Germany crossed 1,000,000 confirmed Covid-19 infections, and the rate of new daily cases places it on course to enter the Top 10 list next month. Chancellor Angela Merkel extended the second nationwide lockdown until December 20th,2020, and several forecasts look for a recession in Europe’s largest economy in the fourth quarter. The export-oriented DAX 30 struggles with expanding breakdown pressures inside its resistance zone.

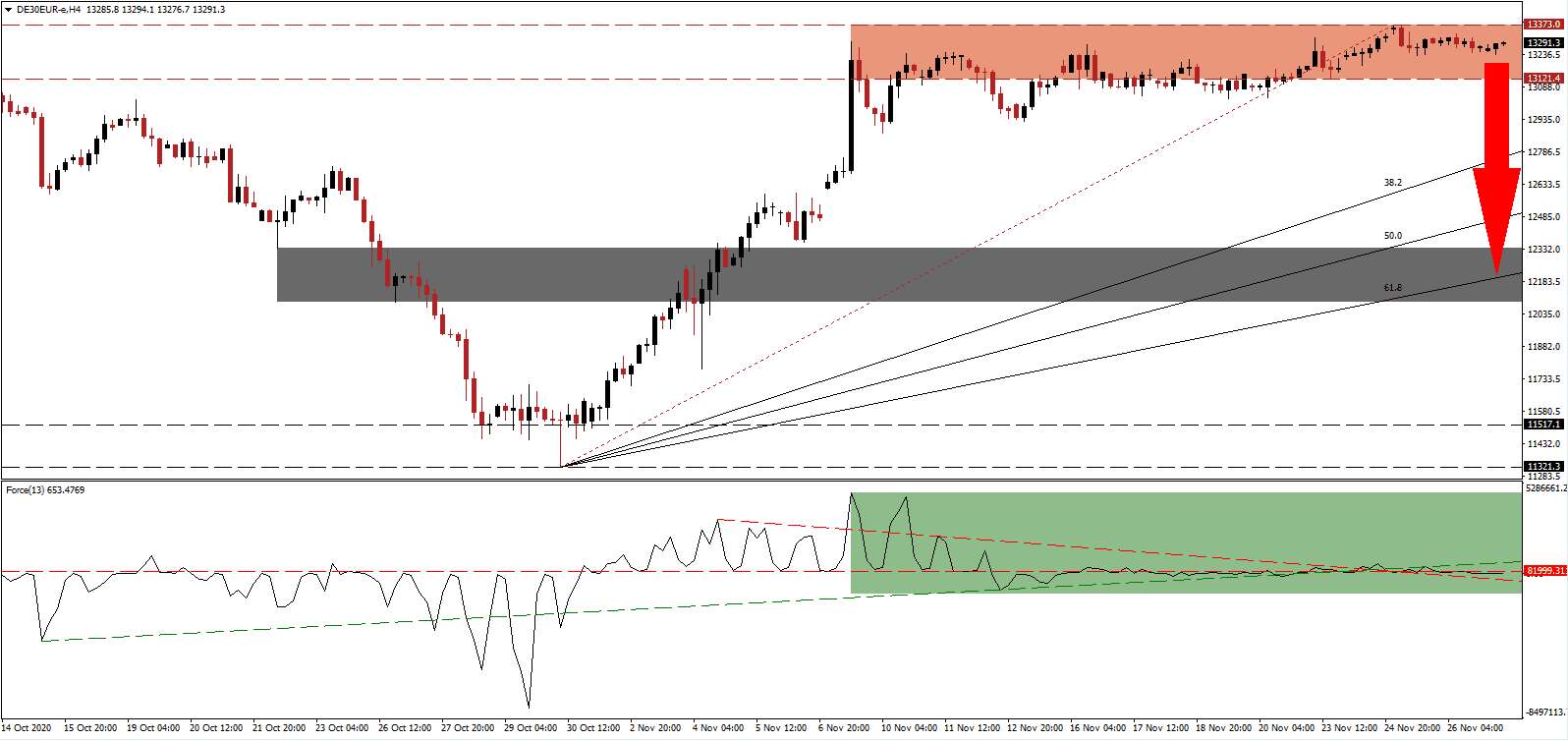

The Force Index, a next-generation technical indicator, remains below its horizontal resistance level after correcting through its ascending support level. It placed it temporarily above its descending resistance level, as marked by the green rectangle, from where a collapse will take this technical indicator below the 0 center-line. The DAX 30 remains under the dominant control of bears.

Plans by the German government to raise €179.82 billion in debt in 2021 deteriorates the outlook for Germany. It also confirms the worse than anticipated impact of the Covid-19 pandemic. In September, Olaf Scholz, the Federal Minister of Finance and Vice-Chancellor, announced plans to borrow €96.0 billion. A profit-taking sell-off in the DAX 30 awaits a breakdown below its resistance zone located between 13,121.4 and 13,373.0, as marked by the red rectangle.

Adding to bearish progress is the collapse in consumer confidence for December, together with an ongoing slowdown in the weekly activity index (WAI), presented by the Bundesbank as an unofficial high-frequency indicator. Following a vaccine-news-inspired rally, the DAX 30 remains vulnerable to a sell-off into its short-term support zone between 12,087.6 and 12,338.6, as identified by the grey rectangle. The ascending Fibonacci Retracement Fan Support sequence will likely determine the next move.

DAX 30 Technical Trading Set-Up - Profit-Taking Scenario

- Short Entry @ 13,290.0

- Take Profit @ 12,190.0

- Stop Loss @ 13,500.0

- Downside Potential: 11,000 points

- Upside Risk: 2,100 points

- Risk/Reward Ratio: 5.24

Should the Force Index reclaim its ascending support level, serving as resistance, the DAX 30 can attempt a breakout. The upside potential remains limited to its resistance zone located between 13,735.7 and 13,827.9. Traders should consider any advance as a selling opportunity, as a slowing economy and weak recovery in 2021 merge with debt pressures for a negative short-to-medium-term outlook globally.

DAX 30 Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 13,650.0

- Take Profit @ 13,820.0

- Stop Loss @ 13,500.0

- Upside Potential: 1,700 points

- Downside Risk: 1,500 points

- Risk/Reward Ratio: 1.13