Germany faces significantly more pressure from the second wave of the COVID-19 pandemic and is on track to become the twelfth country to cross 1,000,000 confirmed infections within the next seven to nine days. Europe’s largest economy is in the middle of its second nationwide lockdown, a lighter version of the previous one, and current conditions warrant an extension past November, the end of the four-week restrictions. The DAX 30 advanced into its resistance zone due to a duo of positive COVID-19 vaccine developments, but deflating bullish momentum can result in a breakdown and profit-taking sell-off.

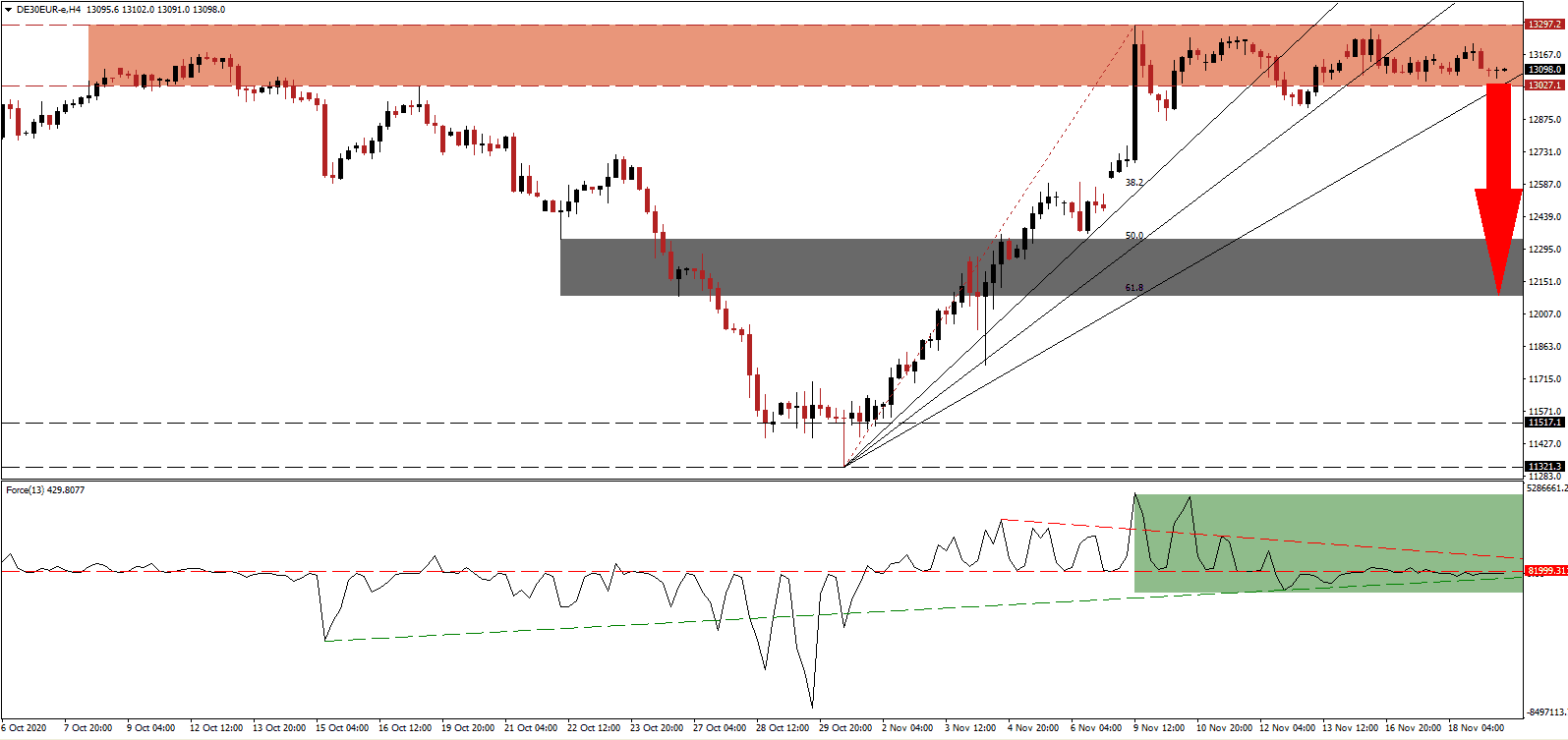

The Force Index, a next-generation technical indicator, formed four lower highs, confirming the lack of bullish momentum, before settling below its horizontal resistance level. With the descending resistance level increasing downside pressure, as marked by the green rectangle, this technical indicator can correct below its ascending support level and into negative territory. It will place bears in complete control of price action in the DAX 30.

High-frequency indicators continue to point towards a slowing economy. The latest Weekly Activity Index (WAI) of the German Bundesbank extended the weakening growth trend and the central bank cautioned against an economic downturn in the fourth quarter. More nationwide restrictions may follow due to the worsening state of the healthcare system, applying further downside pressure on the economy and public finances. The DAX 30 remains vulnerable to a breakdown below its resistance zone located between 13,027.1 and 13,297.2, as marked by the red rectangle.

Heiko Maas, the Minister of Foreign Affairs for Germany, remains confident that the EU will find a solution to pass a financial aid package consisting of €1.1 trillion in EU budget expenses and a €750 billion EU rescue fund. Hungary and Poland vetoed the proposal amid unfavorable conditions to get access to capital. Germany holds the rotating EU presidency and tries to solve the issues. The DAX 30 is well-positioned to correct below its ascending 61.8 Fibonacci Retracement Fan Support Level, clearing the path for a sell-off into its short-term support zone between 12,087.6 and 12,338.6, as identified by the grey rectangle.

DAX 30 Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 13,100.0

Take Profit @ 12,100.0

Stop Loss @ 13,300.0

Downside Potential: 10,000 points

Upside Risk: 2,000 points

Risk/Reward Ratio: 5.00

Should the Force Index sustain an advance above its descending resistance level, the DAX could attempt a brief price spike. Traders should take advantage of any price spike with new sell positions amid a bearish short- to medium-term outlook for German equities due to deteriorating conditions related to COVID-19. The upside potential remains confined to its resistance zone located between 13,496.6 and 13,643.8.

DAX 30 Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 13,440.0

Take Profit @ 13,640.0

Stop Loss @ 13,300.0

Upside Potential: 2,000 points

Downside Risk: 1,400 points

Risk/Reward Ratio: 1.43