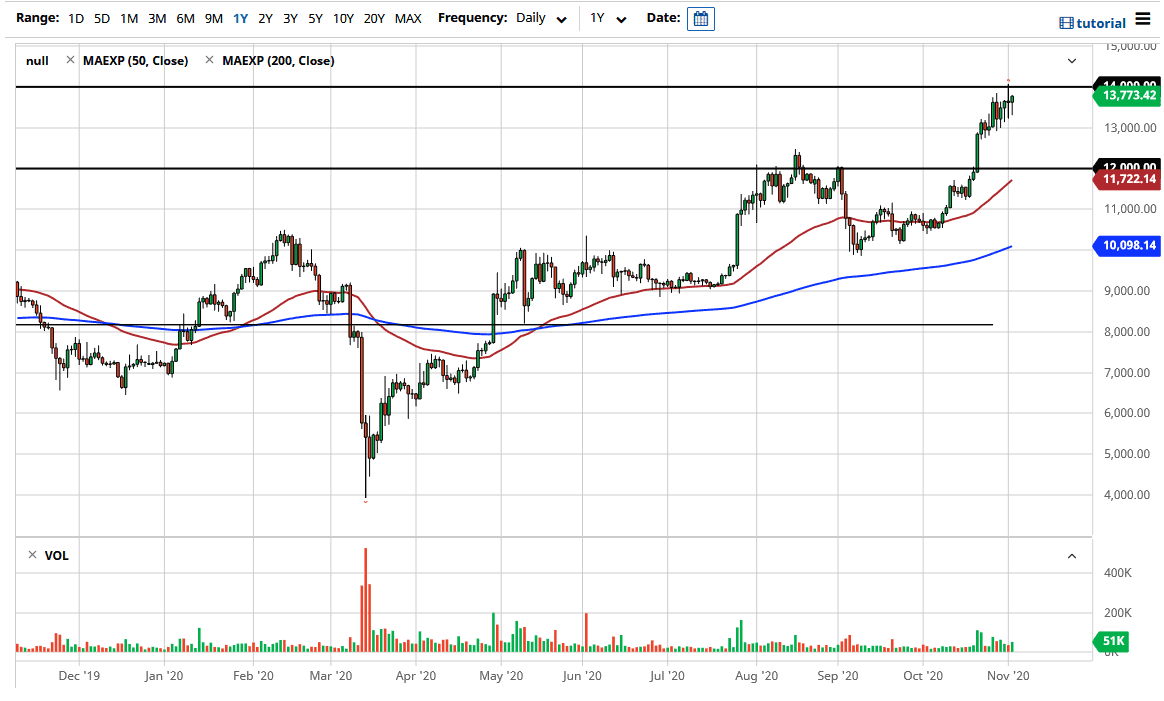

Bitcoin markets pulled back slightly during the trading session on Tuesday, but turned around to show signs of strength again to reach towards the 13,700 level. This is a market that should continue to go higher but I wish I would have seen more of a pullback. It certainly would be easier to buy Bitcoin if we pull back in order to find a certain amount of value that would be advantageous. The $12,000 level would be ideal, but unfortunately, we may not get that off but in the short term.

The reason I like the $12,000 level so much is that it was an area that we smashed through previously and has not been retested. The 50-day EMA underneath is reaching towards the $12,000 level, which is yet another reason to be important. Those are good reasons to go long if we pull back from there. In that case, the market is likely to continue the uptrend at that point, because it shows you a lot of momentum still coming into the marketplace. I do believe that we will go higher but again, I prefer pullbacks because it offers an opportunity to pick up value.

The $14,000 level above should be resistance, so if we break above there it opens up the markets for a move towards the $15,000 level. That is a large, round and psychologically significant figure and I think it will attract a certain amount of attention. The market has gotten ahead of itself, so if we simply take off to the upside, you would be forgiven for simply waiting on the sidelines for another opportunity to buy on the dips. Bitcoin has a long history of snapping back quickly on pullbacks, and it has enough volatility that sooner or later you will get an opportunity to buy it cheaper. Pay attention to the US dollar, because it will have a major influence on what happens with Bitcoin; the negative correlation has been rather strong as of late. I have no interest in trying to short a market that looks like this.