Bitcoin markets were very noisy during the trading session on Monday, as most markets were as they reacted to Brexit headlines. After all, the US dollar got a huge boost due to rumors circulating that the British and Europeans, who were ready to come together with a short-term deal in order to pacify trade for the time being, were not going to make such a deal. We then saw the US dollar strengthened, which had a bit of a knock on effect in the Bitcoin market.

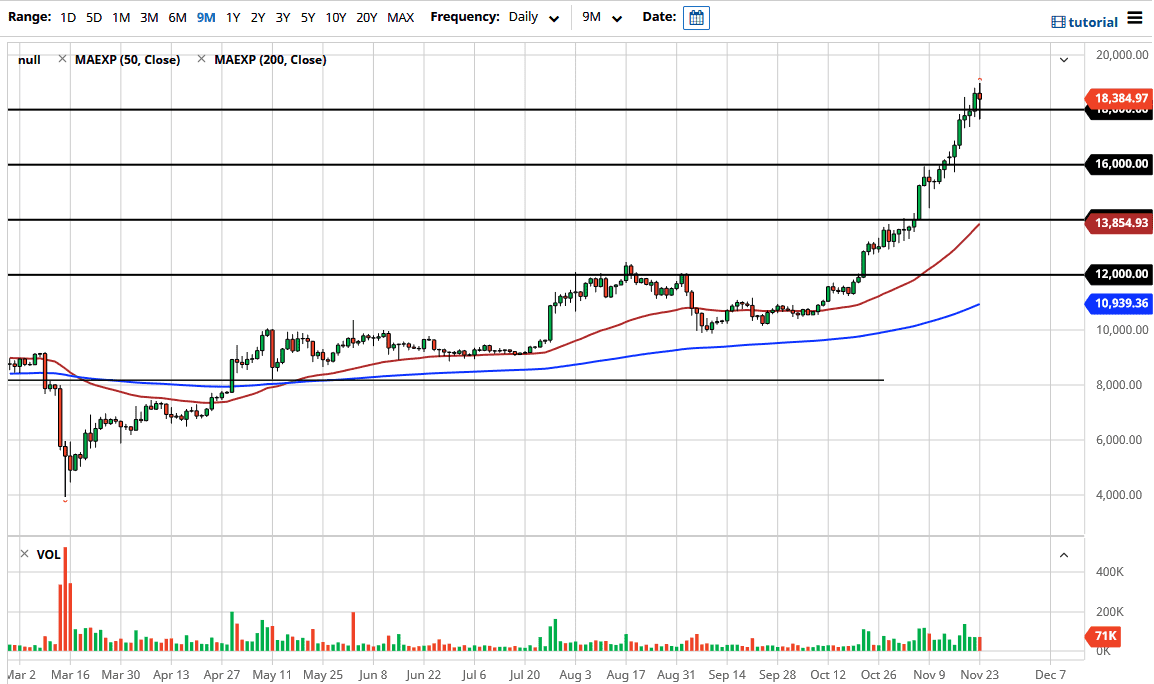

We are well above the $18,000 level and to say that we are pressing our collective luck is an understatement. Bitcoin has done this more than once and it seems as though every time it makes a move like we have seen over the last couple of months, it ends in tears. You need to see some significant pullback before you can jump in and start buying at this point, unless you are planning on holding Bitcoin for months, if not years. The last time we were up in this area we had a massive selloff, which is just now being made up after three years.

I am not suggesting that that is what will happen next; I am suggesting that we have gotten ahead of ourselves. Looking at this chart, you can see just how parabolic things have been. The candlestick for the trading session is very neutral, and this could be the beginning of a pullback. If we break down below the bottom of the candlestick for the trading session on Monday, I suspect that we will finally get a pullback in order to take advantage of value. I would be very interested closer to the $16,000 level, and even more so closer to the $14,000 level if I get that opportunity. I would not be a buyer all the way up here, because things have gotten way out of hand.