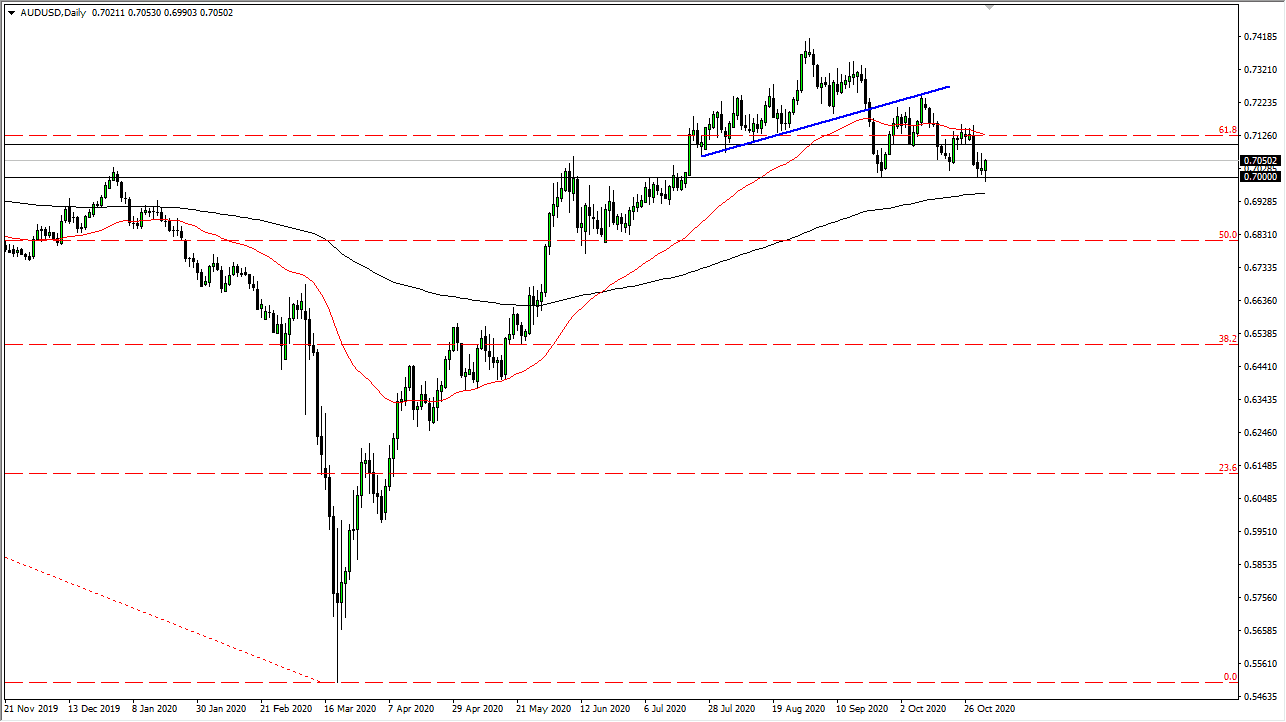

The Australian dollar has steadied during the trading session on Monday, as the market awaits the RBA decision later in the session. This is a market that should continue to see a lot of noise, because the Aussie is overdone. We are concerned about what the central bank may do, so the one thing you can count on is volatility. We have not broken above the resistance barriers from the last couple of sessions, nor have we broken above the 0.71 level. That is something to keep in the back of your mind, because if the RBA becomes aggressive for loosening policies, that would be a potential harbinger of what is going to happen.

The Australian dollar will be highly sensitive to risk appetite in general, and we have the US elections to worry about as well. The massive amounts of volatility that are almost certainly guaranteed out there will keep this market very difficult. This is a market that continues to be noisy in general, so I do think that is something you need to keep in mind. You should also keep your position size relatively small. Underneath, we have the 200-day EMA which could cause support as well. But if we can break down below there, the market is likely to go looking towards the 0.68 level underneath, which has been a support level in the past, and it could put a bit of a fight. Nonetheless, I like the idea of fading rallies, especially near the 50-day EMA as the market seems to be paying close attention to it as of late. I am looking for opportunities to short the Aussie dollar, not necessarily to buy it. It looks to me as if the 0.7150 level looks to be massive resistance, and therefore I would anticipate a lot of sellers would step in and start shorting in that general vicinity. A breakdown below the candlestick for the trading session on Monday would be the beginning of a potential bigger move.