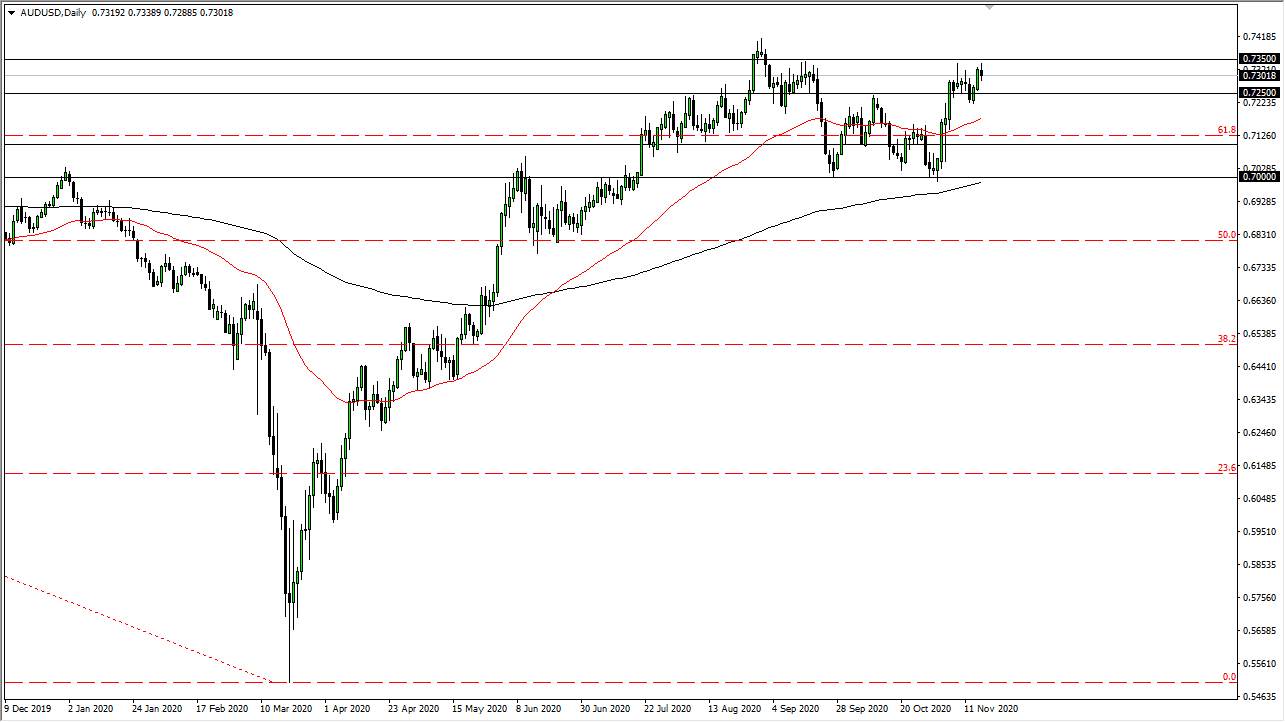

Australian dollar tried to rally again during the trading session on Tuesday, but the 0.7350 level is an area that has caused resistance previously, so it's not surprising that we would struggle there. We will eventually have to make a longer-term decision, but right now it seems like the area between the 0.7250 level and the 0.7350 level is very difficult to crack. If we break down below the 0.7250 level, then we will probably pull back towards the 50-day EMA again.

The Australian dollar seems to be extraordinarily resilient, so it is difficult to get overly bearish. However, that is not to say that we are going to go straight up in the air or that you cannot short it. We will probably get a pullback here, but I do not think we are going to get a major breakdown. With that in mind, the 0.7250 level has to be watched closely, and at that point you can start to talk about shorting the market.

This is a market that will eventually find some clarity, but now it is a bit much to ask that we suddenly get a huge “risk on” type of move because there might be a vaccine this year. The Reserve Bank of Australia still threatens the markets with loose monetary policy and the possibility of negative interest rates. That would be toxic for the currency and could send the Australian dollar lower given enough time. However, people are focusing more on the Federal Reserve right now and the idea that it will be extraordinarily loose going forward. As long as that is the case, people will be trying to short the US dollar, but there are far too many negative possibilities out there to simply jump in with both feet. We have to have at least yet another pullback before we go higher. I like the idea of fading short-term signs of exhaustion like we got on Tuesday.