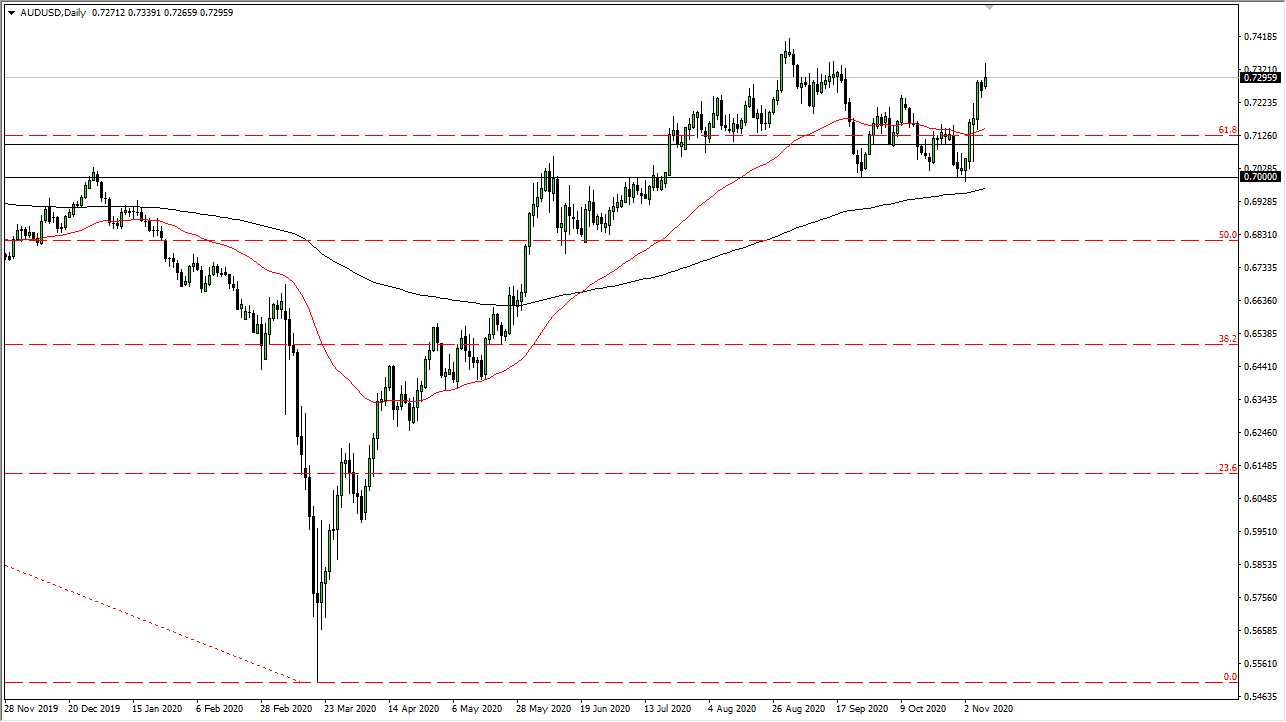

The Australian dollar initially tried to rally during the trading session on Monday, but gave back a substantial amount of the gains to show signs of hesitation in this area. The large shooting star suggests that we may get a pullback from here, and it is likely that the market could go looking towards the 50-day EMA if we get just the slightest hint of trouble. Looking at this chart, we will continue to hear a lot of noise just above.

Underneath, the market has a massive amount of support near the 0.70 level, which is being supported by the 200-day EMA. Between there and the 0.71 level, I would expect to see a lot of support, so I would be more than interested in a bounce from that area. We had recently broken through a significant uptrend line, tested it, and now have tested it again. It looks likely that we are going to continue to see more potential trouble.

The market will continue to see volatility in general, and it now looks like the market is still trying to figure out what to do with itself. Given enough time, we will see a lot of vacillation in deciding where we go longer term. But on the day that we had an announcement of a potential coronavirus vaccine, one would think we would continue to go much higher. The shape of the candlestick does suggest that we are going to continue to see trouble. The Reserve Bank of Australia's likelihood tof going with more quantitative easing and even threatening negative rates will weigh upon the Australian dollar. If we do turn around and break above the 0.74 level, the market could go to the 0.75 handle. That is a large, round and psychologically significant figure, so there is probably some selling pressure in that potential area. If we do break down below the 200-day EMA, the market could go much lower. At that point, I would anticipate a move to the 0.68 handle.