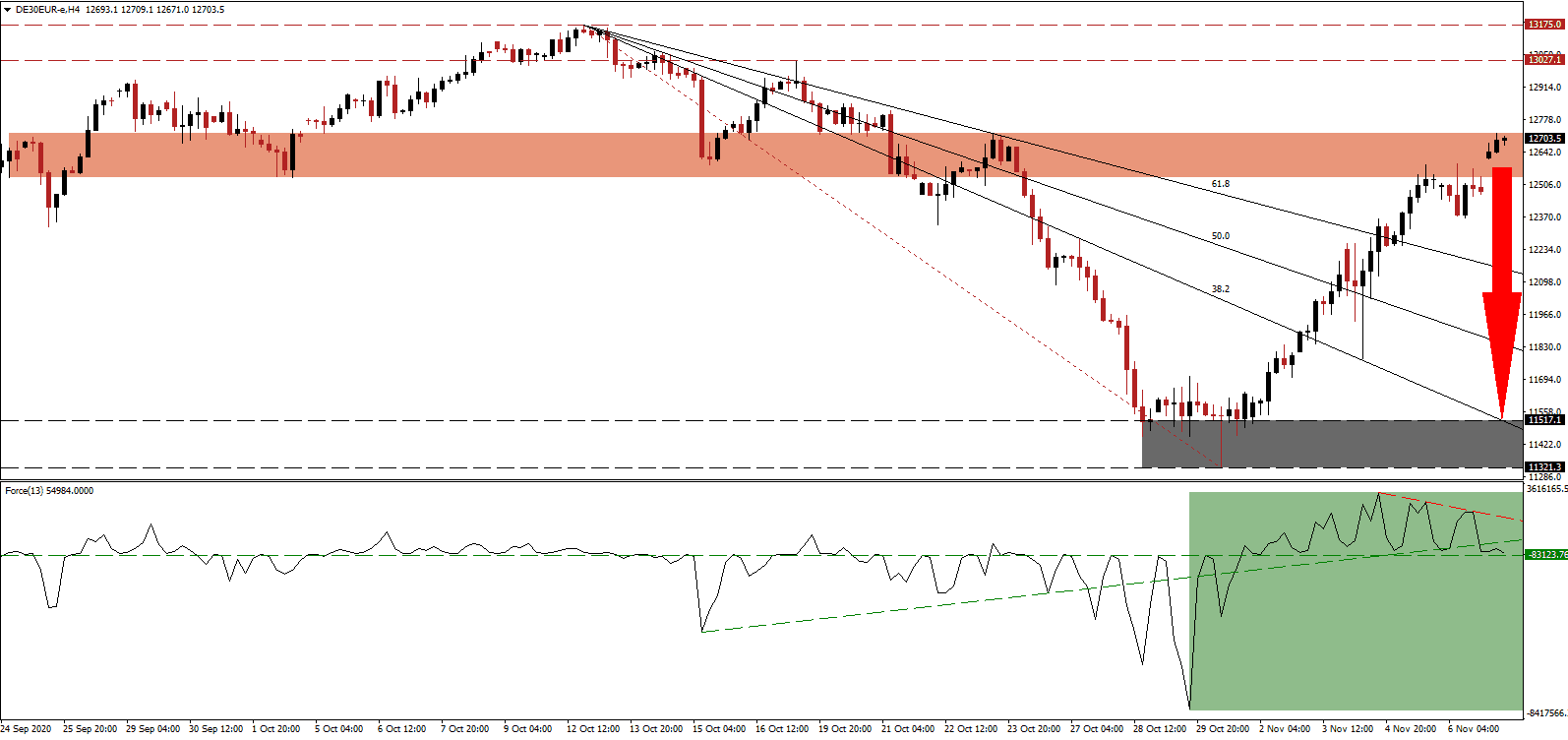

Germany continues to witness an accelerating wave of COVID-19 infections, and financial assistance measures remain exhausted. During the first wave of the pandemic, the government delivered a €750 billion stimulus. On November 2nd, Chancellor Merkel announced a second nationwide lockdown spanning four weeks, but it is not as severe as the first one. The introduced aid package for business totals only €10 billion, granting up to 75% of revenues from November 2019 to small businesses and the self-employed. The DAX 30 shows fading bullish momentum inside its resistance zone, suggesting a potential reversal.

The Force Index, a next-generation technical indicator, formed a negative divergence through three lower highs. It followed through with a move below its ascending support level, as marked by the green rectangle. The descending resistance level is favored to pressure this technical indicator below its horizontal support level into negative territory, granting bears control over the DAX 30.

Adding to growth concerns is the Weekly Activity Index (WAI) of the German Bundesbank, a widely referenced high-frequency indicator during the COVID-19 pandemic, which points towards a slowdown in the expansion. Supporting it was the significantly lower than expected rise in industrial production for September with more weakness ahead. The DAX 30 currently tests its new short-term resistance zone located between 12,535,1 and 12,720.5, as marked by the red rectangle, from where a breakdown may materialize.

An unwanted side effect of the COVID-19 pandemic could be further disintegration of the European Union if Germany recovers well ahead of others in the bloc. Resistance from northern countries to fund the €750 billion Eurozone rescue fund angered southern members plus France and the focus now remains on the recovery phase. While short-term solidarity increased, the cost may have been further integration. The DAX 30 remains vulnerable to a reversal through its descending Fibonacci Retracement Fan sequence and into its support zone between 11,321.3 and 11,517.1, as identified by the grey rectangle.

DAX 30 Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 12,705.0

Take Profit @ 11,515.0

Stop Loss @ 12,905.0

Downside Potential: 11,900 points

Upside Risk: 2,000 points

Risk/Reward Ratio: 5.95

Should the Force Index reverse above its descending resistance level, the DAX 30 may attempt to extend its advance. The upside potential remains limited to its resistance zone located between 13,027.1 and 13,175.0, which will present traders an excellent secondary selling opportunity. A brief post-US election price spike, after Biden secured the presidency for the Democrats, remains a possibility before a potential medium-term reversal.

DAX 30 Technical Trading Set-Up - Limited Breakout Extension Scenario

Long Entry @ 13,005.0

Take Profit @ 13,150.0

Stop Loss @ 12,905.0

Upside Potential: 1,450 points

Downside Risk: 1,000 points

Risk/Reward Ratio: 1.45