Germany struggles with a sharp rise in new Covid-19 infections amid the second wave of the pandemic, which is more violent, as forecast by epidemiologists months ago. Unlike the first wave, where Germany reported a relatively low death toll as compared to other countries, it appears the conditions worsened significantly. German Chancellor Angela Merkel announced a second nationwide lockdown, lasting four weeks and less severe than the first one. It will slow down the pace of recovery domestically, and other countries announced similar measures, dampening the global trade outlook. The DAX nears the end of its short-covering rally following a massive correction, with a new sell-off anticipated to follow.

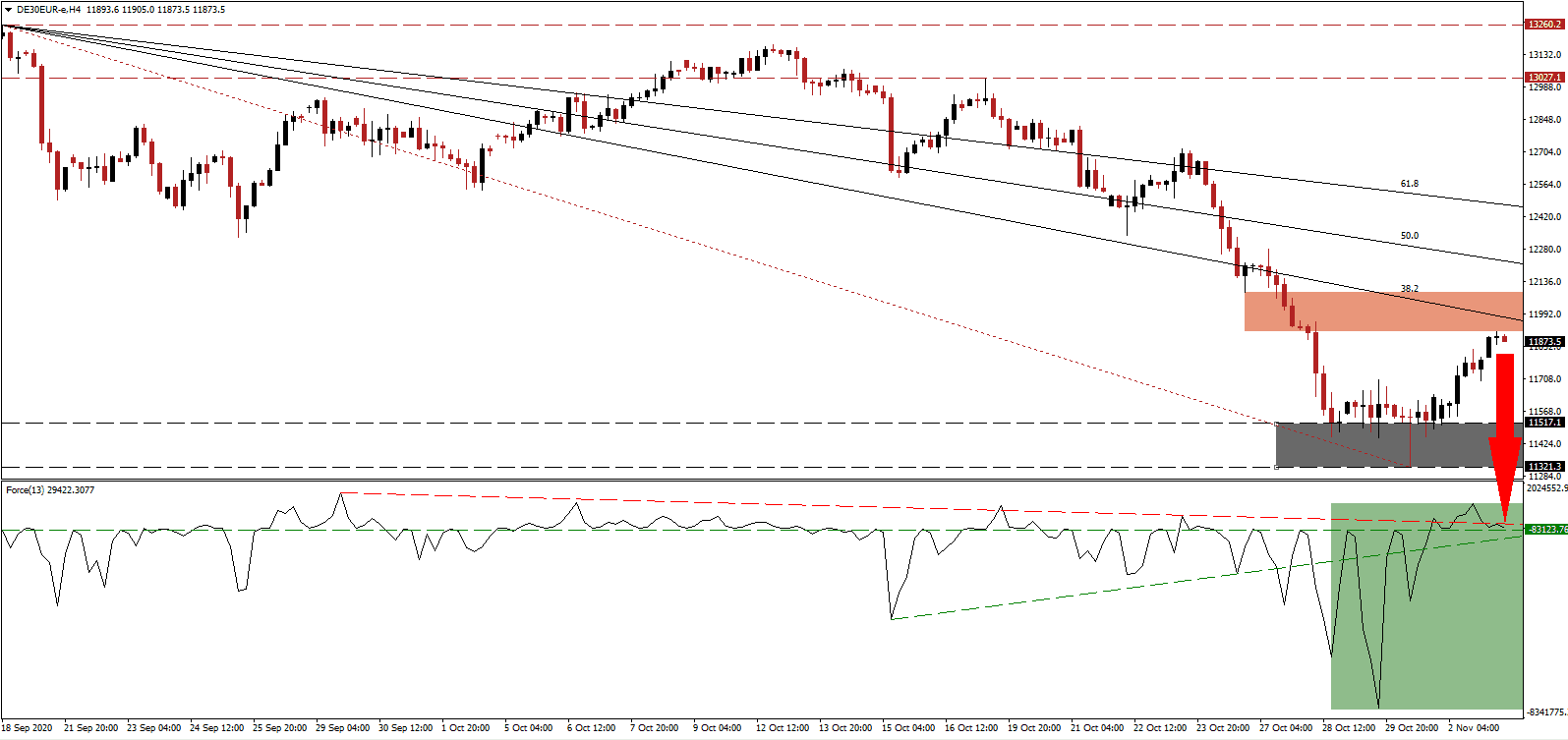

The Force Index, a next-generation technical indicator, plunged to a new multi-month low before retracing it. After peaking above its descending resistance level, as marked by the green rectangle, it reversed below it but maintained its position above the horizontal support level. With bearish pressures on the rise, this technical indicator is favored to collapse below its 0 center-line and through its ascending support level, allowing bears to regain control over the DAX 30.

While third-quarter GDP clocked in above expectations for a rise of 6.6%, expanding by 8.2%, following the same pattern recorded across many economies, the pace will slow down significantly. The second lockdown adds to the bearish short-term outlook for the German economy. The Federal Ministry for Economic Affairs and Energy (Bundesministerium für Wirtschaft und Energie or BMWi) forecasts a 5.5% contraction for 2020 and a 4.4% expansion in 2021. After the DAX 30 reached its short-term resistance zone located between 11,918.2 and 12,087.6, as identified by the red rectangle, more downside is expected.

Adding to long-term negative pressures is the debt binge the German government embarked on while traditionally being fiscally conservative. More debt will follow, as companies will receive 75% of their November 2019 revenues from the government for the November 2020 lockdown. Many companies will fare better than without a lockdown, but the long-term outlook remains uncertain. The descending Fibonacci Retracement Fan sequence is well-positioned to pressure the DAX 30 into its support zone located between 11,321.3 and 11,517.1, as marked by the grey rectangle. A breakdown into its next support between 10,613.5 and 10,759.2, which includes a price gap to the downside, cannot be excluded.

DAX 30 Technical Trading Set-Up - Breakdown Resumption Scenario

- Short Entry @ 11,875.0

Take Profit @ 10,615.0

Stop Loss @ 12,225.0

Downside Potential: 12,600 points

Upside Risk: 3,500 points

Risk/Reward Ratio: 3.60

Should the ascending support level pressure the Force Index higher, the DAX 30 could attempt a breakout. With the global outlook for the economy weak, the export-oriented German economy will suffer. Together with an expected slump in domestic demand, the short-term outlook remains bearish. Traders should sell any advance from present levels with the upside potential limited to its intra-day high of 12,717.8.

DAX 30 Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 12,400.0

Take Profit @ 12,715.0

Stop Loss @ 12,225.0

Upside Potential: 3,150 points

Downside Risk: 1,750 points

- Risk/Reward Ratio: 1.80