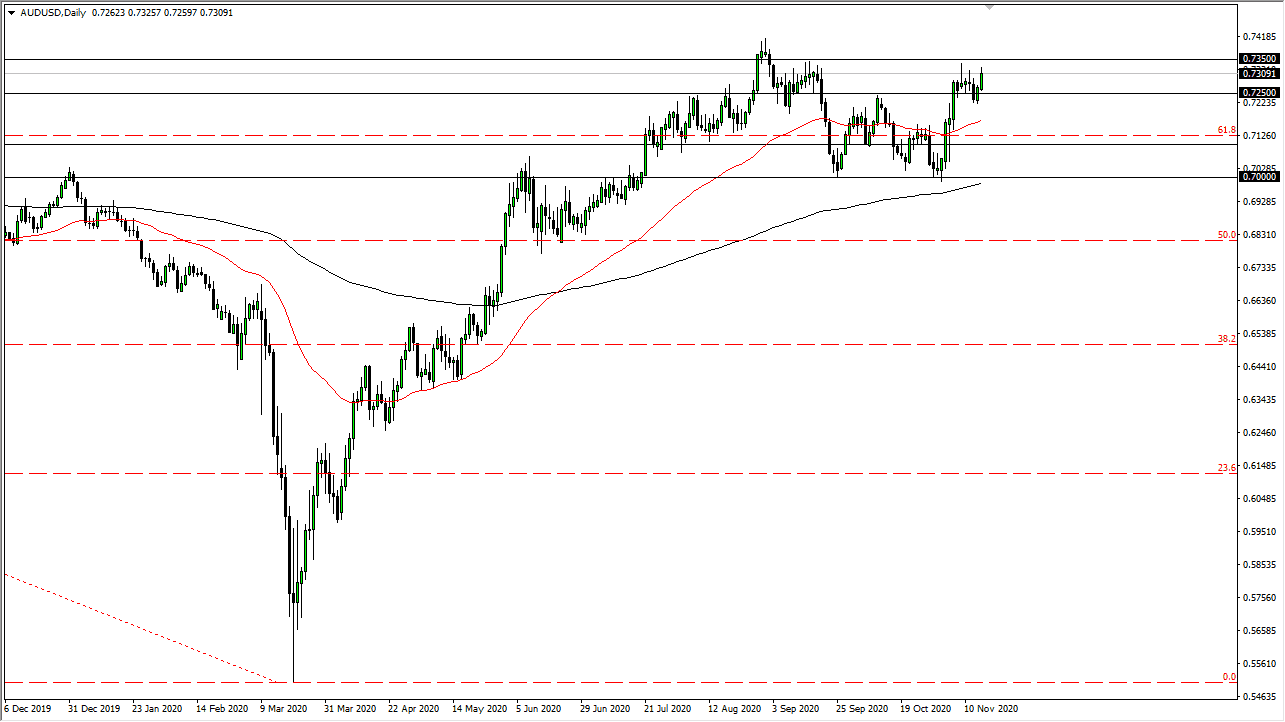

The Australian dollar has rallied during the trading session on Monday after a vaccine showing 95% efficacy was announced. However, you need to take a look at this chart and recognize that we are in the midst of the same range that has been resistance for some time, between the 0.7250 level and the 0.7350 level. Signs of exhaustion will probably get sold into, especially on short-term charts. The market is likely to go lower from here given enough time, because there are plenty of things going on that could have people looking towards the greenback.

We have been in an uptrend for some time, and the vaccine gets people excited. However, if we break down below the lows on Friday, then it is likely that we will go looking towards the 50-day EMA, perhaps even down towards the 0.71 handle. The market has been in a range for some time, so it will be interesting to see if we can break out. If we do, that would be a major turn of events. But right now it is likely that we still have a lot to think about.

The Reserve Bank of Australia is likely to keep its monetary policy loose, and there is the possibility that the market will have to deal with negative interest rates as well. It will be interesting to see how this plays out, but it looks like we are starting to see exuberance which could eventually make this market break out, completely ignoring any of the fundamentals when it comes to Australia. Markets ignoring fundamentals would not be a huge surprise, because a lot of it comes down to liquidity.

There is a long way to go before we break down below the 0.70 level, but if we did, it would be an extraordinarily negative sign. We have seen the Australian dollar grind sideways and now it looks as if everybody in the world is trying to short the US dollar - yet we are still struggling with the overall resistance.