Bitcoin has been all over the place during the trading session on Monday, as the markets try to come to terms with various issues at once. The biggest headline coming out of the trading session on Monday was Pfizer's announcement that their coronavirus vaccine has over a 90% success rate, so we could be looking at the beginning of the end of the virus situation.

This had the markets all over the place as people are trying to figure out what to do next. The US dollar has been the main driver of this, not the Bitcoin market itself. However, this market is priced in those greenbacks, which has a huge influence. What is interesting is that while there was a major “risk on” move initially, the stock markets suddenly got hit and it seems people are questioning whether or not there is going to be enough stimulus for Wall Street. This is where we are right now when it comes to the Bitcoin market, which is why we were all over the place.

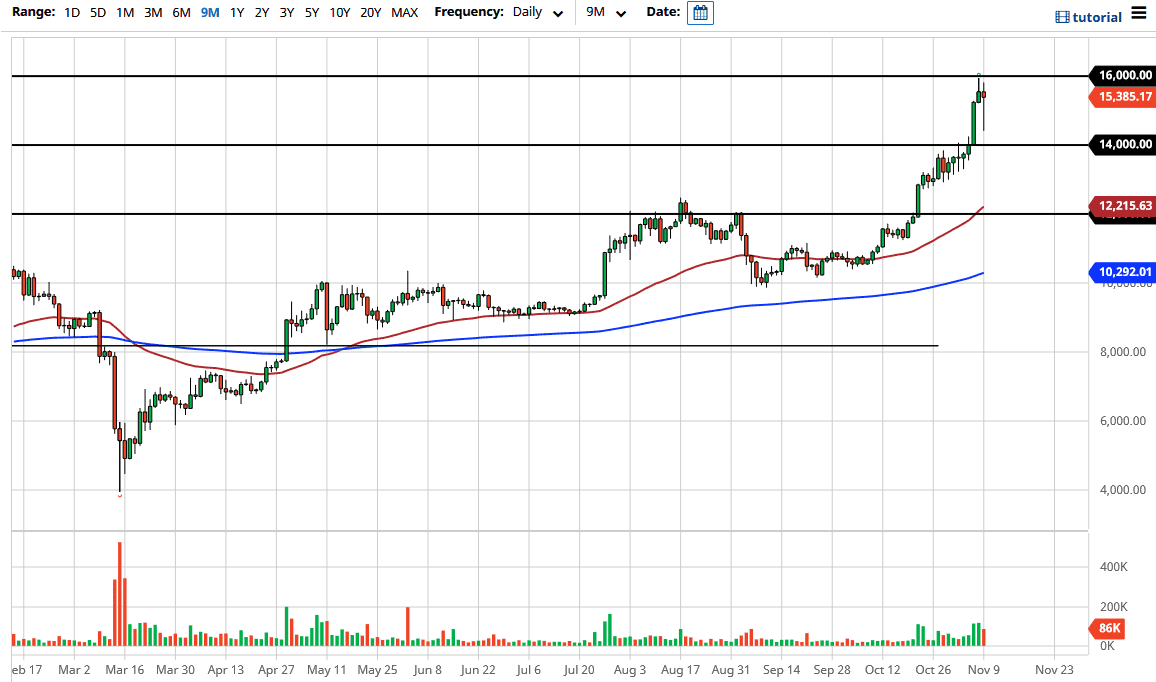

Looking at this chart, the market is likely to see more of a continuation to the upside, so having pulled back the way we have should not be a huge surprise, just as the reaction should not be. It looks as if the $14,000 level should continue to see a lot of support, and the action for the session certainly seems to back that up. It does seem we are going to try to break above the $16,000 level, but it is worth paying attention to pullbacks as potential buying opportunities. Longer term, it looks as if Bitcoin is going to continue to go higher, so I have no interest in shorting this market. Given enough time, we will continue to see plenty of “buy on the dips” traders. It is difficult to tell exactly where we will go longer term, but we will continue to see many people pile into this market every time they get an opportunity.