.

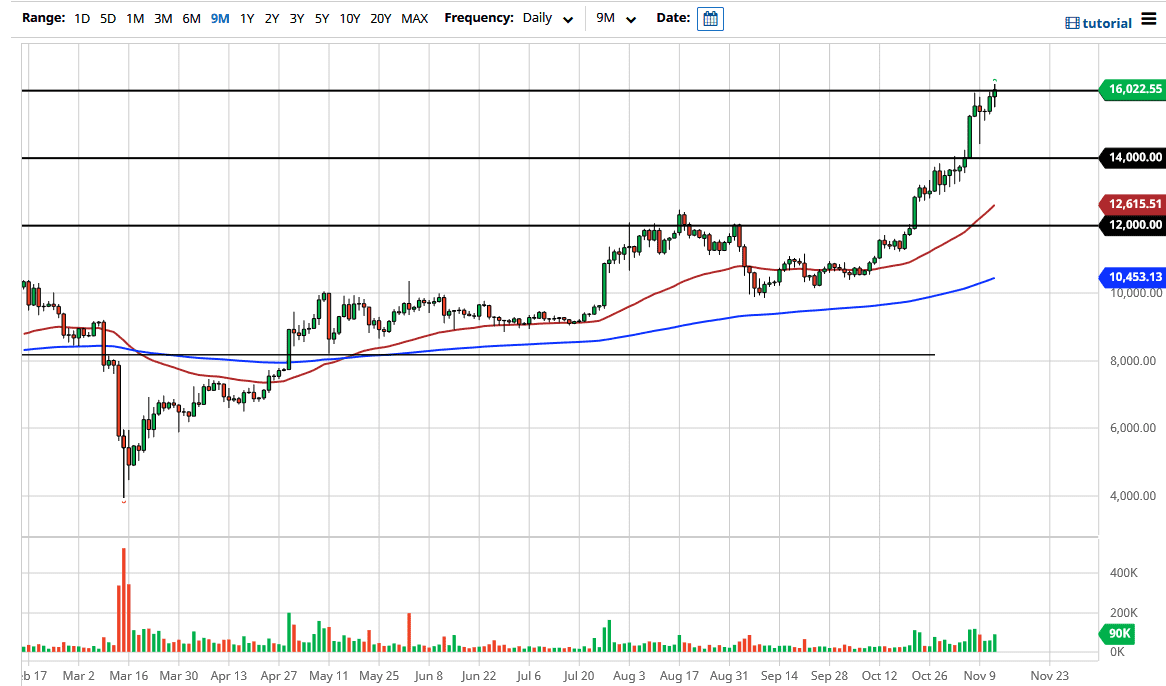

At this point in time, the market is likely to see a lot of back-and-forth trading, perhaps in a bid to try to break out above here. If we can break above the top of the candlestick for the trading session on Thursday, then the market could go much higher. Having said that, the market is a little bit extended so I think at this point in time it is likely that we will see some type of pullback.

At this point in time, you should be looking at this market as one that you need to find value in, and therefore take advantage of dips as they occur. It certainly looks as if the pressure to the upside is building up yet again, and therefore it is probably only a matter of time before we take off to the upside. If and when we finally do break out and close healthily above the $16,000 level, the market is likely to go looking towards the $17,000 level.

If we do pull back from here, I think that there is plenty of support near the $40,000 level, assuming that we can even get down there. At this point in time, pullbacks will occur, and then it looks like we will eventually find value given enough times. If we were to break down below the $14,000 level, it is possible that we could go as low as the 50 day EMA, but I think it is unlikely that we are going to see that happen. Regardless, it is difficult to buy the market at this level because it has run so far. After all, the market is one that bullish, but when you “pay up” for an asset, you can get hurt and end up having to write out a pullback that dropped several thousand dollars in this market. Ultimately, it looks as if we are going to go higher but I would love to see a pullback before getting involved, because Bitcoin has a history of breaking hearts once it starts acting like this. Look for value, do not go crazy with FOMO, and remember that the longer-term trend is most certainly to the upside.