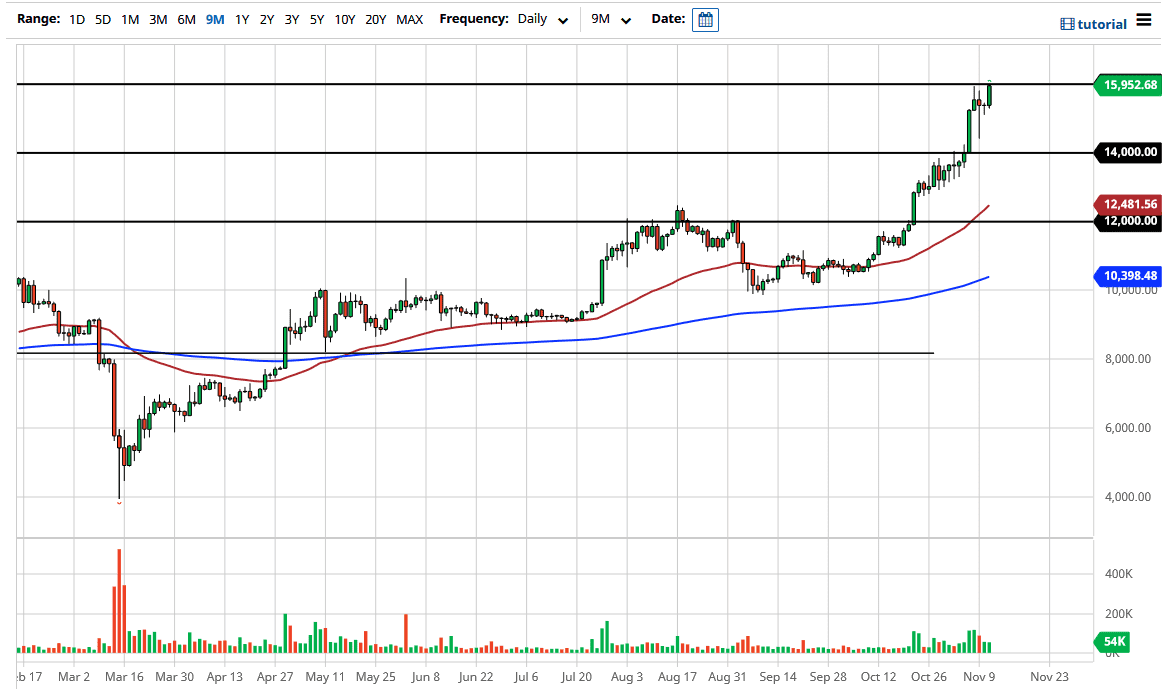

The Bitcoin market has shot higher again during the trading session on Wednesday, reaching towards the $16,000 level. At the end of the day, we are closing towards the top of the room which is a very bullish sign. The Bitcoin market has been extraordinarily bullish for some time. Having formed a hammer during the trading session on Monday, followed by a neutral candlestick on Tuesday and then a very bullish candlestick on Wednesday tells me that we are ready to try to push higher.

The Bitcoin market is a bit overstretched, so even if we do pull back from here, we will get an opportunity to buy Bitcoin at a lower price. The $14,000 level underneath should be a massive support level, so buyers will jump in and start picking up Bitcoin in that general vicinity. However, we are somewhat overdone, so do not be overly surprised at the pullback.

On the other hand, if we break above the $16,000 level, then it opens up the possibility of the $17,000 level. That's the thing with Bitcoin: it can take off rapidly and pass you by if you are not cautious. But you simply cannot just jump in with both feet because Bitcoin can turn around and drop $3000 in the blink of an eye. That is one of the biggest problems within the market; it can be manipulated if you are not paying attention.

One of the bigger influences for Bitcoin as of late has been the concern about global central banks flooding the markets with liquidity, which by extension means that fiat currency will continue to suffer at the hands of commodities and hard assets. This is where Bitcoin comes in, because it is currently being used similarly to other inflationary assets, in that people are concerned about the value of money going forward. As you know, I am not a “Bitcoin Believer” necessarily, but I do recognize that this market is more likely to go higher than lower in the meantime.