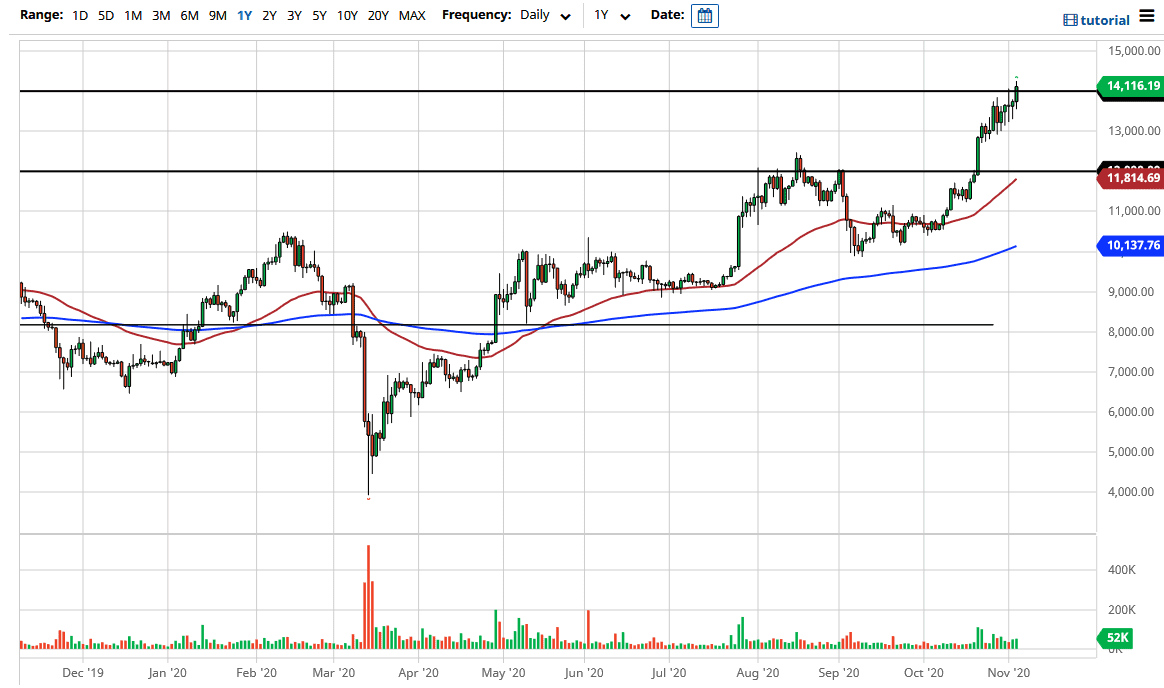

Bitcoin markets initially pulled back during the trading session on Wednesday, as election night jitters moved the market back and forth. But it looks like we are ready to take off again to the upside as there is a lot of noise out there. The $14,000 level being broken is a significant event, but one would think that the $15,000 level would be even more resistive. It is likely that the market will continue to be very interested in that area, as well as bullish. The market is getting a bit stretched, so do not be surprised at all to see a pullback.

The pullback is something that a lot of traders will be looking forward to, as the market has gotten ahead of itself. There is a lot of noise underneath that extends all the way to the 13,000 level, so it is only a matter of time before the buyers jump in. Underneath there, the $12,000 level is massive support as well, not only due to a major breakout from there, but also due to the 50-day EMA sitting just below there. This is a market that is in an uptrend, and I do not see that changing anytime soon.

Bitcoin will continue to rally based upon US dollar depreciation and the uncertainty regarding stimulus. The United States likely to have a divided government yet again, so stimulus will be somewhat subdued and may put more strength in the US dollar than initially thought. Yes, there will be stimulus, but I do not think that the US Senate feels any need to flood the market with massive amounts of liquidity. Although Bitcoin should continue to go higher, it is not going to have the same massive shot higher that it has had for some time.

I have no interest in shorting Bitcoin; I just think that it is not ready to shoot straight to the moon like so many of the long-term believers think. A simple “back and fill” type of action makes the most sense.