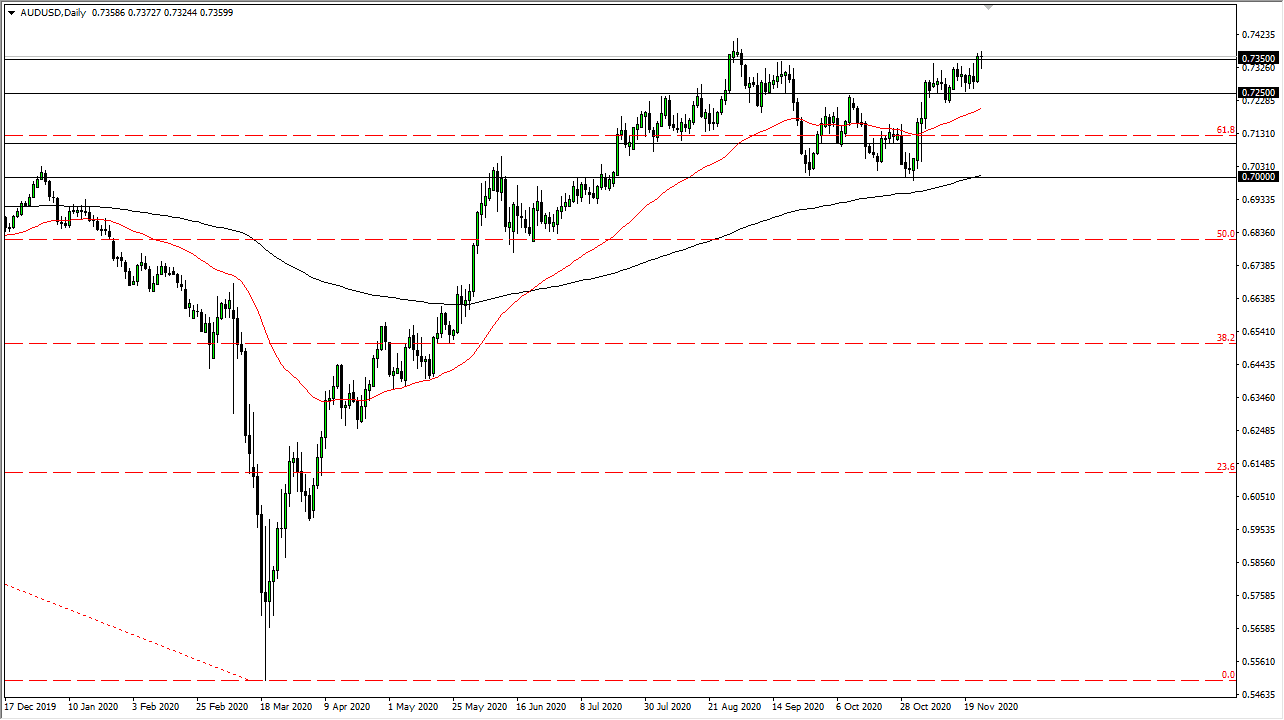

The Australian dollar initially fell during the trading session on Wednesday but found support underneath the 0.7350 level. By doing so, we turned around to form a hammer and the question now is whether or not we have enough momentum to continue going higher. Currently, it looks as if the market is focusing on what the world might look like after the vaccine is released. This will benefit high beta currencies such as the Australian dollar, as not only is it more of a “risk on currency”, but it is also highly sensitive to global growth due to the fact that it is a commodity currency.

On the other side of the coin you have the Federal Reserve, which looks likely to continue flooding the market with liquidity, driving down the value of the US dollar on the whole, so we will probably rally from here. Nonetheless, we will get the occasional pullback, which does make an argument for buying on the dips going forward.

You also need to think about the idea of finding value until we finally get a breakout. The next couple of days obviously will have a serious lack of liquidity, so I would not get overly excited quite yet. But we need to see either a significant breakout above the 0.74 handle, or we need to see a pullback that shows signs of support again. This is a market that has a nice trend higher, and the “W pattern” that is shown itself right now is a good sign for the upside. The market will fluctuat because of global risk appetite, but if we do break out to the upside, it could send the Australian dollar on its next leg higher over the course of several weeks. It all comes down to whether or not people are paying attention to vaccine-related news, or if they are paying attention to more potential lockdowns around the world. We will continue to hear a lot of noise due to that, but overall, it looks as if the buyers are starting to flex their muscles again.