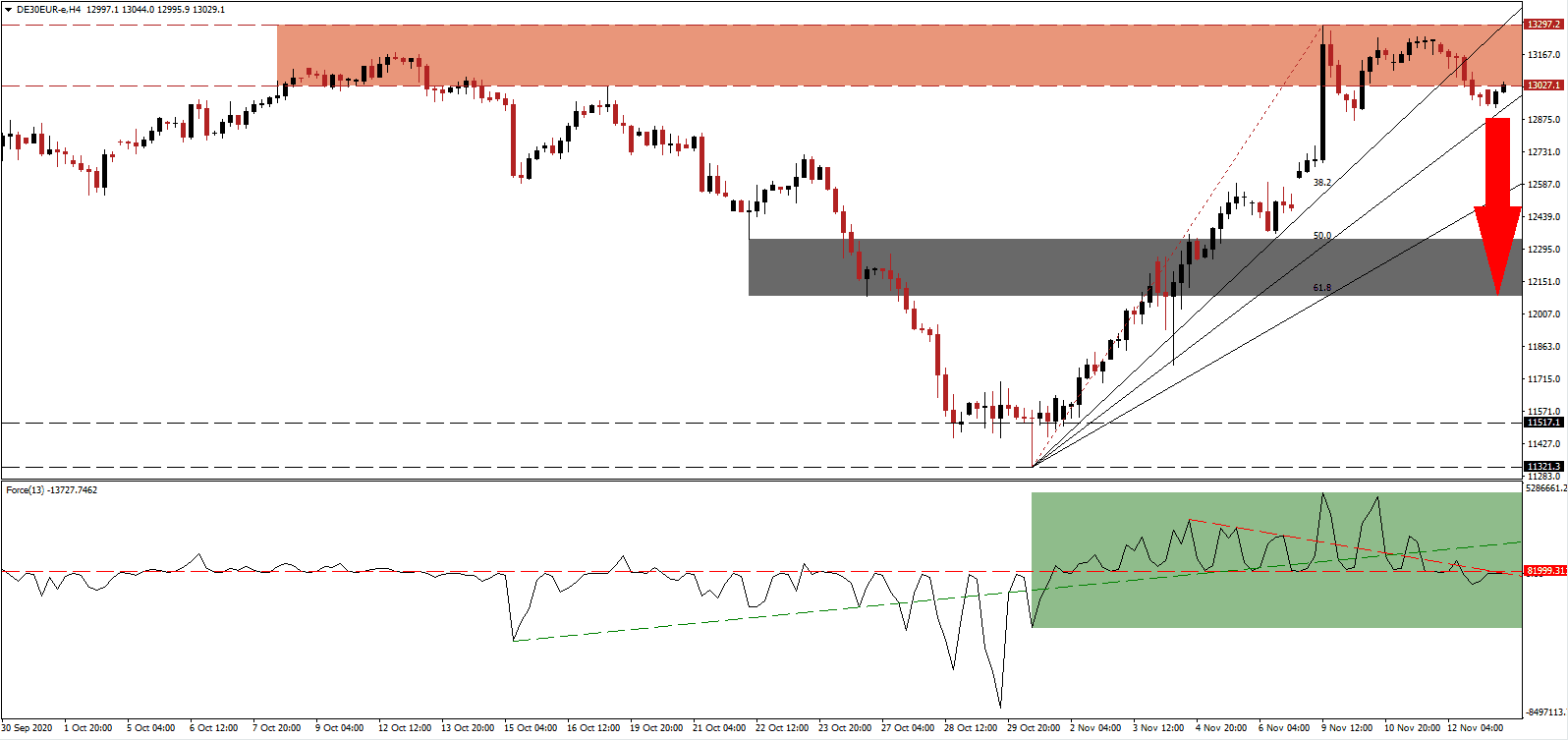

With new Covid-19 infections surging across Germany and a four-week nationwide lockdown in place throughout November, Europe’s largest economy may face a double-dip recession. It will likely drag the rest of continental Europe down with it. Economists note that the industry sector is the last hope for Germany to avoid a recession in the fourth quarter. The DAX 30 lost bullish momentum after the breakdown below its resistance zone, from where a broader profit-taking sell-off is anticipated.

The Force Index, a next-generation technical indicator, retreated from a multi-month peak and recorded a series of lower highs. It moved below its descending resistance level and its ascending support level, marked by the green rectangle. It also moved below its horizontal resistance level with expanding downside momentum. After this technical indicator dropped below the 0 center-line, bears regained complete control over the DAX 30.

While September exports expanded, imports posted a surprise contraction, suggesting weak domestic demand. Adding to concerns was the plunge in the ZEW Economic Sentiment Indicator for November, down to 39.0 from 56.1 in October. Investor confidence also receded while pressures on the economy expand. The breakdown in the DAX 30 below its resistance zone located between 13,027.1 and 13,297.2, as identified by the red rectangle, has significantly more downside potential.

Adding to concerns is the downward revision by the council of economic advisors to the German government for 2021 GDP. It now forecasts an expansion of 3.7%, down from the previous estimate calling for a 4.9% growth rate. The 2020 outlook was improved, calling for a 5.1% drop rather than the 5.5% contraction in their previous assessment. Volatility could spike as the DAX 30 challenges its resistance zone, but a collapse below its ascending 50.0 Fibonacci Retracement Fan Support Level is favored. It can take it down into its short-term support zone located between 12,087.6 and 12,338.6, marked by the grey rectangle.

DAX 30 Technical Trading Set-Up - Profit-Taking Scenario

- Short Entry @ 13,025.0

- Take Profit @ 12,100.0

- Stop Loss @ 13,300.0

- Downside Potential: 9,025 points

- Upside Risk: 2,750 points

- Risk/Reward Ratio: 3.28

In case the Force Index accelerates above its ascending support level, serving as resistance, the DAX 30 may attempt a second breakout attempt. The upside potential remains limited to its resistance zone located between 13,496.6 and 13,643.8. Traders should consider any advance as a selling opportunity amid growing short-term downside pressures for the domestic German economy and the global one.

DAX 30 Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 13,440.0

- Take Profit @ 13,640.0

- Stop Loss @ 13,300.0

- Upside Potential: 2,000 points

- Downside Risk: 1,400 points

- Risk/Reward Ratio: 1.43