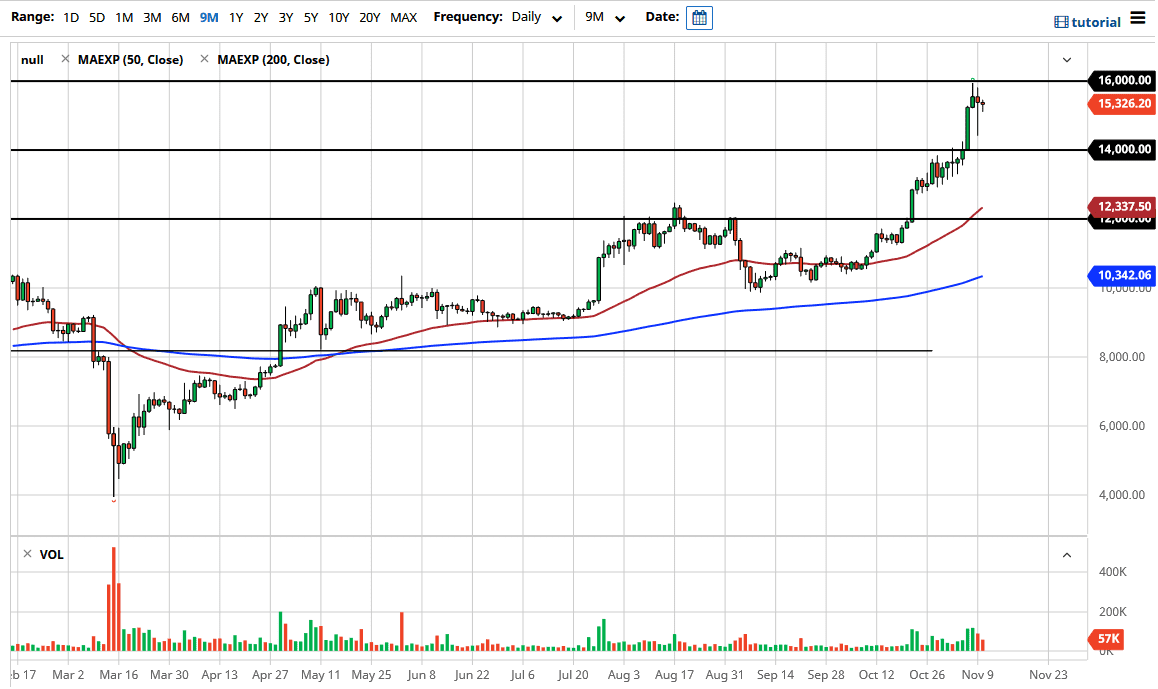

The Bitcoin market fluctuated during the trading session on Tuesday, as we continue to see this market overdone in the short term. We will likely find buyers on dips, but it seems as if the market might be exhausted at the moment. The market has shot straight up in the air, so we would need to see some consolidation, if not a nice buying opportunity on dips.

Looking at the chart, the $14,000 level underneath is massive support, and at one point was massive resistance. We need to pull back and retest that level. On the other hand, if we were to break above the $16,000 level, then it will continue to go to the upside. Looking at this chart, you can see that we are clearly in an uptrend, and no matter what happens, you have no argument to start shorting this market unless the US dollar suddenly explodes to the upside. I do not see that happening, but it is likely that Bitcoin will continue to be a market that goes much higher.

Underneath, we have the 50-day EMA at the $12,300 level offering support, and I would be more concerned about the trend. It is likely that we will see value hunters returning to this market, so a lot of people will be willing to jump in near that indicator, assuming we could even get down there. One obvious tell is the candlestick from the previous session, as it shows plenty of buyers underneath. Even though we had a major “risk on event” with the introduction of a possible coronavirus vaccine, the reality is that the underlying trend is very much intact. Look for value and take advantage of it. If we can break above the $16,000 level, the next obvious target would be $17,000, and then the $18,000 based on how this market tends to move in symmetrical increments.