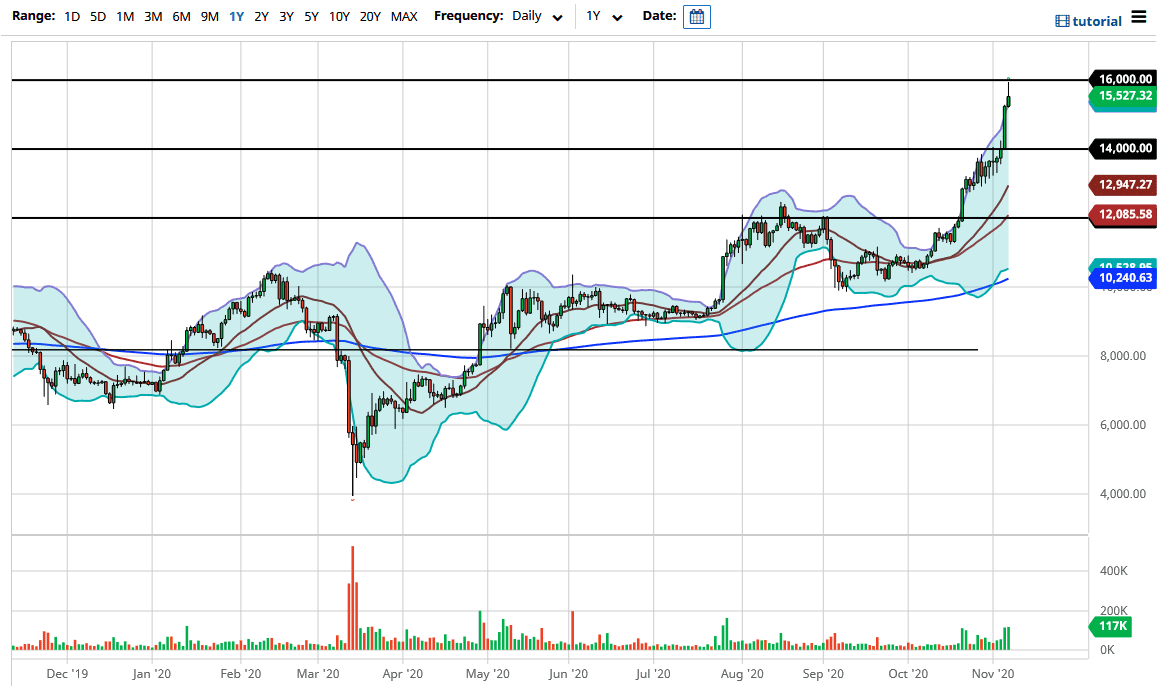

The Bitcoin markets rallied again during the trading session on Friday, reaching the $16,000 level before giving up $500 from there. We ended up forming a shooting star candlestick, which is a negative sign. This is not to say that you should be selling Bitcoin; we just may finally get a pullback. This is the biggest problem with trading Bitcoin: it can take off rapidly, but then you need to wait ages to get an opportunity to pick up Bitcoin at a decent price.

The fact that we may pull back is something you should pay attention to and is something that I would welcome. The $15,000 level could be a target, but so could the $14,000 level, as it was from where we had broken out. The fact that the market shot straight up in the year to the $16,000 level makes you wonder who is left to buy. There will be buyers eventually, but paying for Bitcoin at $16,000 probably did not feel that good earlier in the day. Remember, no matter what anybody tells you, Bitcoin is the same as in the other market. You are looking for opportunities to pick up an asset at a decent price.

The market is likely to hear a lot of noise in general, and the fact that we have broken above the top of the Bollinger Bands indicator also suggests that we are overbought, as we are beyond two standard deviations from the 20 SMA. You might see the market pull back once it gets this far ahead of itself, but that does not mean that we are going to change any type of trend right now. In fact, there are plenty of traders who have missed this trade who would love to get involved. The US dollar appears to be trying to form a bottom, at least for the short term, which could also work against the value of Bitcoin. Longer term, Bitcoin looks healthy, despite the fact that it is slightly overbought at this particular point in time.