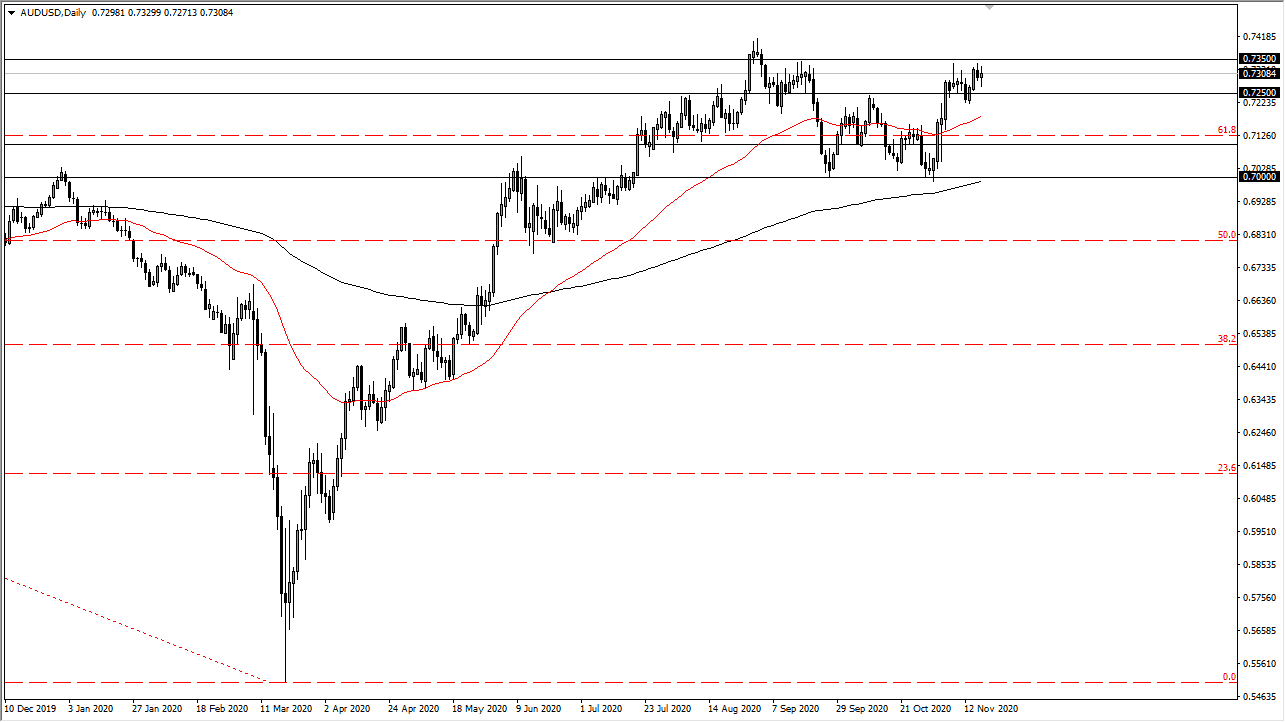

The Australian dollar fluctuated during the trading session on Wednesday, as we continue to struggle with the same overall area that has been a headache for so long. This market continues to see the 0.7350 level as difficult, so if we were to break above there it would mean something. But right now, it seems like we are simply content to trade back and forth in a 100-point range between that level and the 0.7250 level. Because of this, I am looking at short-term charts more than anything else. It is worth noting that the most recent low was higher than the previous one, so it looks as if people want to try to break this market out, but there are a lot of problems out there.

This is one of those situations in which the market is facing many moving pieces simultaneously. The Reserve Bank of Australia is likely to continue to loosen monetary policy, and there is also the possibility of negative rates out there. That is toxic for a currency, so if the market is likely to see negative interest rates, it will probably sell the Australian dollar in general. Beyond that, the Aussie dollar is also considered to be a “risky currency”; in other words, we need to see some “risk on” behavior around the world. If we get there, then we will see this pair rally. However, with all the things going on it is a bit difficult to expect the Australian dollar to simply take off to the upside.

Granted, there is a vaccine for coronavirus coming, but it is a good year away at the very least. Between now and then, we have to see whether or not the economy can pick up. Right now, I do not see it happening, and we have to decide whether or not there is going to be a significant amount of stimulus coming out of the United States. While there will probably be stimulus, if the Republicans hold on to the Senate, it is likely that the stimulus will be smaller than people had hoped. Furthermore, there are a lot of questions as to whether or not there will be stimulus between now and the special runoff election in Georgia.