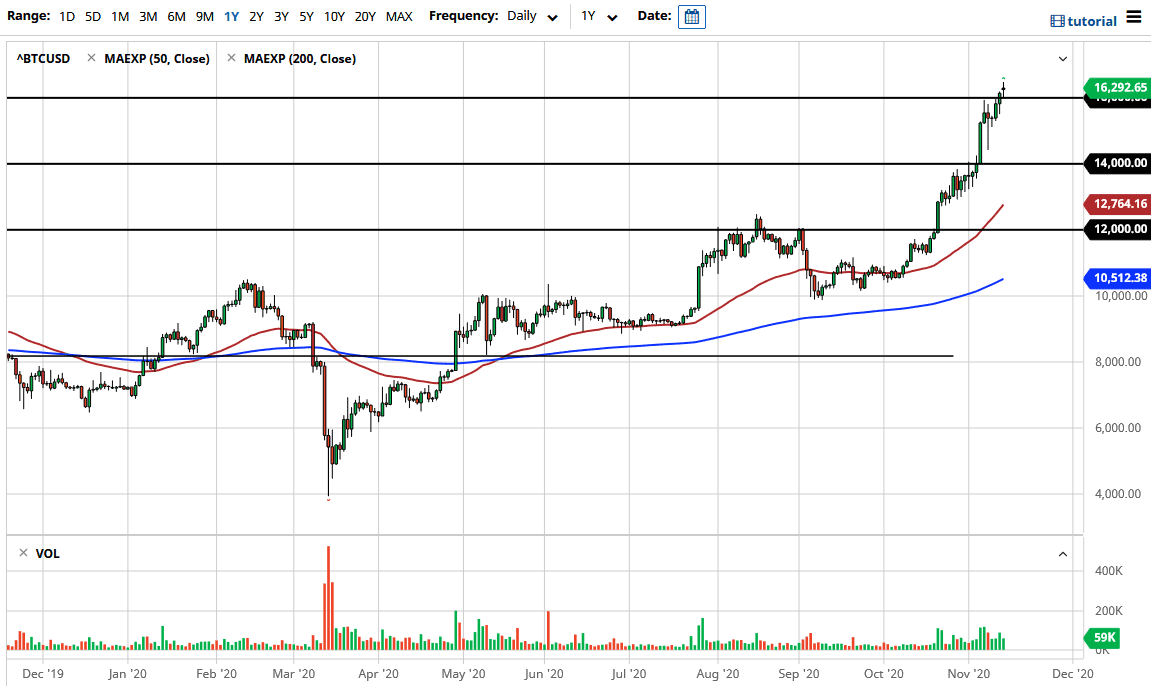

The Bitcoin market has fluctuated during the trading session on Friday, as we have broken above the $16,000 level. The biggest problem with the Bitcoin market is that it tends to go a bit parabolic, and then breaks down significantly to white people out. We are clearly getting closer to that type of move, although it is not necessarily imminent. Looking at the chart, you can see that the $16,000 level has offered some support. The market will have to look at the $16,000 level as a major area.

If we do break down below there, we should see buyers looking to pick up Bitcoin at a better price. Somewhere between the $15,000 level and the $16,000 level we will see an attempt at defense. It would not surprise me to see the market pull back there over the weekend, only to find buyers again. However, if we were to break down below there, then we start to look towards the $14,000 level for support. That was the scene of a recent breakout and, as a result, also has a lot of technical importance built into it. Furthermore, by the time we get down there, it is hard to tell where the 50-day EMA will be, but it could very well be near that level, depending on the amount of time it takes.

You cannot be shorting Bitcoin, because fighting this type of trend is very difficult to do. However, what most retail traders do not do is look at pullbacks as something going “on sale.” Bitcoin is very bullish so no shorting should be considered, although if and when the market turns around it can be quite brutal. What I am afraid of is as we get closer to the area of the all-time highs, a lot of the people that were in Bitcoin during the massive bubble will be more than willing to take profits, thereby putting downward pressure on the market again. Regardless, we are parabolic, and you simply cannot chase a parabolic market. I assume that any of you that were buying Bitcoin a few years ago when we were off at these levels have learned that lesson. If you are not there, simply look at the longer-term chart and see exactly what could happen if you chase the trade.