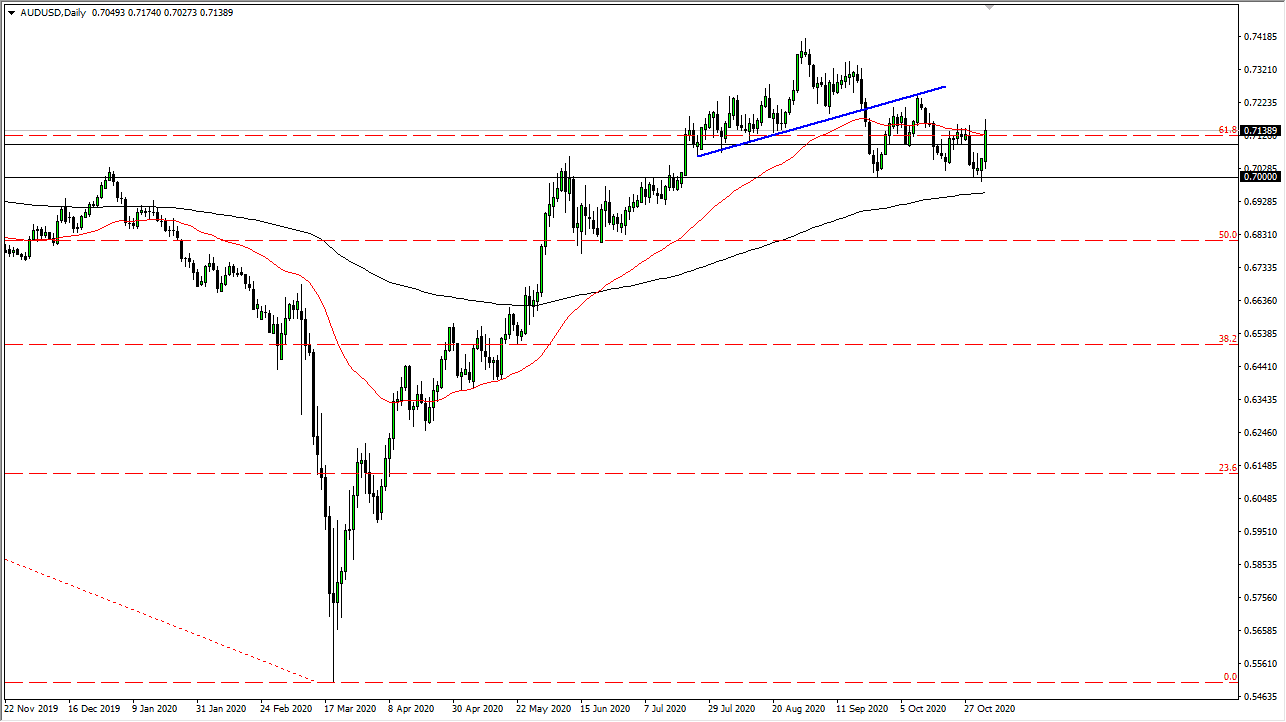

Looking at this chart, the 50-day EMA is right around where we are closing, which is something worth paying attention to as well. The 0.70 level underneath is an area that will also garner attention, since it is a large, round and psychologically significant figure, and the bottom of what could be a potential descending triangle. That descending triangle measures for a move down to the 0.68 level, an area where we have seen significant support previously. The 200-day EMA sits just below there, and that could be massive support as well. A lot of people will continue to see the markets move for multiple reasons.

Looking at this chart, if we do break down below the 0.70 level and the 200-day EMA, it is likely that we go down to the 0.68 handle. Breaking down below that level could open up a “trapdoor” in this market, perhaps sending it down to the 0.65 level. The Australian dollar had no business rallying during the trading session, at least not on its own merits. The RBA is likely to continue the loose monetary policy for quite some time, and clearly the bounce has been a bit overdone as of the last several months. However, the question now is whether or not we still have the momentum or if we are going to grind lower? There are many potential scenarios here, so you need to be paying attention to that 0.70 level. To the upside, the 0.73 level above would be significant resistance, and breaking above there would warrant attention as well. The only thing you can count on is extreme volatility.