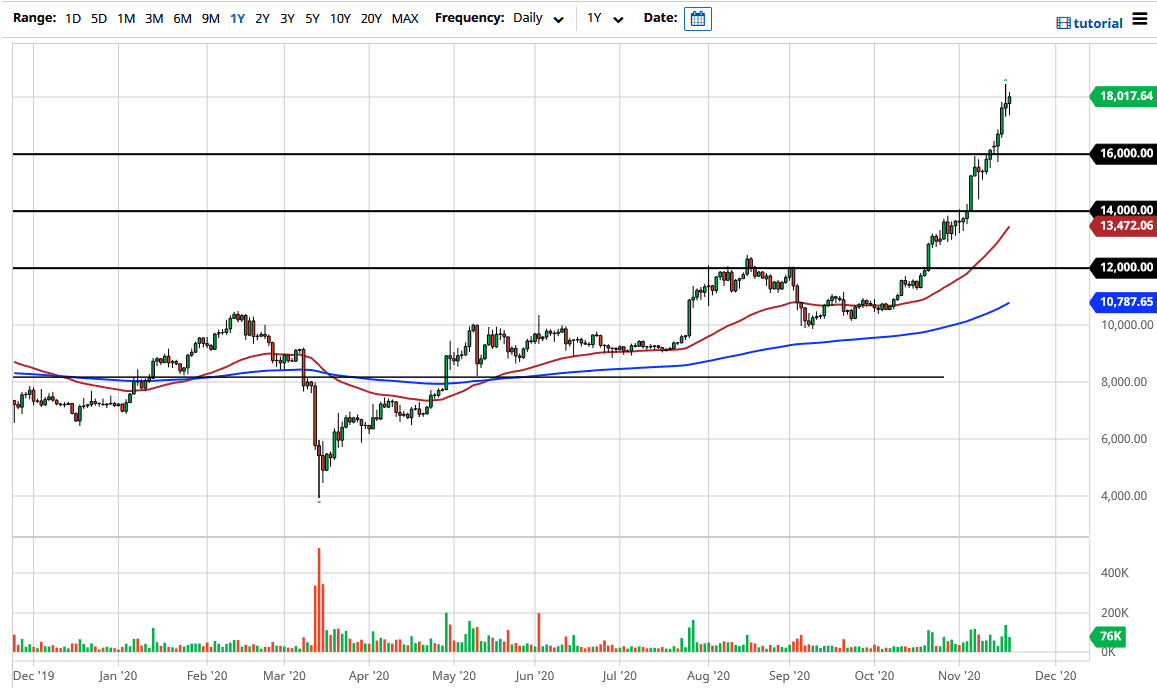

While I still believe that Bitcoin is very bullish overall, the market is without a doubt parabolic at this point. At this point in time it is obvious that the market has seen a lot of buying pressure but ultimately, we need to keep in mind that there is a significant amount of concern any time the market goes straight up in the air. The candlestick from the trading session on Wednesday was a massive shooting star, which should of course send off alarm bells. Ultimately, this is a market that I think continues to see a lot of “FOMO” entering, which unfortunately can cause a lot of losses if you are not careful.

However, if the market is going to pull back, this does not necessarily mean that you need to be a seller. What is interesting is that the market fell initially during the trading session but found buyers yet again. At this point in time, we are probably a candle or two away on the daily candlestick chart from running out of momentum. This is not to say that we cannot go straight up in the air from here, but the longer this happens to be the case, the more likely we are to see a sudden panic. In fact, options traders are out there are starting to protect themselves from a potential pullback. Nonetheless, that does not necessarily mean that the market is going to suddenly become a very bearish place to be. It is just that essentially sooner or later you will see gravity come back into the picture.

Even a massive volatile instrument like Bitcoin will get the occasional correction and I think at this point if you are not already long of the market, then you need to wait for value to come back into play. Simply buying Bitcoin near the $18,000 level is making the same mistake the people made a few years ago who are just now getting back to break even. This is the last thing you need to do, and therefore if you are patient enough, I do believe that you will get a better price. At the very least I would anticipate a pullback to the $16,000 level but I think we could even be looking at a pullback to the $14,000 level where things get a little bit more interesting.