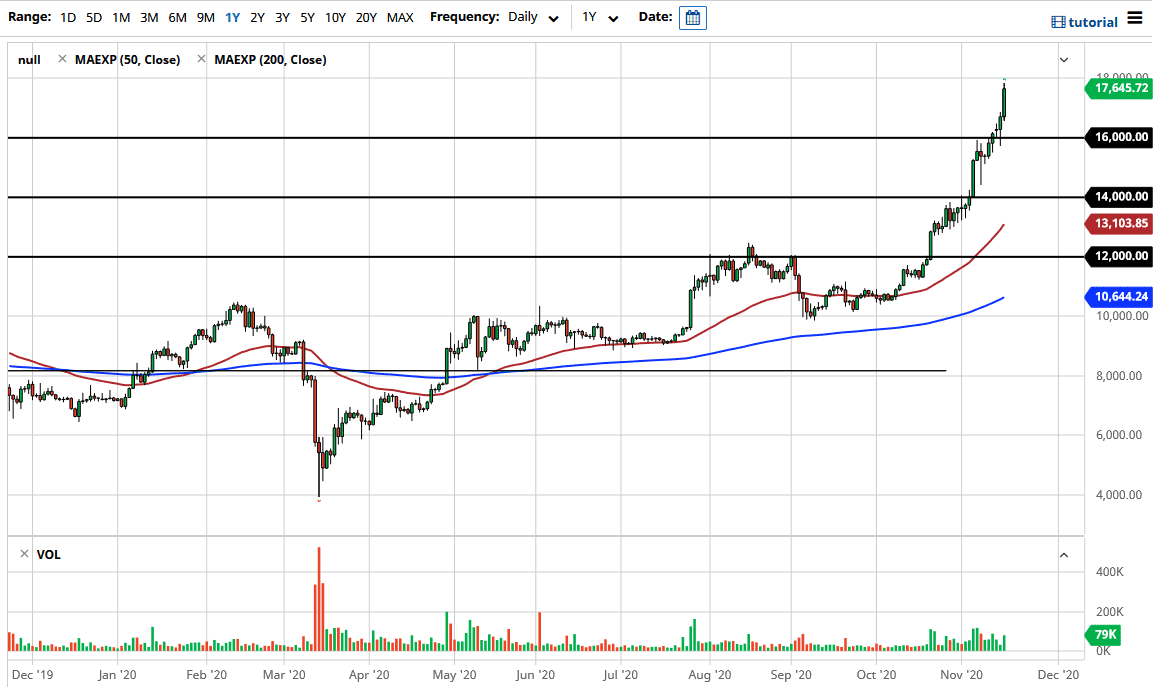

Bitcoin markets are now officially parabolic, and it is an extraordinarily difficult market to get involved in. When you look at this chart, if you did not know that it was Bitcoin, you would say that this is a stock or commodity that has gotten far too ahead of itself. This is the same thing that I would say about Bitcoin, but people who trade Bitcoin do not look at it the same way. Nonetheless, people are going to be hurt sooner or later, because we will run out of people buying this market. This is not to say that I am jumping in and shorting here; rather I believe that people should be very cautious.

If you are already longing the market, you should be looking at tightening up your stops or perhaps taking some gains. After all, the market has risen from $10,500 in October to $17,683 in just six weeks. That is an extraordinarily large and dangerous move. Somebody will eventually run for the exits and then we will have problems. It turns into a self-feeding machine that causes major issues.

Looking at this chart, the $18,000 level does seem to be resistance, which is nothing new, because every $2000 or so we have seen a reaction. It is no surprise that the $18,000 level would be a bit of resistance. It is reason enough to think that we will pull back, but I am not willing to sell this market. This market seems like it has no sense of gravity, which is the most important thing you should pay attention to. If we do break above the $18,000 level, then the next target is $19,000, and then eventually $20,000. Things are going to get very ugly for retail traders if they are not cautious and if they are highly leveraged. Do not get me wrong, we can go through the $20,000 level, but this looks a lot like it did a few years ago, although I am the first to admit that the Federal Reserve is doing everything it can to inflate the price of any asset, not just Bitcoin.