The Australian dollar has rolled back during the trading session on Friday, but finished off the lows as we continue to see general volatility. The Australian dollar has gotten ahead of itself in my estimation, because we still are not sure what the stimulus package out of the United States is going to be, and we have the Reserve Bank of Australia talking about the possibility of negative raise. That is negative for a currency, but people are also starting to look at the possibility of stimulus coming out the United States as being more important.

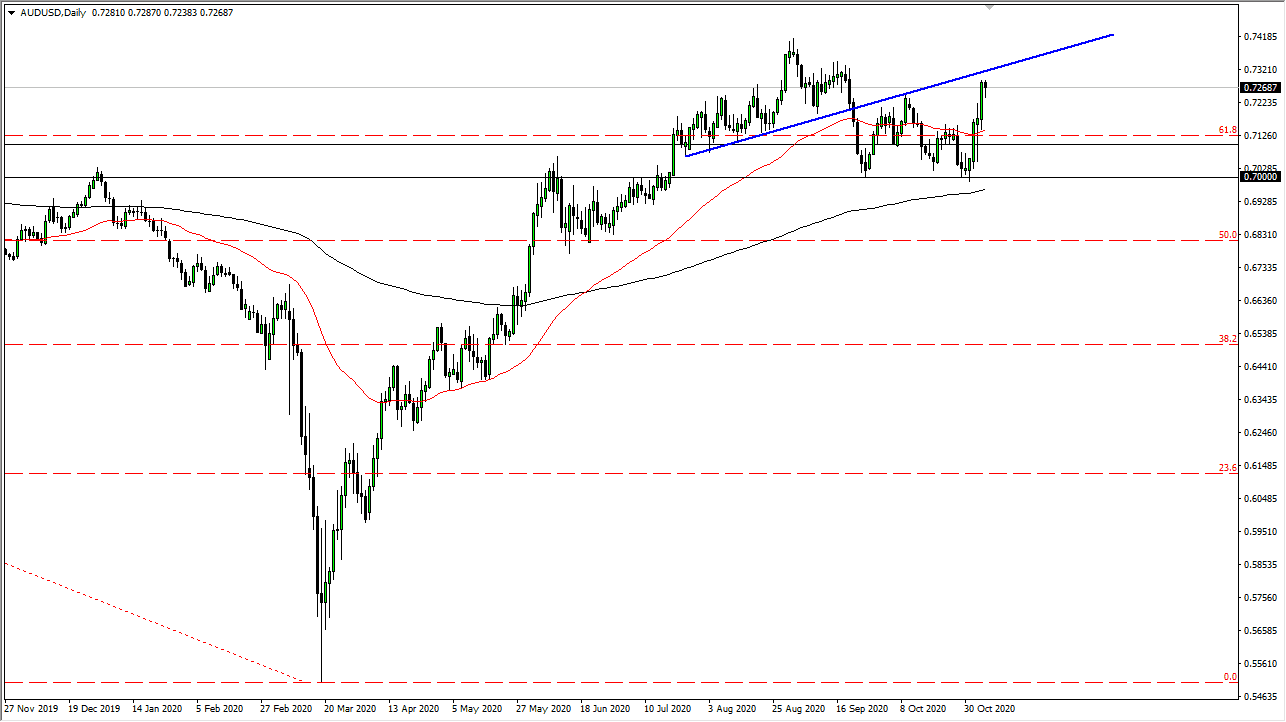

When you look at the technical analysis, the 0.73 level is an area where we have seen supply. It now looks as if we are struggling to get above there. Furthermore, we also have the previous uptrend line that should offer resistance, so it is possible that we do get a break down. Beyond that, we have to worry about headlines coming out of the weekend that could cause major issues and having people run towards the US dollar for safety. The bond market should be paid close attention to, because if rates start dropping, the US dollar will probably strengthen as people run towards safety.

The question now is whether or not there is going to be enough stimulus to get the markets overly excited. I doubt that it is a longer-term move, because even if the US dollar is going to get hit, it is a relative game we play in Forex, so you have to look at the other economies around the world. Eventually, the negative interest rates in Australia will weigh upon the currency, so I am looking for selling opportunities. But I do not necessarily have the set up yet. If we were to break down below the bottom of the candlestick for the trading session on Friday, it is going to end up being a “hanging man”. I would then look at this as a possible range bound play, perhaps reaching down towards the 0.70 level again. If not, and we break above the 0.7350 level, then the market is likely to continue going much higher.