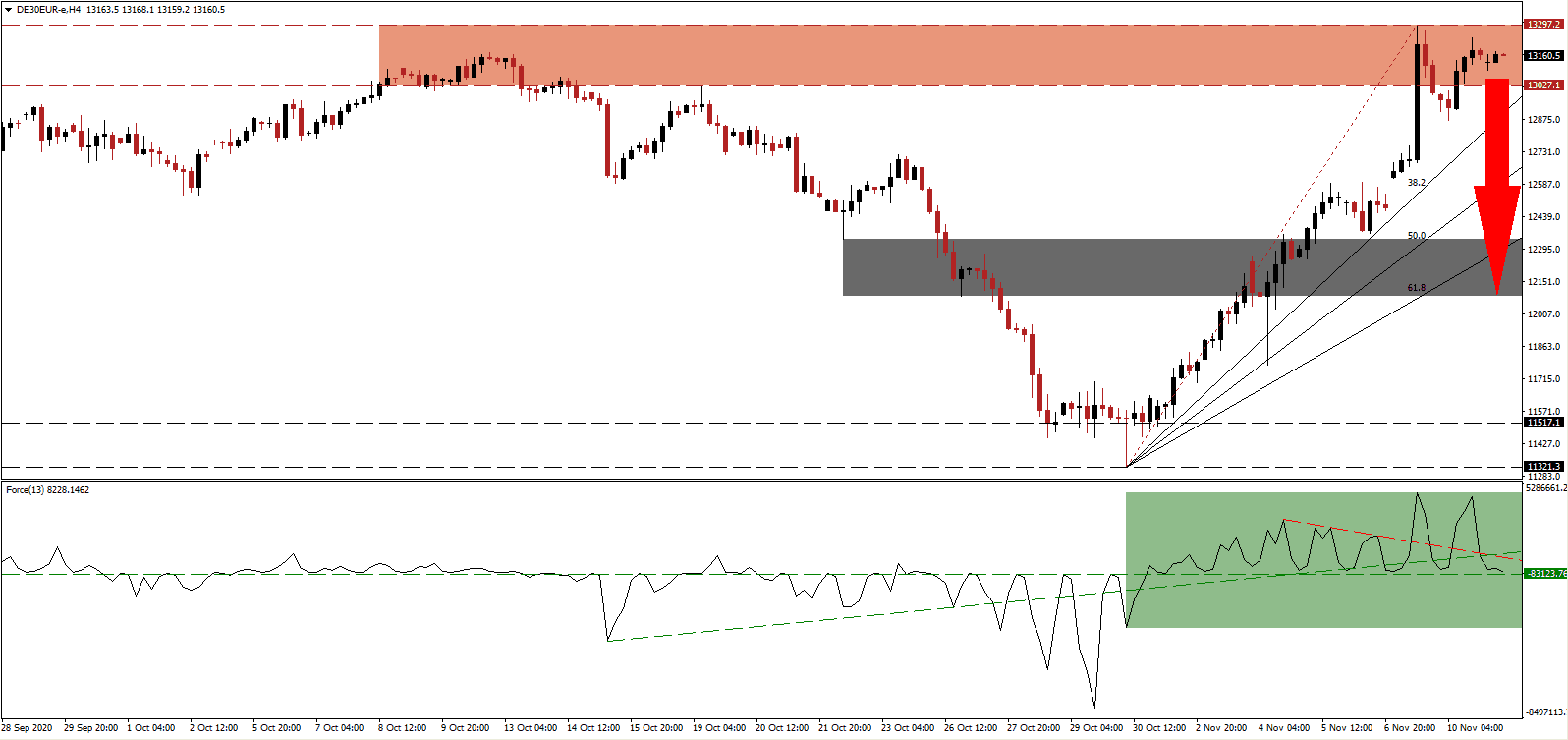

Following the US election in which Democratic challenger Joe Biden was declared President-elect by media networks, global equities advanced. The rally gathered steam following positive news regarding the COVID-19 vaccine produced in collaboration between US-based Pfizer and German-based BioNTech. It took the DAX 30 into its resistance zone from where the previous sell-off materialized. The exhausted upside is now vulnerable to a profit-taking sell-off.

The Force Index, a next-generation technical indicator, recorded a marginally lower high before correcting below its descending resistance level and its ascending support level, as marked by the green rectangle. Bearish pressures are now favored to extend the retreat below its horizontal support level. Bears will regain complete control over the DAX 30 after this technical indicator moves into negative territory.

Germany faces domestic pressures from the second COVID-19 wave as infections rise, and Europe’s largest economy is under a new nationwide lockdown throughout November. It is not as severe as the first one, but enough to pressure retailers and the hospitality sector, which will send ripple effects across the economy. Breakdown pressures are expanding after the DAX 30 moved into its resistance zone located between 13,027.1 and 13,297.2, as identified by the red rectangle.

GDP for 2020 may contract by 5.1% in Germany due to the COVID-19 pandemic before expanding by 3.7% in 2021. The data comes from a leaked report by the advisory council to the German government. Since Germany relies heavily on exports, especially to China, it is likely to fare better than its neighbors. Investor confidence dropped for November, while fears of EU and Eurozone disintegration continue to rise. The DAX 30 is well-positioned for a correction through its ascending Fibonacci Retracement Fan sequence and into its short-term support zone between 12,087.6 and 12,338.6, as marked by the grey rectangle.

DAX 30 Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 13,160.0

Take Profit @ 12,160.0

Stop Loss @ 13,375.0

Downside Potential: 10,000 points

Upside Risk: 2,150 points

Risk/Reward Ratio: 4.65

A sustained breakout in the Force Index above its ascending support level, serving as resistance, can temporarily extend the rally in the DAX 30. It will present traders with an excellent secondary selling opportunity amid an uncertain global economic outlook over the next few months. The upside potential remains confined to its next resistance zone located between 13,496.6 and 13,643.8.

DAX 30 Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 13,475.0

Take Profit @ 13,640.0

Stop Loss @ 13,375.0

Upside Potential: 1,650 points

Downside Risk: 1,000 points

Risk/Reward Ratio: 1.65