Today’s AUD/USD Signal

Risk 0.75%.

Yesterday’s deal was activated from the specified levels and the first goal was reached.

Best Buying Entries:

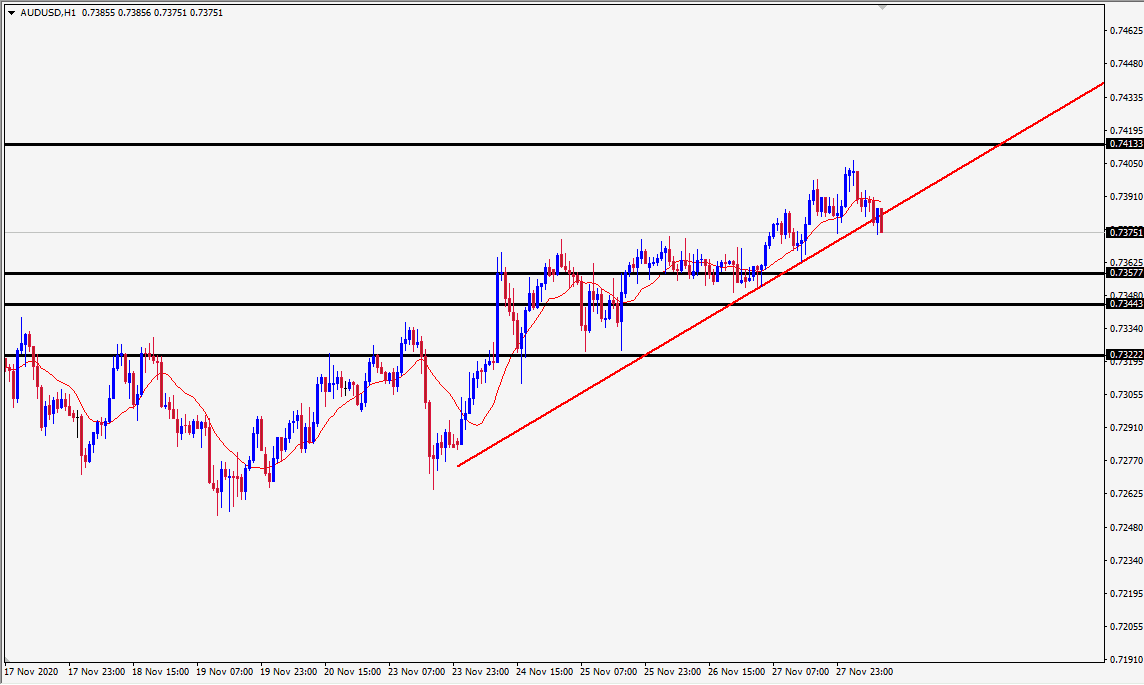

Long entry from support levels at 0.7343 and 0.7357 on the hourly timeframe.

Put the stop loss below the 0.7322 support.

Move the stop loss to the entry point and continue profit with a 20 pips price movement.

Close half of the contracts when the trade is 30 pips in profit and leave the remainder of the contracts to run until the strong resistance level at 0.7413.

Best Selling Entries:

Short entry below the 0.7320 level on the hourly timeframe.

Put the stop loss above the 0.7335 level.

Move the stop loss to the entry point and continue profit with a 20 pips price movement.

Close half of the contracts when the trade is 40 pips in profit and leave the remainder of the contracts to run until the 0.7266 support.

AUD/USD Analysis

The AUD/USD opened its trading session lower after closing last week higher, as the first target was achieved before the pair retreated before the second target.

Private sector credit in Australia stabilized monthly at +1.8 percent year-on-year in October. The Australian Bureau of Statistics said on Monday that corporate profits in Australia rose by a seasonally adjusted 3.2 percent on a quarterly basis in the third quarter of 2020.

Corporate inventories decreased by 0.5 percent on a quarterly basis.

Manufacturing sales increased by 4.3 percent on a quarterly basis.

Wholesale sales increased by 3.8 percent on a quarterly basis.

Wages and salaries rose 2.4 percent on a quarterly basis.

On a technical level, the AUD/USD is trading in a generally bullish trend in the medium term at the moment, and the pair retreated in a profit-taking wave. We expect that to end at the 0.7375 level. The pair is targeting 0.7413 resistance as a first target after resuming the uptrend.

To enter a long position, it would be better to re-test one of the above mentioned support levels before the resumption of the pair's rise. But if the pair reverses the trend and breaks all the support lines, then we can start selling after retesting 0.7320.