The Bitcoin market continues to defy gravity, which is something it has been known to do. However, it is far too dangerous to get involved now. You need to be very cautious of possibly seeing a repeat of a couple of years ago. I am not suggesting that Bitcoin is going to have the same massive meltdown that it had a few years ago, but it certainly has gotten ahead of itself.

If the bottom falls out of this market, we could see a $5000 drop in the blink of an eye. Bitcoin is not a very big market, and if we were to see a selling event, it could start a bit of a panic. This is not like when the S&P 500 goes parabolic; the volume is nowhere near what we see in a market like that.

This is not to dissuade you from buying Bitcoin; just that right now you would be basing your investment thesis on the “greater fool theory.” In other words, you believe that buying Bitcoin now is a good idea only because some fool will buy it later. The market is very likely to continue to see a lot of frothy behavior, due to the fact that we are now starting to see a Bitcoin timer on various programs on CNBC, which is the darkest indicator that I can imagine.

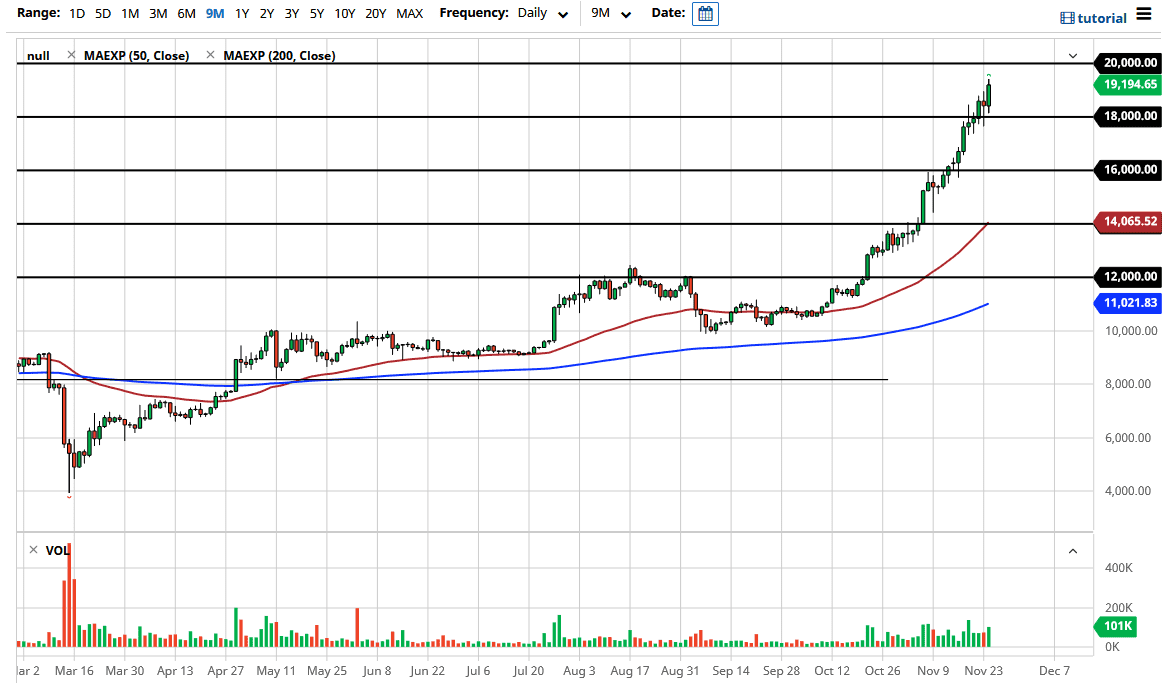

The $18,000 level should be supported, but we need to pull back to at least the $16,000 level before you can even make a reasonable argument for buying. Underneath there, we have the $14,000 level, which is where the 50-day EMA sits. Furthermore, that is roughly 50% of a pullback, which would also do this market a world of good. I am not suggesting that you should short Bitcoin, as you obviously could have lost quite a bit of money trying to do so all the way up. This market could go higher, but chasing the trade at this elevated level could be very dangerous. In other words, you need to be looking for value.