Bitcoin markets have been noisy during the trading session on Monday, due to volatility and noise in currency markets overall. The US election on Tuesday will have a significant effect on the US dollar in general. That could have a major influence on what happens in the Bitcoin market, as well as any other commodity market.

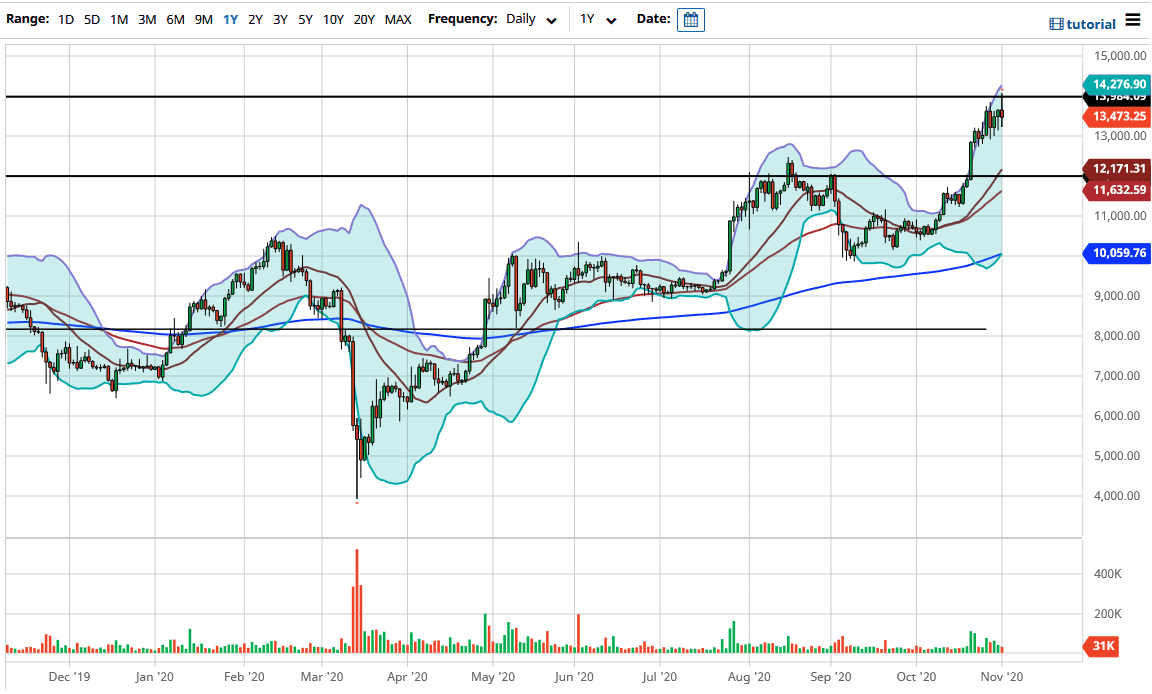

It may irk people to want to talk about Bitcoin as a commodity, but that is how it behaves. The volatility profile of Bitcoin looks very similar to some of the commodity markets that I follow. What we have seen recently is an explosion in volatility, followed by a lack of momentum like we see now. What is interesting about the Monday candlestick is that it shows signs of exhaustion. In fact, we are trying to form a shooting star at the crucial $14,000 level which is worth paying attention to.

While I do not think that it is going to offer a nice selling opportunity, I do think it shows that we may be stretched. We are looking at a market that needs to kill time before we continue to go higher. The last thing you want to see is a massive parabolic market again, because Bitcoin does tend to have that at times, only to crash. I have also added the Bollinger Bands indicator to the chart, showing just how overstretched we have gotten. What I find particularly interesting is that the 20 SMA sits right above the $12,000 level, an area that I had suggested could be a target for pullbacks. This is because it is an area out of which we had broken out, so retesting that area is prudent. I think we are looking at a market that you should not be buying yet, but pullbacks could offer value. This week is going to be extraordinarily noisy, so do not be surprised at all to see this market be just as volatile as all of the other ones.