Today's signal for AUD/USD:

Risk is 0.75%.

The pair's spanking deal activated before yesterday's target.

Best long entry points

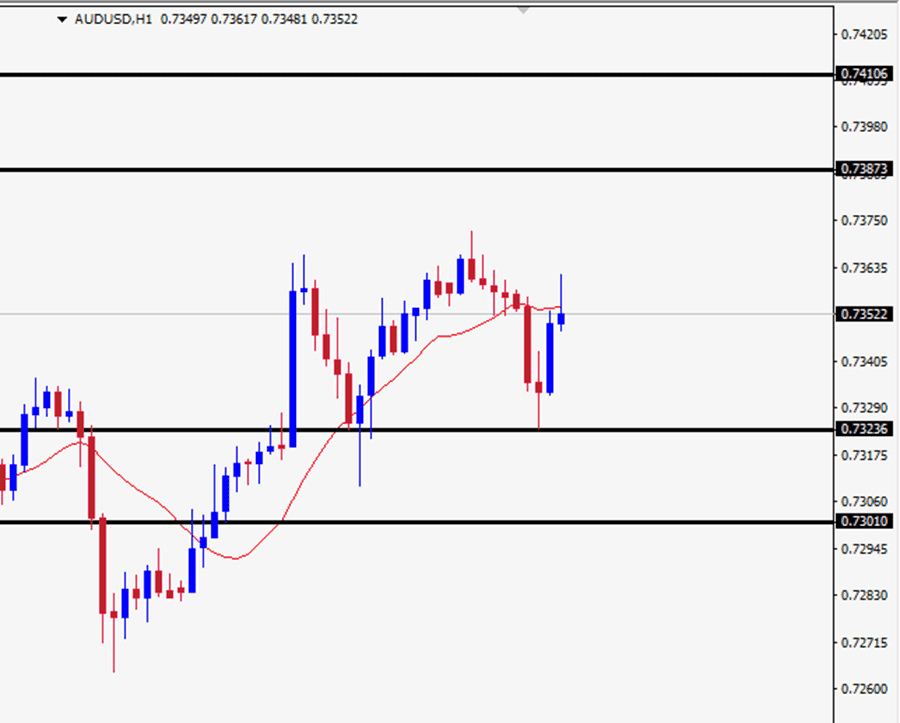

Long entry from current levels or any of the levels better than 0.7323 on the hourly time frame.

Pull the stop loss point below the support levels at 0.7301.

Move the stop loss to the entry area and continue the profit with the price moving by 20 pips.

Close half of the contracts with a profit of 30 pips, leaving the remaining contracts until the strong resistance levels at 0.7387, 0.7410 respectively.

Best short entry points

Enter a sell position from below the support line 0.7300, on the hourly time frame.

Put the stop loss above 0.7333 levels.

Move the stop loss to the entry area and continue the profit with the price moving by 20 pips.

Close half of the contracts with a profit equal to 40 points and leave the remaining contracts until the support levels of 0.7246.

AUD/USD Analysis

The Australian dollar fluctuated against the US dollar, although the pair continued its general bullish trend. This comes despite data issued by Australian statistics on Wednesday showing that the total value of construction work completed in Australia decreased by 2.6 percent, seasonally adjusted on a quarterly basis in the third quarter of 2020 to $51.179 billion.

On an annual basis, the construction value decreased by 4.2 percent. Construction business decreased 2.0 percent on a quarterly basis and 7.2 percent year-on-year at $28.971 billion.

The Australian dollar is trading on a general bullish trend in the medium term. We expect the pair's rise to continue as long as it trades at the highest support levels, which are at 0.7338 and 0.7323, respectively. The pair targets resistance levels at 0.7410.

To enter long, it would be better to re-test one of the above mentioned support levels before the resumption of the pair's rise, but if the pair reverses the trend and breaks all the support lines, then long trades can be entered after retesting 0.7309.