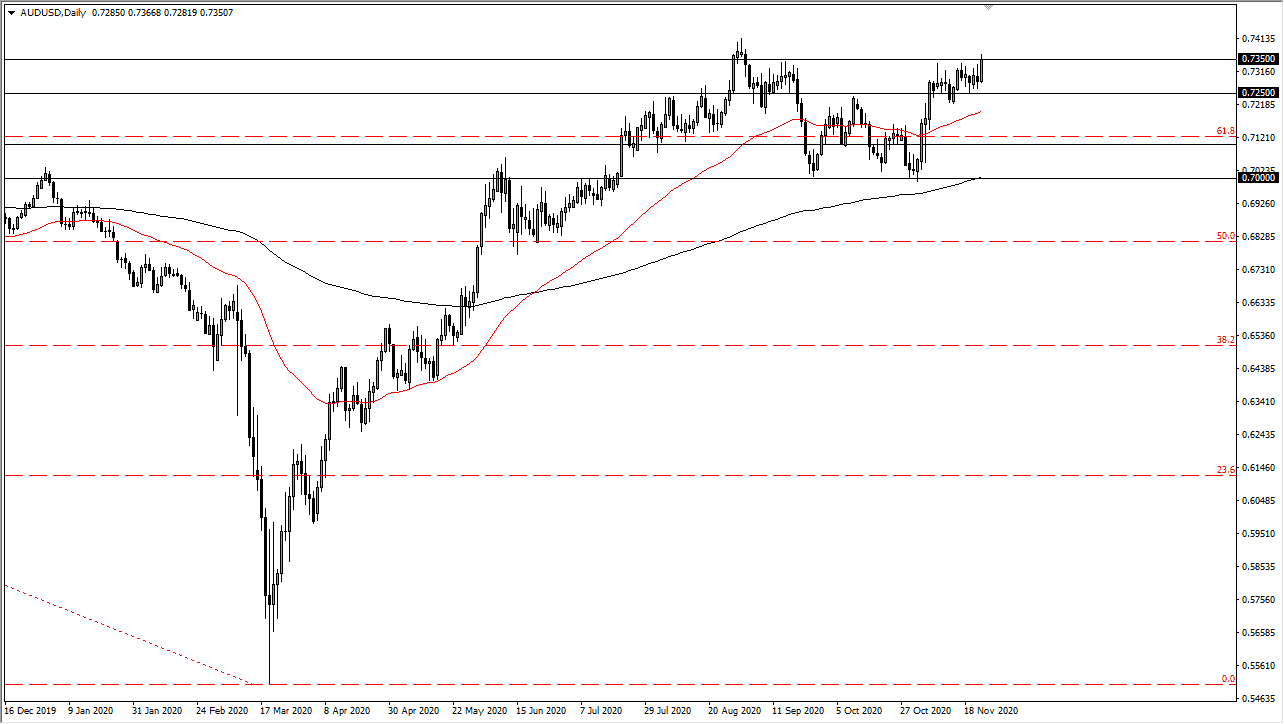

The Australian dollar rallied significantly during the trading session on Tuesday to slam into the 0.7350 level. This is an area that has offered resistance multiple times, and it looks as if we are trying to finally break out. But this market still has a lot of noise just above, so it is somewhat difficult to start buying. The 0.74 level above would be a sign of an accomplishment higher, and would allow the market to go towards the 0.75 level.

The Australian dollar is highly sensitive to risk appetite, so it is worth paying attention to how stock markets are behaving. After all, they are one of the most common risk barometer that we can follow, so if the S&P 500 and the NASDAQ 100 start to take off to the upside it could send the Australian dollar higher. However, if we get some negative news, that could send the Aussie lower.

It is worth noting that the markets are trying to move based on future vaccine hopes and, as there is a lot of good news on that front, they may be perhaps pricing on next year's recovery. It is then likely that the Australian dollar will be a major beneficiary. Nonetheless, I would be a bit cautious in this area, but a short-term pullback should present nice buying opportunities.

The size of the candlestick for the day is rather impressive in relation to the previous several candlesticks, so it looks as if we are trying to make that move. Whether or not we will do it over the holiday is a different story, and the volume dropping this week could be a catalyst for some type of move or for doing absolutely nothing. It all comes down to whether or not traders are choosing to take advantage of the markets or not. It is obvious that buyers are clearly starting to take control. Nonetheless, it does not mean that you should jump in with both feet; the easiest trade is to buy the pullbacks.